Check Fraud Featured at FraudCON 2023

Speaking at this year's FraudCon 2023, Dr. David Maimon, a professor and Next Generation Scholar in the Andrew Young School of Policy Studies’ Department of Criminal Justice & Criminology at Georgia State University, provided attendees with the latest data and schemes on check fraud from the dark web.

As you may remember, Dr. David Maimon is the founder and and director of Georgia State University’s Evidence Based Cybersecurity Research Group. Dr. Maimon has been at the forefront of research of the dark web check fraud phenomenon, analyzing data way back in 2021.

Stolen Checks for Sale on the Dark Web Continues to Increase

At about 10:30 into the video, Dr. Maimon addresses the dark web and how stolen and forged checks are being offered for sale. He notes that in late 2021, more and more of these personal and business checks became available. His group began monitoring multiple Telegram channels to analyze the images and offers the fraudsters posted.

As we can see from his group's research, there continues to be an increase of stolen checks available for sale between 2021 - 2023:

Stolen Check Market Price Rising

The last trend discussed is the fluctuation in prices of underground online checks. Whereas they were seeing checks offered for sale at $120 to $175 per personal checks; $250 for business checks range, now prices have climbed considerably higher. He notes that what is driving this increase in price is the balance of the checking accounts and the belief you can make a lot of money from one single check.

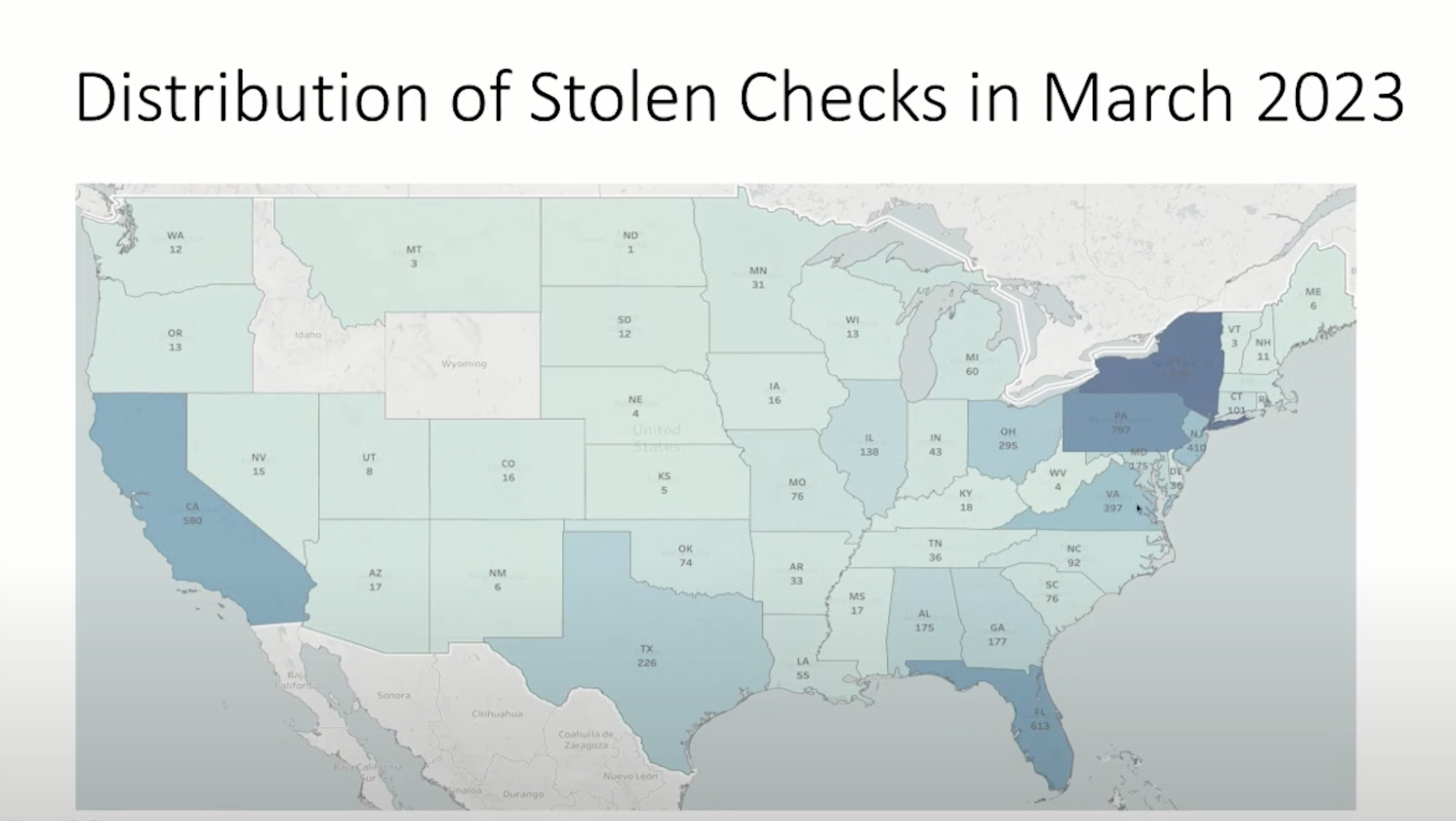

Furthermore, the distribution of stolen checks has proliferated across the country. The Georgia State University’s Evidence Based Cybersecurity Research Group only monitors 60 channels out of thousands...yet the effects can be felt across the country:

What's New in the Dark Web Check Fraud Ecosystem?

Fraudsters are getting more and more creative. As we have noted in the past, fraudsters will continue to find new ways to commit fraud -- and there is no lack of ingenuity.

Take, for instance, official USPS uniforms. Fraudsters are selling authentic uniforms online to make theft from mailboxes less conspicuous.

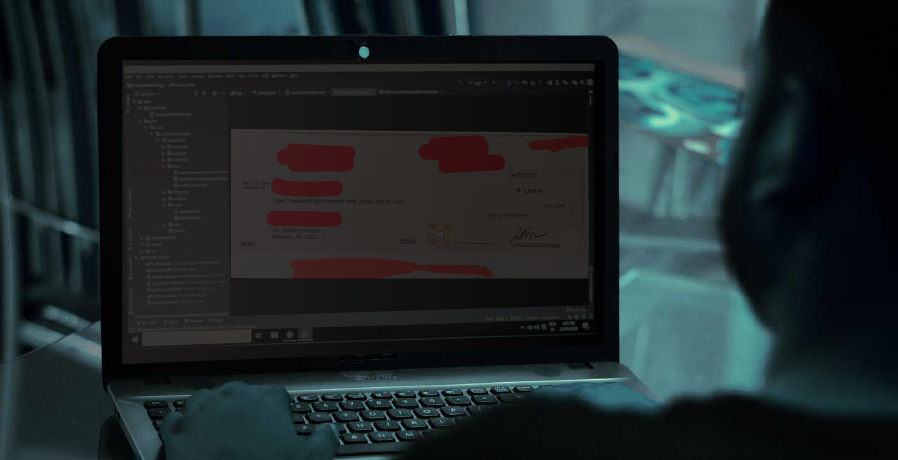

Dr. Maimon also provides video of fraudsters washing and "cooking" (baking) checks. "With the quality of the supplies these guys are having now, very difficult to for banks to detect that the checks the criminals 'cook' are indeed fake," he notes.

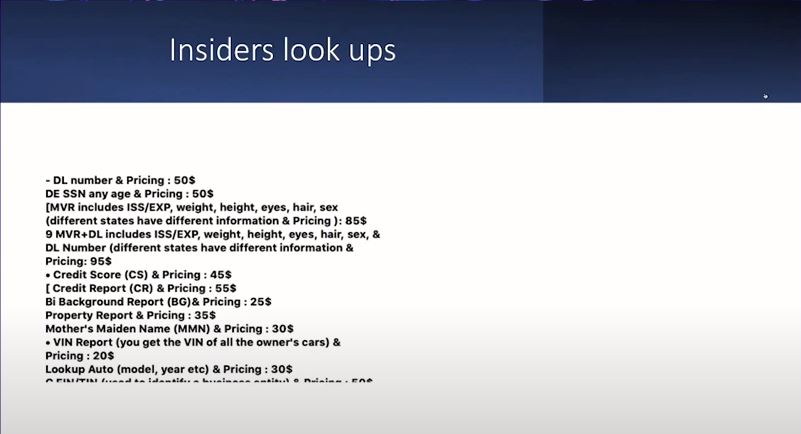

Another trend he points out is the availability of "insiders services" to look up and provide any sort of information the fraudster needs to know about their victim in terms of things like account balance and other personal details.

"We are seeing on many markets menus offering 'lookup services' for individuals' Social Security numbers and the cars they driving and credit scores," Dr. Maimon says. This is something we recently addressed when discussing how information from checks can lead to identity theft.

Check Fraud Will Get Worse

Dr. Maimon ends the presentation with a stark warning:

"Check theft and check fraud have resurrected unfortunately during the last year and half or so here in the United States...And, it is our belief that this epidemic that we are experiencing here in the United States has disrupted and will continue to disrupt the online fraud ecosystem dramatically."

In order for FIs to stop the fraudsters, they will need to continue their investments in check fraud detection technology -- blending transactional analysis & image forensic AI with other solutions like dark web monitor systems to ensure that cashed/deposited checks are legitimate and their customer's checking accounts are not compromised.