PODCAST: “Check Fraud Is An Industry”

- It's no secret - check fraud is on the increase

- Organized fraudsters have made check fraud an industry

- Fraudsters make up in VOLUME what they can't accomplish in QUALITY

John Zollinger, Executive Vice President and Director of Commercial Banking at Home Bank, joined the Discover Lafayette podcast to discuss ways you can stay vigilant to fight fraudsters, who are working 24/7 to get access to your financial assets.

With over $5 billion in check fraud last year alone, it is, to say the very least, an important topic to understand.

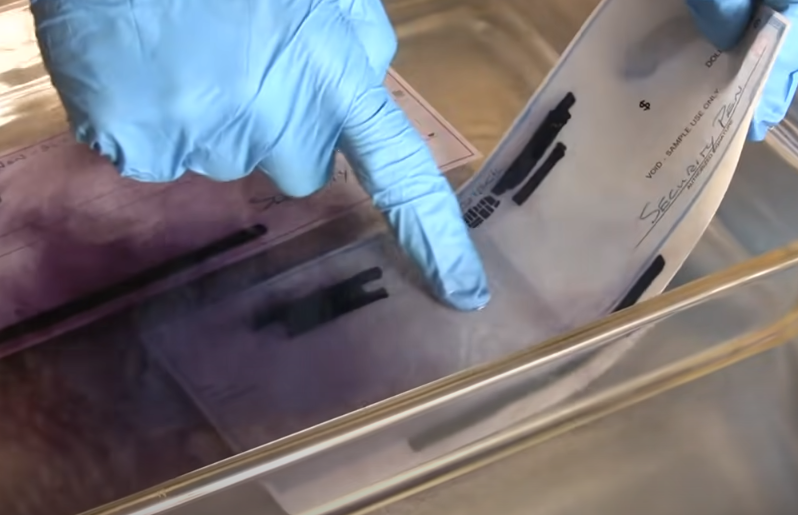

It has become commonplace for checks to be stolen and then ‘washed’ by eraser or chemical baths which remove the ink and allow an alteration to the original. While most checks have security features such as watermarks, threads, and holograms, and alterations can look like a third-grader did the task, with one million checks being deposited per month many fakes slip through the cracks. While artificial intelligence is used to forage out fakes, unless a check is made out for over $10,000, it is unlikely to be picked up on. So criminals make up for it in volume, and as John Zollinger says, “the check fraud business is an industry.”

Guidance for Banks

When it comes to check fraud, there are steps that both banks and consumers can take to prevent losses. First, Zollinger expounds upon the virtues of Positive Pay:

“Our ability to serve clients through technology continues to improve. We spend more today on technology than on our facilities. Ten years ago the industry said checks were going away. We said the same thing five years ago, but checks are still here. I don’t know if they’ll ever go away unless banks say they won’t continue to offer that service.

As we have noted, positive pay systems are seeing a boost in effectiveness and automation with the increased read rates from advancing check recognition technologies. As we've seen from customers utilizing our Anywhere Positive Pay solution -- which acts as a powerful extension to traditional positive pay systems -- hundreds of banks benefit from this functionality, and it's proven effective in detecting altered payee names when compared against the payee inside the issue files.

In addition to deploying a positive pay system, it's important for banks to review their current thresholds within their fraud detection systems. As noted above, Zollinger refers to a $10,000 threshold for systems to review, which is most likely due to the how their systems have been "tuned." While it is impossible for a normal human to review all the check items being deposited, this is not the case for artificial intelligence, in both transactional and image forensics based systems.

With the processing power of GPUs, thousands upon millions of items can be processed in a short amount of time, enabling real-time fraud detection. The key for banks is not to set an amount threshold to process through the system, but rather establish an amount threshold to flag items for manual review. Banks must find a balance to determine the amount of items their fraud team can inspect.

Guidance for Consumers

A news story from NBC10 Philadelphia illustrates a common fraud scenario that consumers are facing:

As noted in the clip, though banks are indeed responsible for reimbursement of fraudulent checks that they have cashed, the process can take an inordinate amount of time - - in the case above, the customer waited three months. The bank in question is quoted as saying that the nationwide increase in cases of fraud made this case take longer to resolve than what is typically expected -- they also noted that they are using this case to update their approach to fraud cases.

It's recommended that when mailing checks, consumers should drop envelopes off directly at the post office, reducing the chance of bad actors to steal them. Additionally, it's further recommended that consumers check their bank accounts more often -- even daily -- to spot odd transactions. Fortunately, this can be done instantaneously through the bank's mobile app or online web portals.

Still, it can be a lopsided battle. As Zollinger notes:

“Fraudsters spend 100% of their time trying to take advantage of us. And people spend maybe 10% of their time trying to prevent being taken advantage of."