Restrictive Endorsements a Big Part of Regulation CC Changes

Image: WikiHow

The Expedited Funds Availability Act (EFAA) and the Check Clearing for the 21st Century Act (Check 21 Act), announced in 2014, will have amendments effective July 1, 2018. We learn this via the Federal Reserve Board (FRB) publishing in the Federal Register final amendments to Regulation CC (Availability of Funds and Collection of Checks). These amendments contain a number of changes that will affect financial institutions, such as modifications to check return requirements, additional warranties, and new indemnities, including a new indemnity for remote deposit capture (RDC).

The Lexology website provides a tidy overview of what to expect. Another source is the ECCHO.org presentation.

Their advice follows:

Financial institutions should start planning for these changes now as some of the changes will require coordination with financial institutions’ third-party vendors, which can be a lengthy process.

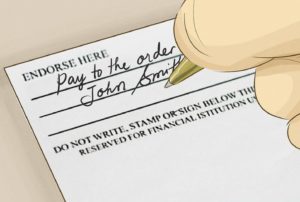

Several steps should be taken to address the new RDC indemnity as that Regulation CC change creates a new form of risk that must be cabined. Financial institutions should review and revise all of their customer-facing agreements that include RDC provisions–consumer and business, mobile and cash management–to require financial institution customers to include restrictive endorsements on each RDC item the customer deposits, and to allocate liability for loss regarding RDC items to the customer in connection with subsequent deposits of the same item.

“Restrictive endorsements and technologies that can verify restrictive endorsements should be a top priority for FIs offering RDC. It can not only help to prevent duplicates, it can also shield that FI from liability when duplicates do happen,” said John Leekley, Founder and CEO of RemoteDepositCapture.com. See article.

As you might expect, OrboGraph is working to enhance the OrboAnywhere Validate module with Restrictive Endorsement capabilities that are designed to deal with the challenges of enforcing and detecting varying restrictive endorsement types, beyond the existing endorsement presence detection. In the upcoming weeks, we’ll be sharing how this technology is evolving and best practices for deployment.

Any questions, let us know at info@orbograph.com.