Stimulus Package: Direct Deposit or Check?

Congress passed a $2 trillion stimulus bill — the largest in United States history — that promises to revive a coronavirus-stricken economy. These are payments that will be sent directly to Americans, with many adults getting $1,200. For every qualifying child age 16 or under, the payment adds an additional $500. The plan is for a single payment, but future bills could order up additional disbursements as well.

The US Government plans to make as many payments as possible via direct deposit for people with bank accounts. But what about those who don’t have a bank account?

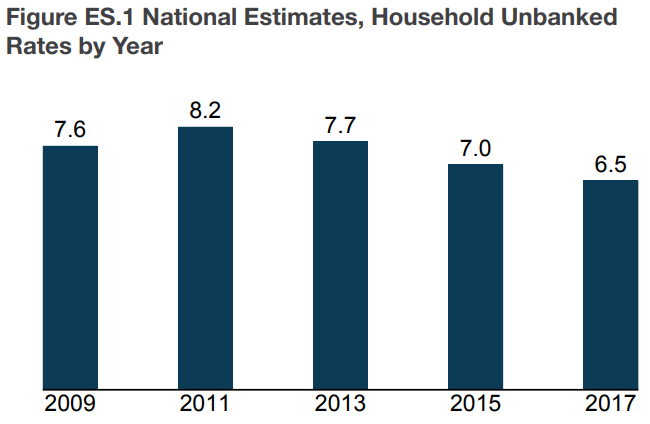

That turns out to be a significant portion of the population. According to a 2017 survey by the Federal Deposit Insurance Corp, twenty-five percent of U.S. households are unbanked or underbanked. That means they either don’t have an account, or have an account that charges fees or does not offer direct deposit services.

The math is daunting: That works out to potentially as many as 29.43 million households that will need a paper check mailed to them and then deposited. That does NOT take into account households who don’t have direct deposit information on file with the IRS – – which is 20% of taxpayers, adding an additional 29 million persons at the high end. Many of them are millennials, who have little experience with checks.

UPDATE: On March 30, the I.R.S. said on its website that it would build a portal where people can update their information “in the coming weeks.”

Even if the total is substantially lower than 40-50 million, this introduces pretty significant issues.

- Americans could end up waiting as long as four months for relief if they don’t have their direct deposit information on file with the IRS. The IRS can only mail roughly 20 million checks per month; there could be up to 60 million persons needing checks.

- Up to 60 million checks entering the financial eco-system at one time could add stress to select deposit systems, particularly fraud prevention. And, let’s remember that the check must be deposited and paid, so that’s actually 120 million+ total transactions.

Financial institutions’ ability to absorb a huge wave of deposits and efficiently detect fraud attempts will test every system they have in place. FI’s, having previously pursued efficiencies in check processing and fraud prevention in order to remain competitive in the marketplace, should be able to deliver expedited funds availability — something which is of utmost importance to the large number of Americans facing immediate financial stress.

Automated check recognition, field negotiability testing, along with image analysis provide the underpinnings to streamlining these deposits, along with protecting bank accounts from fraud.

This blog contains forward-looking statements. For more information, click here.