Stolen Checks: What Information is Exposed for Fraud?

- Checks contain many "exposure components"

- Fraudsters can use one of more of these components to instigate theft

- Banks that deploy image forensic AI tech can greatly reduce these fraud opportunities

Stolen checks continue to be one of the major events covered in today's media -- specifically when it comes to assaults and robberies against mail carriers and mailboxes. The rampant crimes have even garnered the attention of Congress, opening up the USPS to questions on the how and why these crimes continue to occur.

One aspect of these crimes that does not receive enough coverage is what happens to the checks once stolen. While many of these checks are washed, with criminals altering the payee and amount fields, there is a lot more that can and does occur -- particularly if the checks end up on the dark web being sold.

Stolen Checks Hold a Lot of Information

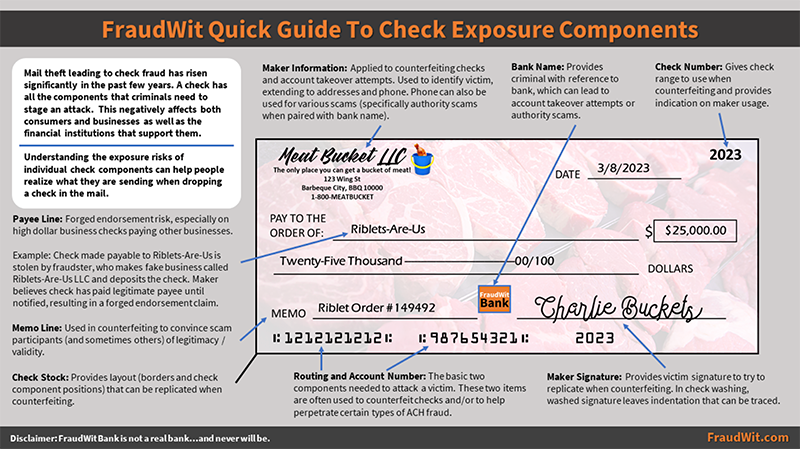

The FraudWit website, home to "short and quirky articles, educational presentations, and other content" created with consumers and fraud professionals in mind, offers a useful guide to the exposure components that can be found on a check -- in other words, the elements of a check that can be used for fraud.

Source: FraudWit

As you can see from the guide, a single stolen check opens up an individual or business to countless fraud channels.

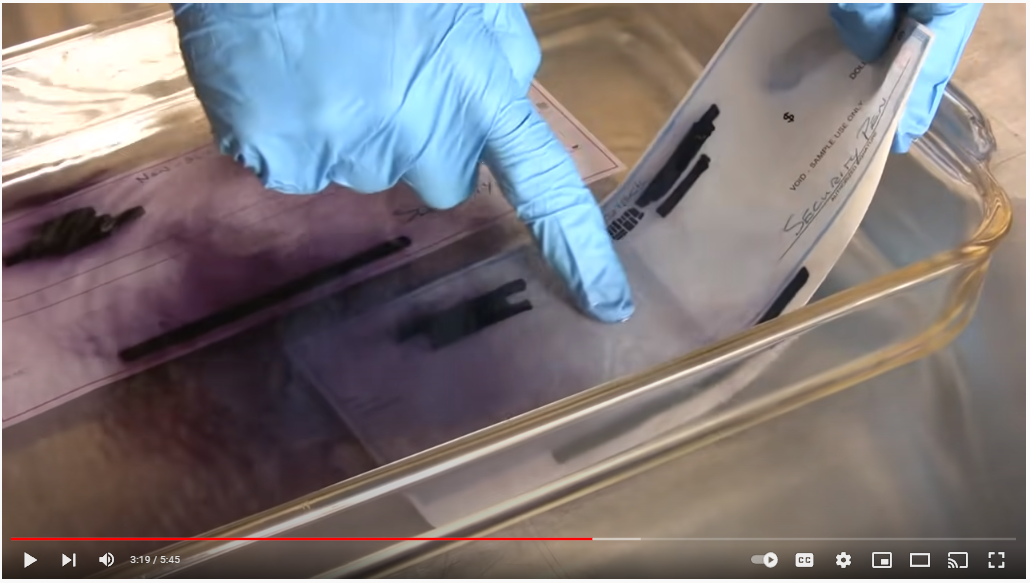

Altered Checks

The simplest and most convenient fraud tactic is altering the check. By watching a simple how-to video on YouTube and $10 worth of materials from the local store, criminals are able to use chemicals to weaken the ink from the payee and amount fields, and gently scrub them off the check. From there, the criminal will add their own name to the payee field along with a different dollar amount, depositing the check in a newly created account -- one they opened specifically for the fraud via the internet.

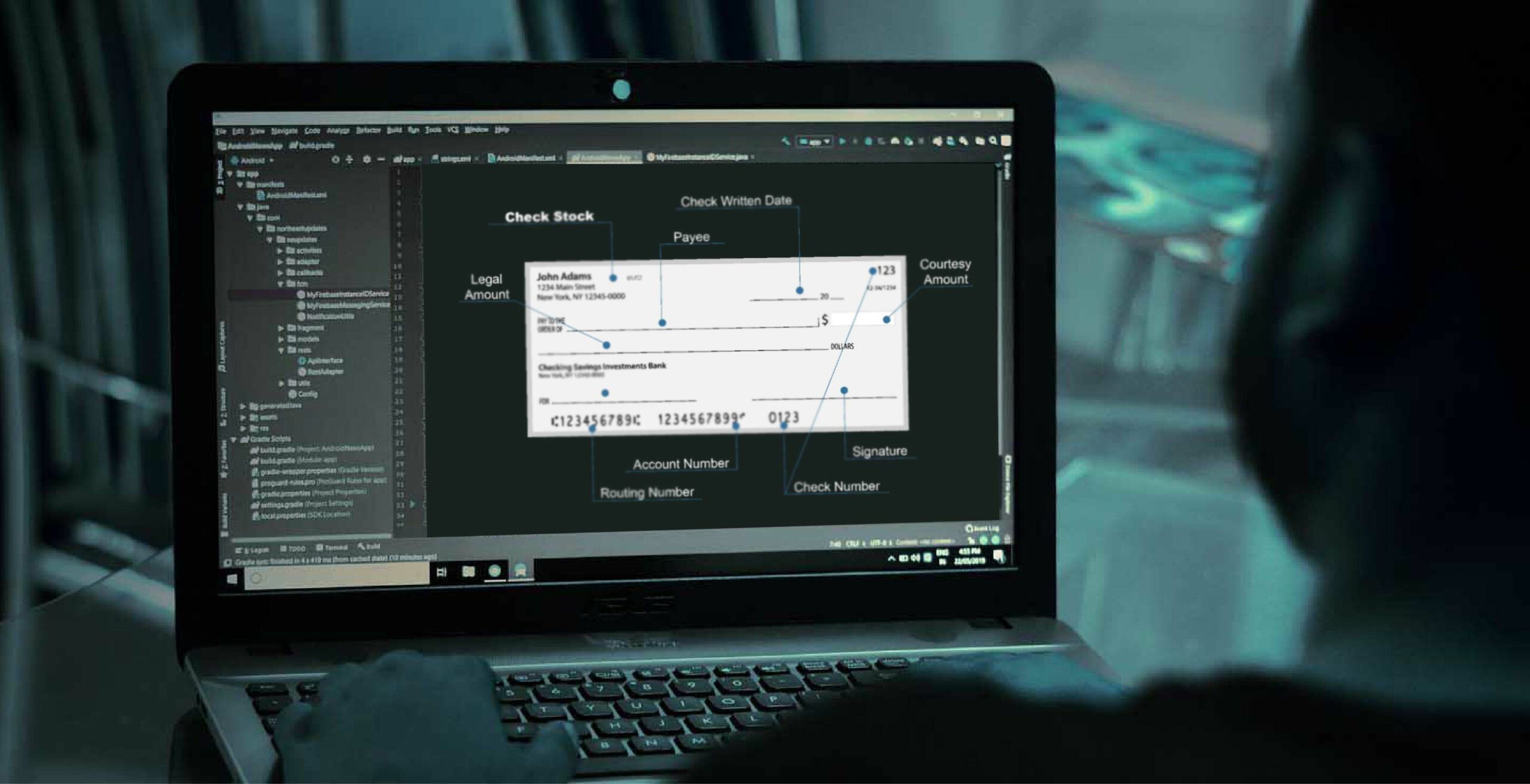

Counterfeit Checks

This is where the most damage occurs. Typically, the stolen checks are posted and sold on the dark web. Once a criminal gets their hands on a stolen check, they can use the information above to create multiple counterfeit versions to empty the account. Criminals have the check stock and, with simple computer programs, can duplicate numerous counterfeit checks that look nearly identical to the original. All that's left to do is digitally embed a copy of the signature.

Account Take-overs and Stolen Identity

A check contains enough information for criminals to either take-over an account and transfer funds to their own account, or use the information to steal an individual's identity.

Specifically for personal accounts, checks contain the individual's name, address, and name of the bank they are using. This information creates the base profile for both account take-overs and stolen identities -- an outcome that requires a level of sophistication, but causes significant damage as can lead to years spent proving the fraud and rebuilding credit.

The Importance of Advance Check Fraud Detection

While we are seeing the USPS taking steps to stop criminals from stealing checks, these actions could as much as a decade to deter criminals from stealing checks. Fortunately for banks and their customers, technological advancements and innovations are available to stop fraudsters before funds are accessed.

Banks are recognizing the fraud threat and complementing their current transactional-based fraud solutions with image forensic AI technology to actively interrogate captured check images -- comparing newly deposited checks with previous cleared checks and previously identified fraudulent items to identify possible counterfeits, forgeries, and alterations for review. Fraud departments within banks can then ensure a check's legitimacy, while at the same time adding fraudulent items to negative matching lists and improving system recognition of good checks.

Furthermore, banks are partnering with fintechs that are actively monitoring the dark web for posted stolen checks, enabling the bank to contact customers and close accounts before funds are stolen.

Remember -- the more banks can do to stop fraud, the more customers will trust their bank to keep their money safe.