Strategic Treasurer: 90% of Banks Rank BEC as Top Fraud Concern

- COVID created an uptick in fraud activity

- Remote work conditions contributed to vulnerability

- A new survey reveals 22% of respondents plan to spend more on security this year

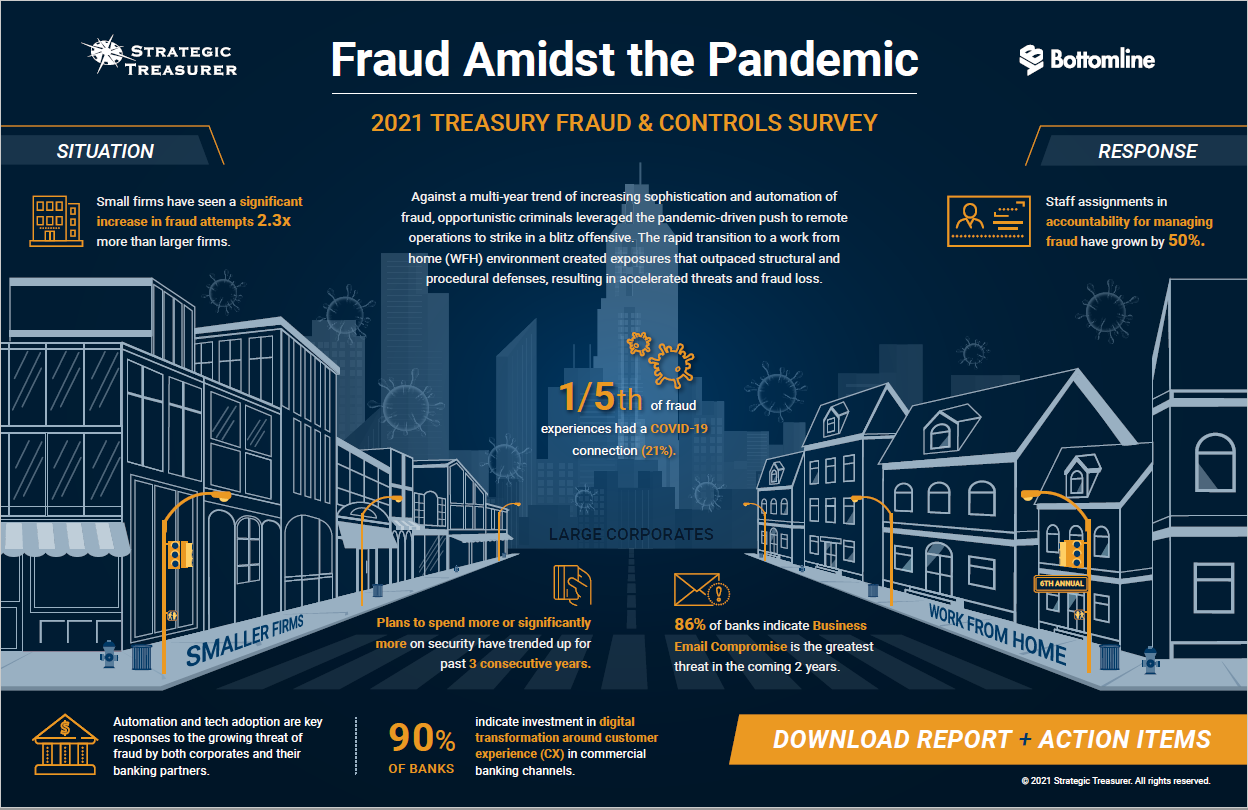

Once again, we see evidence that the COVID pandemic boosted the frequency and sophistication of fraud activity. As tallied in the 2021 Treasury Fraud & Controls Survey by Strategic Treasurer and related by Omri Kletter, global VP for fraud and financial crime at Bottomline, a good deal of fraud is due to the contortions businesses had to make -- in a hurry -- to accommodate remote work:

One-fifth of survey respondents said their fraud experiences had a pandemic connection. This isn’t surprising considering that the rapid transition to remote working scenarios often outpaced the ability of businesses to ramp up defenses. That trend was harsher for smaller businesses, who attributed a quarter of their experienced fraud to the pandemic.

In the world of remote working, two factors likely drove this finding: an increased incidence of malicious link clicking, and greater use of personal devices for work activity. Nearly half of these small businesses said that providing compliance through treasury fraud and controls services has become more burdensome.

In fact, 90% of respondents predict that business email compromise (BEC) and “authorized” fraud will represent the greatest risk to their businesses over the next year or two. Reported fraud losses due to BEC and related fraud have nearly doubled over the last two years.

Kletter notes:

This establishes a clear call-to-action. Recognition of risks and potential gaps across the customer base, combined with education and training, are critical efforts that can be undertaken by banks to protect customers. It’s not enough to have compulsory, static training. We’re seeing increasing success among those who are modernizing the education within payment landscapes. They’re gamifying education, leaving a message that sticks.

The survey also revealed a telling three-year trend: respondents reported spending more on security.

- 22% of respondents plan to spend more on security this year, up from 17% in 2019.

- Planned investments in payment technologies that cover BEC/authorized fraud are followed closely by those focused on protecting against account takeover.

The Strategic Treasurer provides an easy listen to digest the results of the survey in their Treasury Update Podcast below, or you can watch the webinar here.

However, it's important to aim that spending at the correct target. Kletter makes clear that data is the answer:

Data is both key and king, so data science becomes a fundamental piece of the ‘people process’, especially in the application of artificial intelligence and machine learning, the speed of investigations and the screening of watchlists. Processes are the bread-and-butter of every control—increasingly, we’re seeing their effectiveness determined as a cultural thing. As process evolves, we’ll also continue to see the development of hub mentalities—with more people having more responsibility, and more data to support us, we are coming together to share, learn and act.

When dealing with check fraud, banks need to focus on multiple battle fronts. For on-us fraud, leverage image analysis technologies with forensic AI is a proven method to detect counterfeit, forged, or altered checks. For deposit fraud, banks are leveraging a combination of image analysis technologies along with transactional analysis, field validations, and payee matching. These, in combination with education, provides banks and their customers the right tools to fight fraud.