Blog Post

New LexisNexis study identifies the true cost of fraud Fraud spans across the spectrum of both payment channels and customer journey Multi-layered technology approach is needed to lower fraud costs ABA Banking Journal reports on a new study called “The True Cost of Fraud™” from LexisNexis Risk Solutions that reveals rising monthly fraud attacks in 2021 compared…

Read MoreFraud increased tremendously as the pandemic entered its second year New fraudsters are entering the arena due to the ease of committing fraud 10 predictions for fraud in 2022 As the industry saying goes: “New Year, New Fraud.” It couldn’t be more accurate, as Frank McKenna’s Frank on Fraud blog opened the new year with…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreThe pandemic has created a definite uptick in fraud Rather than reactive, FIs should be PROACTIVE in their approach to combatting fraud It’s time to “think like a fraudster” James Ruotolo, a senior manager in the fraud and financial crimes practice at Grant Thornton, contributed a valuable article to ABA Bank Compliance magazine which discusses…

Read MoreA special research team has been closely studying fraud Check fraud can lead to cybercrimes such as identity theft Check fraud is growing and supported by an “underground” structure Many of us in the banking industry rely heavily on check fraud data from various industry sources such as the American Bankers Association (ABA), Association of…

Read MoreChecks can be “washed” Many businesses buy checks with anti-fraud features Deploying forensic AI technology thwarts “check washers” Since checks are most often delivered by mail — via what are generally non-secure receptacles that can be emptied by any sticky-fingered thief willing to open a public mailboxes or stolen directly from home mailboxes — they…

Read MoreThe pandemic has made digital solutions more vital than ever Credit unions faced a disadvantage in getting aboard the “digital services train” AI and ML solutions are giving CUs the leverage they need PYMNTS.com takes a look at how the pandemic has forced consumers to “rush to digital channels to tackle daily tasks including grocery shopping,…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

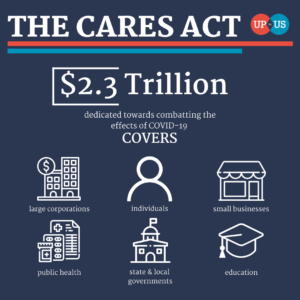

Read MoreFraudsters are being targeted by the United States Secret Service Nearly $100 billion in pandemic relief funds have been stolen Stimulus check scams are used to get personal information The National Review reports that fraudsters have stolen nearly $100 billion in pandemic relief funds. This has resulted in the arrests of more than 100 suspects, and…

Read MoreAs the final days of 2021 wind down, we’d like to thank all our partners and clients for supporting OrboGraph in a record breaking year. Also enjoy our holiday video below! Season’s Greetings! The OrboGraph Family

Read More