OrboNation Newsletter: Check Processing Edition – December 2021

Will Check Fraud in 2022 Mirror 2021? Start Preparing Now.

Recently, the Association of Financial Professionals (AFP), in conjunction with JPMorgan, published new data in their 2021 AFP Payments Fraud and Control Survey, reporting post-pandemic figures indicating that “In 2020, checks and wire transfers continued to be the payment methods most impacted by fraud activity (66 percent and 39 percent, respectively).”

In an article published by PYMNTS.com, Paramita Bhattacharjee, vice president, product line leader, risk insights at Early Warning, notes that while fraud is prevalent in all payment channels, including digital, check fraud accounts for 60% of attempted bank account theft (American Bankers Association’s 2019 Deposit Account Fraud Survey)...

Seven-Step Deposit Fraud: Would Your Bank Catch This?

We all know about scams involving passing fake or altered checks, but what about elaborate multi-step operations? Here's an interesting "What if?" exercise -- could your bank spot this scam?

The short version: A 37-year-old New Jersey man and two accomplices used the stolen identities of three children to construct an elaborate scam that netted at least $250,000 for the conspirators before they were found out...

Virtual Experiences: The Matrix vs. #OrboZone

In his FinExtra Blog, Dmitry Dolgorukov, the CEO of GiniMachine, takes a look at the newest trends and tech that the industry will need to be aware of ASAP in order to remain competitive.

Back when we first heard of Bitcoin in 2009, many brushed off the cryptocurrency as just a new fad, refusing to believe that technology had the power to impact such a stalwart industry as finance...

OrboGraph Recognized in 2021’s “Top 5 Fraud Detection & Prevention Software Companies” by Enterprise World Magazine

OrboGraph is proud to be recognized by The Enterprise World as one of the "Top 5 Fraud Detection & Prevention Software Companies in 2021."

With check fraud persisting as an issue for banks and their customers, OrboGraph has focused its resources on enhancement of its fraud capabilities to help banks detect and prevent fraud losses...

GPU Advancements Highlighted at NVIDIA GTC Virtual Conference

Kevin Levitt, Global Business Development, Financial Services, NVIDIA, has an excellent post at Finextra.com examining the prevalence -- and importance -- of Artificial Intelligence adoption in fintechs, investment firms, and consumer banks.

Financial institutions are using AI-powered solutions to unlock revenue growth opportunities, minimize operating expenses, and automate manually intensive processes. Many in the financial services industry believe strongly in the potential of AI...

A Real Life Innovation Lab Story at Royal Bank of Canada

Recently, Royal Bank of Canada (RBC) has taken an approach similar to that of OrboGraph's OrbNet AI Innovation Lab to bring AI technology to the financial industry; partnering with NVIDIA and Red Hat to create Borealis AI. But what is Borealis AI? And what do they do? Well, Borealis AI describes themselves...

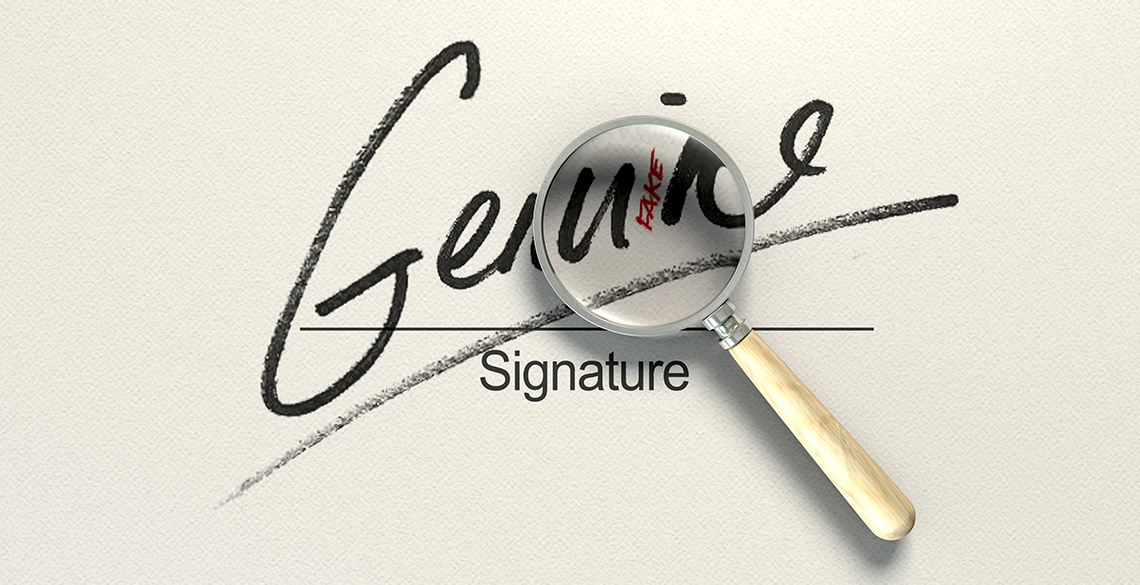

Forensic Document Examination: Impact on Banking, Fraud, and Payments

Forensic document examination is foundational to OrboGraph’s OrbNet Forensic AI technology. To assist in describing the applicability of forensics in banking, fraud detection, and payments, we talked to forensic expert and author, Khody Detwiler...

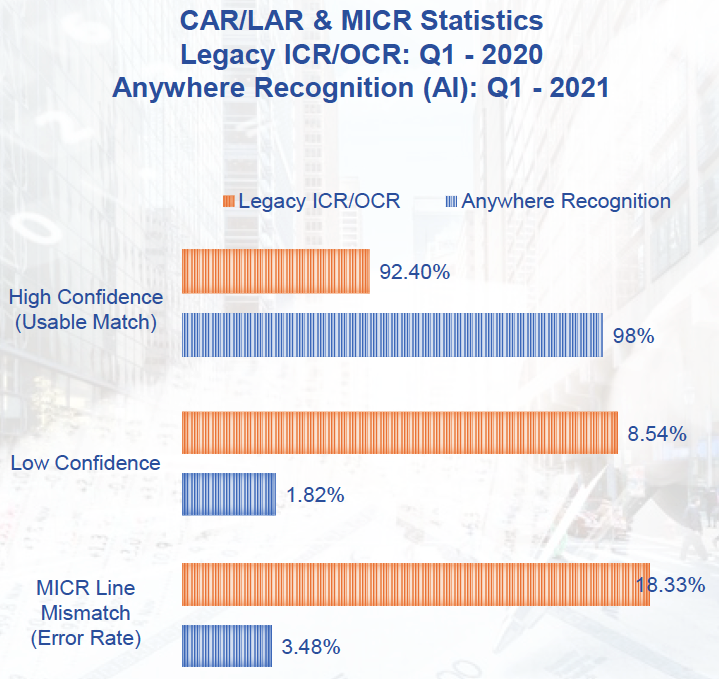

OrboGraph’s OrbNet AI Boosts Lockbox Accuracy to 98% For TMR

Last week, the OrboNation blog featured the NVIDIA GTC Virtual Conference, highlighting the importance of GPUs to Artificial Intelligence in financial services. These dynamic sessions provided attendees with information invaluable to advancing financial services, particularly the banking industry.

To further display the benefits and results of artificial intelligence in banking, we collaborated with our friends at Technology Management Resources, Inc. (TMR) to take a deep dive into the performance of OrboGraph's Anywhere Recognition solution with OrbNet AI technology...

Ceto & Associates: Community Banks are at a Disadvantage in Fraud Detection

Community banks and credit unions are at a disadvantage. Their lack of necessary internal resources and budget to upgrade their systems and integrate new technologies compared to big banks leads to gaps in fraud coverage, automation capabilities, and outdated systems. These gaps are perilous when almost all industry numbers indicate check fraud is on the rise. Meanwhile, the banking industry is more competitive than ever as new fintech companies like Chime, Brex, and Acorn hit targeted markets. Community banks and credit unions also perform much more manual work compared to these new fintech companies...

LexisNexis Report: Cost of Fraud is On the Rise Since the Pandemic Set In

One of the harsh realities of fraud: actual LOSSES due to fraud exceed the monetary amount involved in the transaction. Digital Transactions reported on LexisNexis Risk Solutions’ “True Cost of Fraud” study for e-commerce and retail merchants, which reveals that each $1 in fraud costs e-commerce merchants in the United States $3.60 in total expenses. That compared to $3.13 pre-pandemic...

71% Call Check Deposit Critical or Important for Mobile Banking Capabilities

Forbes took a look at new research from Cornerstone Advisors and found that more than three-quarters of Americans who have a smartphone are now mobile banking users. Mobile banking adoption is approaching ubiquity among Gen Zers and Millennials (ages 21 to 40) with 88% of each of the two generations...

Fraud, AML, and Compliance: $960M Sanctioned Penalties in 2020

Lexology recently released their Economic Sanctions and Anti-Money Laundering Developments: 2020 Year in Review report, examining economic sanctions and anti-money laundering (“AML”) developments and trends in 2020 as well as a look at the year ahead under the new Administration in Washington...

Deluxe Corp: Checks Are a Primary Cog in Digital Payments Ecosystem

Barry McCarthy the CEO of Deluxe, is a proponent of checks as payment tools. Even with the pivot for consumers to digital payment options, business-to-business is still reliant upon an older payment method: checks. Yes, you read that right. Although check usage has decreased significantly since the mid-2000s, physical checks accounted for 42%of B2B transactions in 2019 despite the explosion of digital options...