The Drive Towards Digital: Adoption of Mobile Check Deposits

The latest PaymentsJournal podcast, with guest speaker Chuck Doherty, Fiserv's Director of Client Relations for Deposit Solutions, and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group, discusses mobile check deposits, best practices to drive greater accountholder adoption, and the challenges financial institutions face as they continue to search for ways to mitigate risk.

Over the last few years, mobile banking with financial institutions across the country has soared as consumers happily embrace the shift to digital. It is important for both banks and credits unions to continue to grow their accountholders’ adoption of digital payment methods – specifically mobile check deposits – to not only drive greater end-user satisfaction, but also to address the massive shift to remote and digital transactions.

Driving Accountholder Adoption of Mobile Check Deposits

Checks Are Still Relevant

Though we've grown used to hearing that they are "on their way out," the fact is that checks still account for 7% of all consumer transactions -- and they are often larger transactions.

Typically, check users write about three checks per month and the average dollar value of each check is about $300, versus the $87 average across other payment types. Checks are often used for household phone or cable bills, as well as payments for tradespeople such as plumbers or landscapers.

“Even if a consumer may use a digital interface [for bill pay],” noted Grotta, “on the back end, that actual payment may still go by check.”

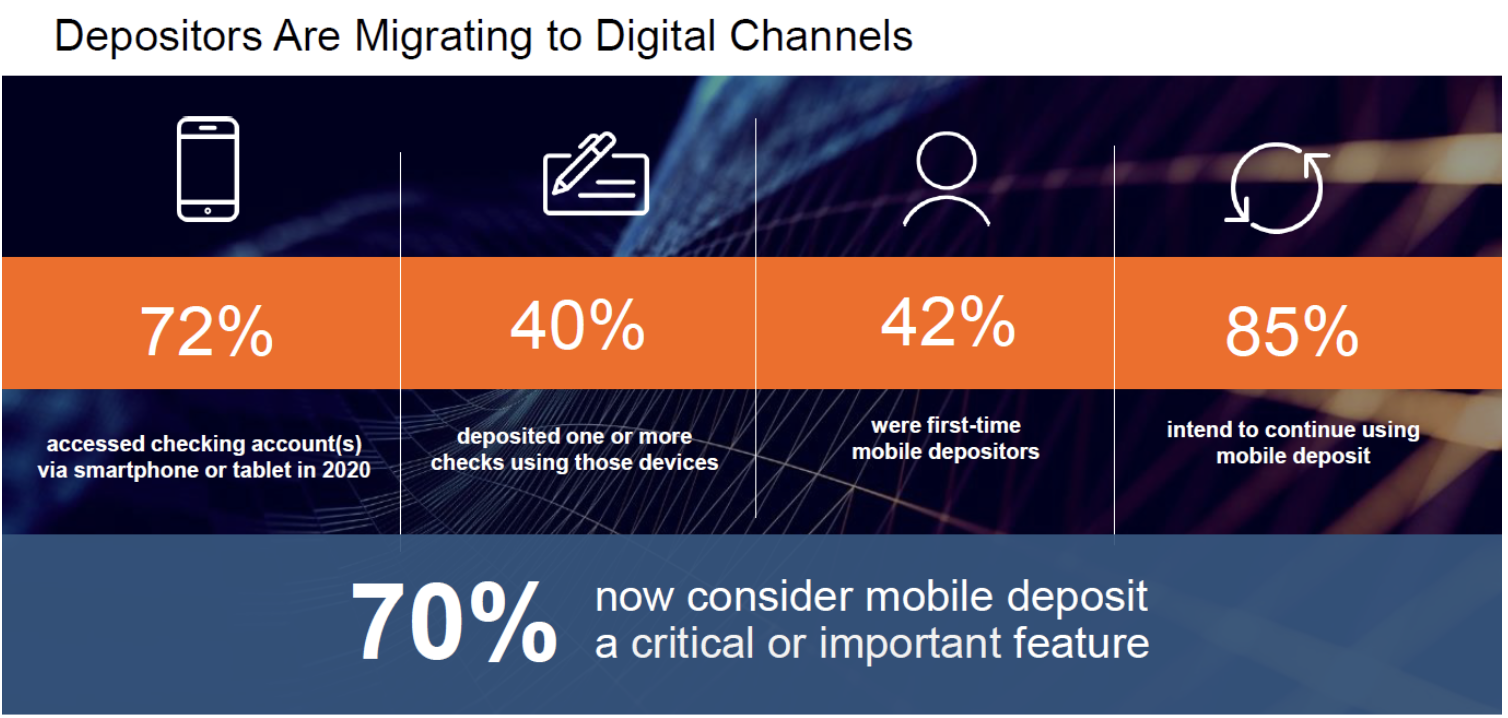

Click image above to enlarge.

The Move to Digital Deposits

Depositing paper checks at a branch via electronic images and scanning has been around for years, However, as PaymentsJournal points out, financial institutions have lagged behind in encouraging customer adoption. Accountholders are asking for easy, quick, and convenient deposit transactions like mobile deposit, and banks are slowly responding.

To no one's surprise, mobile deposit is most prevalent among 18 to 24-year-olds.

It seems the instinct among younger generations is to rid themselves of any physical funds as fast as possible.

Payments Journal graphic

"Gen Z" is not alone:

The second largest group is ages 45-54, for whom 50% prefer mobile as the most frequent check deposit method. Even among ages 55-64, 32% use mobile deposit most often. Regardless of age, the COVID-19 pandemic caused people to start seeing the convenience of mobile deposit solutions.

“We used to talk a lot about the digital divide, where the young folks were digital and the rest of us were just kind of lagging behind,” Grotta pointed out. “We’re certainly seeing that change quite a lot. It’s what I call the blurring of the digital divide.”

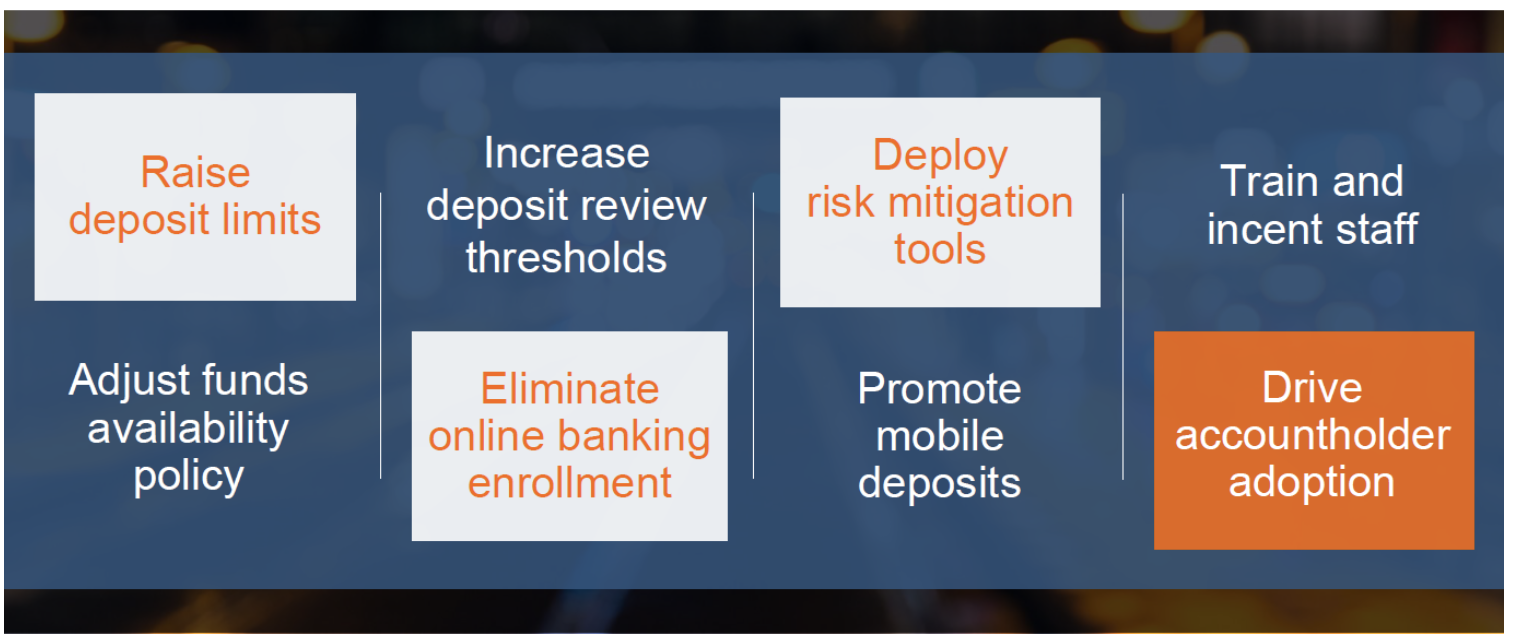

The Now -- How

The question, then, is how? Fortunately, Mr. Doherty and Ms. Grotta go into substantial detail regarding exactly how banks can encourage mobile check deposits:

PaymentsJournal graphic

Mobile deposit solutions are vital to help banks and credit unions remain competitive in the current digital landscape. With customers embracing this technology, it's important for banks and financial institutions to ensure that their back-end technology supports the demand and provides added protection. Deploying technologies like OrboAnywhere -- able to be utilized in any channel while adding the ability to identify counterfeit, forged, and altered checks -- will ensure that the consumer enjoy a seamless and secure experience.