The Prevalence of Invoice Fraud in Businesses

- Invoice Fraud is a pervasive problem

- Fraudsters often capitalize on alternate payment methods

- Invoice Fraudsters are sophisticated and do their homework

Pymnts.com looks at the startling emerging story of a Germany payments company called Wirecard, where as much as $2.1 billion may be unaccounted for.

The story notes that "even the largest companies with the most resources to digitize and combat fraud are not immune to the risk — from both within and outside of, the organization."

Auditor EY was unable to confirm the existence of 1.9 billion euros ($2.1 billion) in cash balances on trust accounts, representing about a quarter of Wirecard’s balance sheet, the payments company said on Thursday.

There was evidence of “spurious balance confirmations”, it added.

Invoice and "insider" fraud is anything but rare, as Pymnts.com further reports:

What is Invoice Fraud?

Invoice fraud takes advantage of the myriad payment methods currently available and the fact that it is certainly within reason to believe that a known vendor is changing their payment method. So, often invoice fraud involves the fraudster notifying a company that supplier payment details have changed in some manner -- completely reasonable, right? -- and providing alternative details in order to defraud the company.

Sometimes the fraudster will ID themselves as the company’s real supplier, or even pose as a member of the company itself. Since funds are often transferred quickly -- that's the goal -- recovering money from fraudulent accounts can be very hard to do.

Anyone Can Be Victimized - Even The Shark Tank!

Barbara Corcoran, an entrepreneur best known for appearing on the startup investment television show “Shark Tank,” told People Magazine she'd lost nearly $400,000 to an invoice scam and confirmed that she will not be able to recover the funds.

“I lost the $388,700 as a result of a fake email chain sent to my company. It was an invoice supposedly sent by my assistant to my bookkeeper approving the payment for a real estate renovation. There was no reason to be suspicious as I invest in a lot of real estate.”

She's not the only Shark Tank panelist to be taken: billionaire investor Mark Cuban recently told CNBC about his own experience getting victimized, losing $82,000 that was stolen from Cuban's first company, MicroSolutions, via AP fraud:

“I’m like, ‘OK, for our accounts payable, we print out the checks to the vendor,’” he recalled, adding that those checks were then given to a receptionist to pay suppliers. Yet that receptionist forged those checks to pay herself, leaving just $2,000 left in the company’s bank account — a scenario Cuban ultimately said helped him get more serious about his business ventures.

Invoice Fraud Strikes Individuals As Well

As the "gig economy" grows and more and more sole proprietors exist, they, too, must be wary of being targeted by fraudsters masquerading as vendors and hoping to get lost in the shuffle of billing chores.

Barclay's offers a checklist of steps to take in effectively preventing invoice fraud:

- Always verify details of any new/amended payment instructions verbally by using details held on file, and not on the instruction. Fraudsters can spoof email addresses to make them appear to be from a genuine contact, including someone from your own organization.

- If you are suspicious about a request made by phone, ask the caller if you can call them back on a trusted number. Fraudsters will attempt to pressure you into making mistakes – take the pressure off by taking control of the situation.

- Consider removing information such as testimonials from your own or your suppliers’ websites on social media channels that could lead fraudsters to knowing who your suppliers are.

- Look carefully at every invoice and compare it to previous invoices received that you know to be genuine – particularly the bank account details, wording used, and the company logo.

- Consider setting up single points of contact with the companies you pay regularly.

- Apply the same principles to requests from within your own organization.

- Regularly conduct audits on your accounts

- Make all staff aware of this type of fraud, particularly those that are responsible for making payments.

When considering invoice payments, checks have a clear advantage to other payment methods. Banks are able to deploy several technologies that detect fraudulent payments, including transactional analysis, image analysis, and positive pay systems.

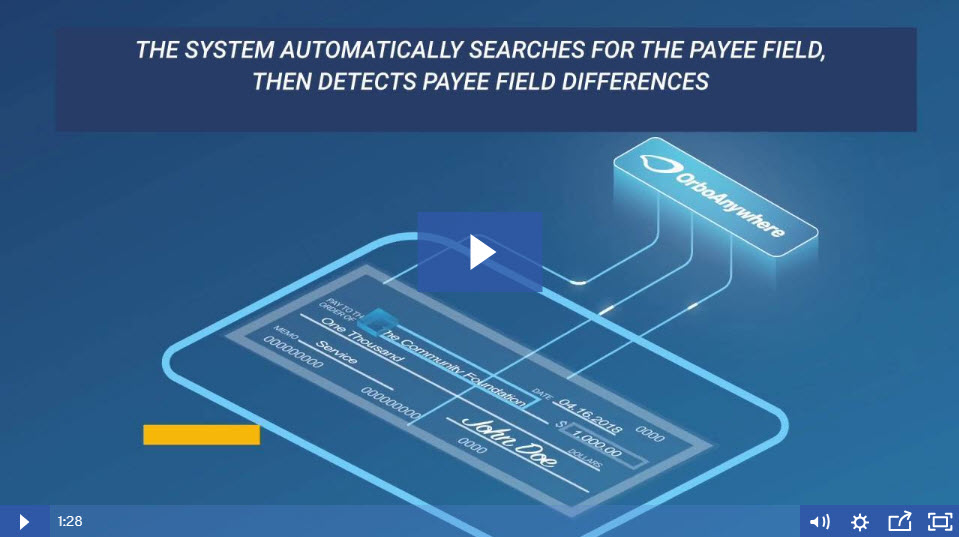

What banks need to consider is combining these technologies to provide powerful fraud protection for businesses. By leveraging transactional analysis to identify irregular payments to known and unknown vendors, image analysis to detect counterfeits, forged, or altered checks, and positive pay systems to extract payees names to verify against an approved vendor list, banks are able to provide comprehensive check fraud detection for their clients.

Anywhere Fraud

Click the image above to watch the video.

Anywhere Positive Pay

Click the image above to watch the video.