UK Finance Reports Cases of Check Fraud Increased +35% in H1 2023

- UK Finance has released their 2023 Half Year Fraud Update

- Digital banking has grown more popular - and is a fraud target

- The UK lacks incentive for many sectors to fight or identify fraud

While we typically focus on fraud as it occurs here in the USA, many financial institutions operate in multiple countries. This includes our friends "from across the pond": the United Kingdom.

Recently, UK Finance released their 2023 Half Year Fraud Update, a report on fraud statistics for the first half of this year (PDF downloadable here).

As noted in the foreword of the report:

The latest UK Finance figures show that fraud continues to be one of the most prevalent crimes in the UK. From impersonating companies and creating fake investment adverts, to stealing card details and taking over personal accounts, criminals are using social engineering to ruthlessly target their victims. In the first six months of this year alone, criminals stole over half a billion pounds.

The data shows that criminals stole over £580 million through fraud during this period, with authorized push payment (APP) fraud accounting for over £239 million of losses.

A Closer Look at the Numbers

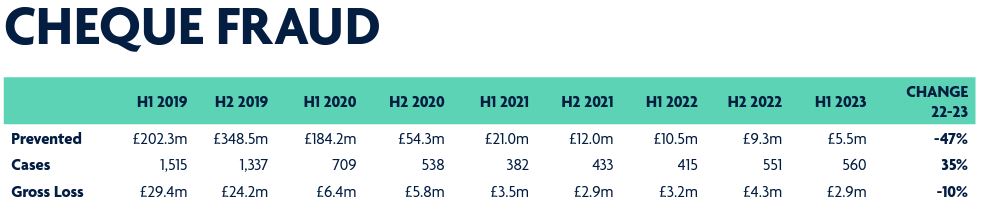

When examining the numbers, we can see that check (or cheque) fraud still remains a significant challenge, even with the UK looking to move towards the digital pound.

According to the data, cases of check fraud in H1 2023 were up 35%. Additionally, the UK appears to have gotten better at check fraud detection, as losses were down 10% -- a strong indicator that their strategies are working. It's important to note the volume of checks in the UK pales in comparison to the USA, but the data is nevertheless significant.

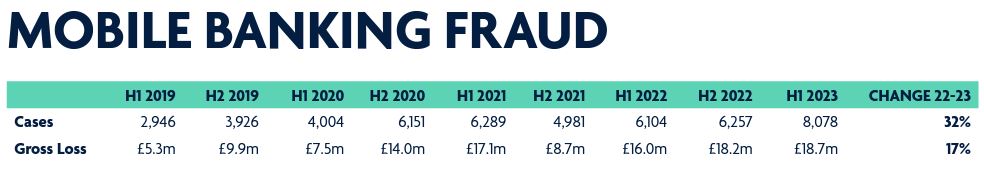

When we consider the UK's commitment to pushing digital options, we are seeing that fraudsters are also looking to exploit these channels. The report notes that 53% of adults in the UK access their banking accounts through mobile or tablet in 2022. This access has also led to an increase in fraud.

Both the number of cases and gross losses increase in H1 2023 -- 32% and 17% respectively. This is a strong indicator that, while the move towards digital banking has increased commercially and for personal use, it is also a major target for fraudsters.

Solving the UK's Fraud Problem

One key issue that is affecting the UK is that many sectors do not bear responsibility for reimbursing victims, meaning "there is little commercial incentive for them to truly tackle the problem that proliferates on their sites, platforms and networks." This leaves the mess for financial institutions and government entities to solve.

Ben Donaldson, Managing Director, Economic Crime, UK Finance, notes the following:

Criminals will continue to try to ruthlessly exploit the trust of people across the UK, including the most vulnerable. Fraud is an ever evolving and complex threat to people and businesses and technological change and the greater prevalence of AI will continue to make it more challenging. It is only through collective action across government, law enforcement and all industries involved that we can truly stop fraud and protect people from all the harm it causes.

This is not unlike what is occurring here in the US, with social media platforms and other companies not bearing responsibility for the fraud that takes place via their platforms. That's why financial institutions from both the UK and USA can benefit from leveraging AI and machine learning technologies to solve the fraud problem -- particularly when it comes to check fraud.

By deploying solutions like image forensic AI, financial institutions are able to stop fraudulent check -- or cheque -- payments from hitting and harming their customer accounts.