The Digital Pound: The Future of Payments in the UK?

Digital currency has been a topic of discussion for many years now. Most have heard of Bitcoin and other cryptocurrencies; yet no digital currency or cryptocurrency has made a strong enough case as a viable replacement for current payments.

One major drawback -- or advantage, depending on who you ask -- is that cryptocurrencies are unregulated. However, The Bank of England is doing its best to create interest for their new virtual currency, called the Digital Pound.

The digital pound would be a new type of money issued by the Bank of England for everyone to use for day-to-day spending. You would be able to use it in-store or online to make payments.

This type of money is known as a central bank digital currency (CBDC). You may also hear it being called ‘digital sterling’ or even ‘Britcoin’. We call the UK version of CBDC the digital pound.

Widespread usage of the digital pound would, of course, make cash or other payments like physical checks a relic of the past. We've seen digital payments take hold in many Eastern countries, particularly in China where WeChat and Alipay are heavily utilized to pay for goods and services in the major metropolitan areas.

The way people pay for things is changing. People are not using cash as much as they used to. Digital payments are becoming more common.

There are also new forms of money on the horizon. Some of these could pose risks to the UK’s financial stability.

In light of these trends, the Bank of England and HM Treasury judge there is likely to be a future need for, and benefits from, a digital pound.

Digital Pound: The Ideal Scenario

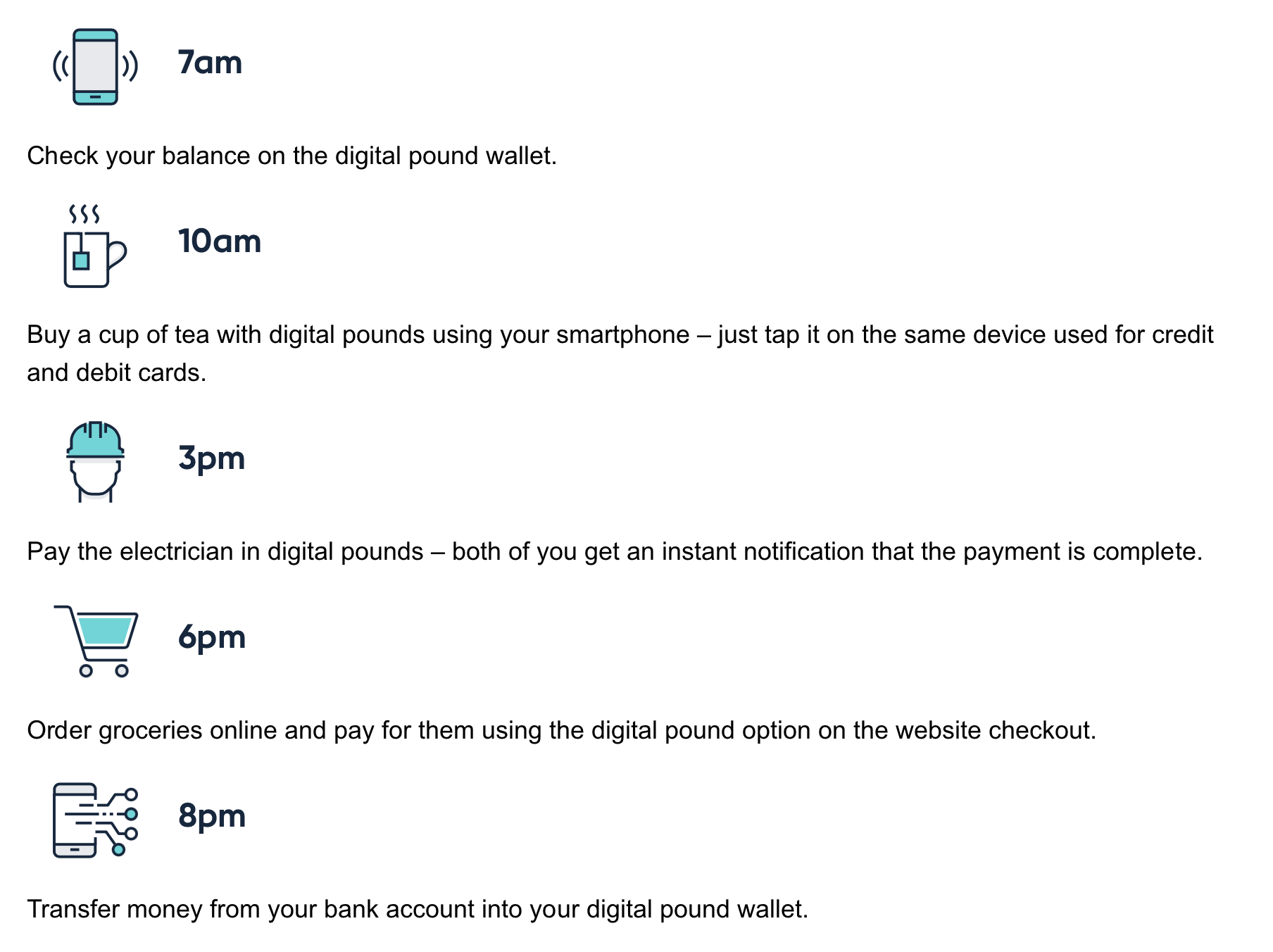

The Bank of England paints an idyllic picture of a day in the life of the digital pound user:

It's important to understand that this is the "ideal" scenario. There are many drawbacks -- particular in the delivery system: Your smart phone.

What happens if your phone is lost or stolen? What happens if you are in an area out of service or the wifi is down at the location? What securities are being put in place so that your digital pounds are not stolen?

Not a Done Deal

The popular opinion seems to be that the Bank of England will follow through, though they state that the digital pound is not yet a "done deal." Still, most observers and news outlets anticipate the change:

The Bank of England has identified the need for a central bank digital currency in the future, signaling that a digital pound is likely to become a reality. This digital currency would function as a “digital banknote” issued by the Bank of England, providing households and businesses with a convenient and secure means of conducting everyday payments. The adoption of a retail digital pound has the potential to stimulate innovation across various domestic markets, including rental and e-commerce, while fostering financial inclusion and reducing costs for small and medium-sized enterprises. Janine Hirt, CEO of Innovate Finance, believes that the digital pound, alongside a broader ecosystem of digital payments, will enhance the United Kingdom’s global standing in payments innovation.

So, does this mean the end of the paper check--and attendant security issues--in the UK? Not if we look at the experiences of the UK and other countries that made similar moves in the past.

As we examined in a recent post, Australia announced their intention to end the need for checks by 2030. However, that announcement was met with skepticism because, way back in December of 2009, the board of the United Kingdom Payments Council set October 31, 2018 as their target date for the end of paper cheques (or checks) as a common payment vehicle in the UK. Soon, the Payments Council realized that their plan to eliminate cheques by 2018 did not have public or political support.

In July 2011, the Council withdrew [PDF] its 2018 date, proclaiming that “cheques will continue for as long as customers need them.”

For now, financial institutions cannot put their eggs in a single basket, as many would say. Flexibility in accepting all payments -- both current and new -- ensures that financial institutions are meeting all their customers' expectations, not just the technologically savvy. This means that financial institutions will need to continue to modernize their platforms -- automating payments like checks with AI and machine learning technologies -- to achieve straight-through processing.