WTHR’s “13 Investigates” Report: Why Does Mobile RDC Struggle to Catch Blatant Check Fraud?

- Check fraud ranges from "craftsmanship" to cut-and-paste

- Businesses and individuals are being defrauded, at work and at home

- Underfunded AI and deep learning tools at small banks may be to blame for "easy fraud"

WTHR-13 News of Indianapolis takes a fascinating look at the range of "craftsmanship" that goes into check fraud, all the way from "how did they even get away with that?" to some pretty good replicas.

The report is particularly fascinating because it shows three very different approaches to check fraud, which, according to level of difficulty, can be listed as follows:

- Literal paste-overs of fake names and amounts on stolen checks

- Checks stolen from mailboxes -- personal and business -- that are altered

- Complete counterfeit checks

"So Blatant, It's Ridiculous"

Sometimes, it doesn't seem to take much effort to pull off a scam.

As WTHR reports:

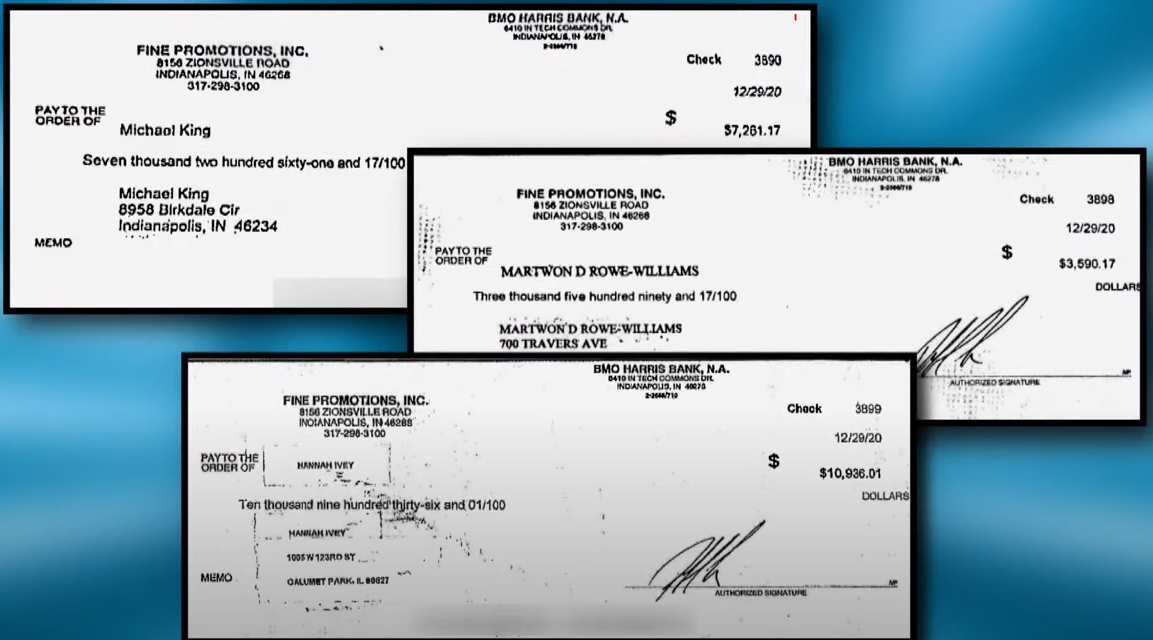

Robb Fine and his wife own a promotional products distribution company on the northwest side of Indianapolis. They take pride in paying their vendors quickly. But in January, the Fines started hearing from some of those vendors who had not received timely payments.

“They said they hadn’t received the checks we sent, so we put a stop payment on them and re-issued new ones right away,” Fine explained. “Then, we come to find out the original checks had already been cashed. They were stolen and altered and cashed by someone else. And they’re so blatant, it’s ridiculous.”

Click the image above to enlarge.

These particular fakes were almost insultingly amateurish:

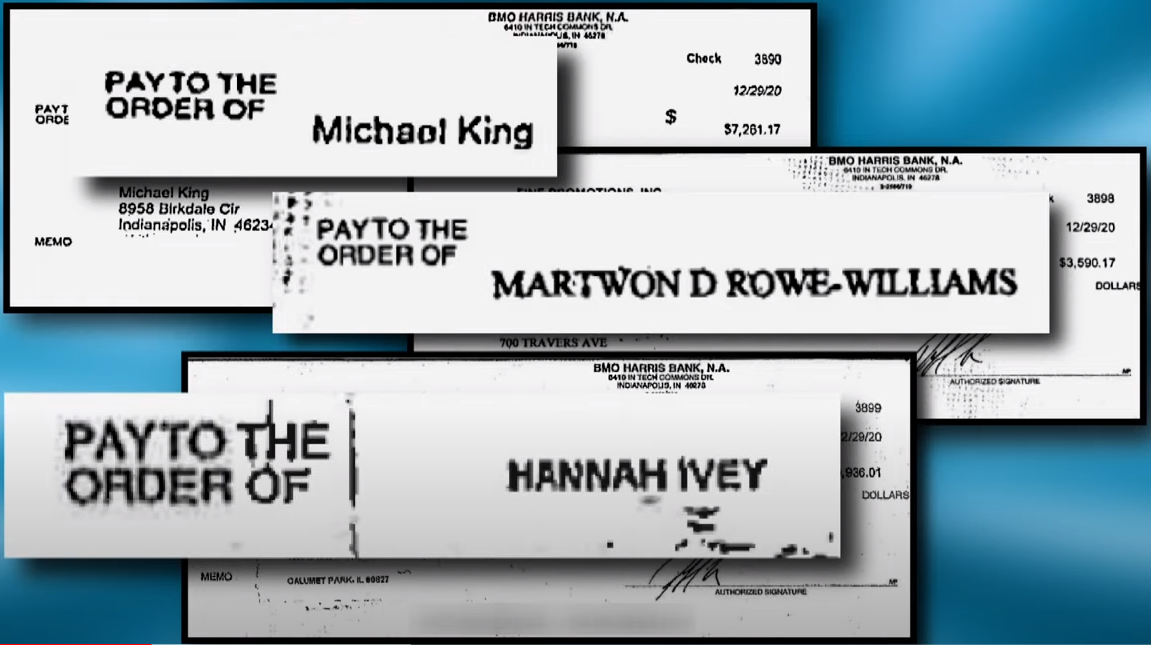

The type font used to alter the information on the checks is clearly different than the type used on the rest of each document. And one of the photocopied checks shows the name and address of the original payee were sloppily covered by strips of paper that the perpetrator cut and pasted onto the altered document. As far as con-jobs go, this wasn’t even a good one.

“That looks absolutely ridiculous. The whole thing just screams fraud,” Fine said, pointing to the altered check and shaking his head in disgust. “It was absurd that the bank accepted that check and allowed that to happen.”

Click the image above to enlarge.

Mobile and Banking Apps Are Blamed

Many see the 200% increase in mobile banking since in April 2020, when the pandemic and lockdowns began, as a reason for so many more fraud cases. Ready or not, many small banks had to ramp up their mobile banking offerings.

Last April alone, soon after the pandemic started, new mobile banking registrations jumped 200 percent, according to Fidelity National Information Services which works with dozens of the world’s largest banks. Mobile banking traffic rose 85 percent just a few months into the pandemic and, with millions of new users, has not slowed since.

“The fraudsters are always one step ahead, and they’ve figured out how to make a deposit and quickly go withdraw the money,” said John Ravita, marketing director for SQN Banking Systems, a company that creates and markets fraud prevention tools for the banking industry. “Check fraud is not that difficult – it’s actually surprisingly easy – and using mobile banking as a channel does make it easier to get away with.”

Ravita believes online banking is ideal for criminals because they never have to show up at a bank or an ATM. Video monitoring systems record fraudulent transactions and bank tellers are trained to ask questions and spot bogus checks.

“I think the challenge with mobile banking is it's faceless, so it is easier for a fraudster to perpetrate fraud,” Ravita told 13News. “They are getting smart, and they know how to increase their odds of avoiding detection.”

The Solution: Forensic AI Approach to Check Fraud

Check fraud is reaching new heights with the American Bankers Association (ABA) reporting $1.3 billion stolen in check fraud in 2018 -- with anticipated new data from the ABA coming in January 2022. While the actual total losses are difficult to estimate, there is a sense in the industry that check fraud continues to rise, particular with the pandemic.

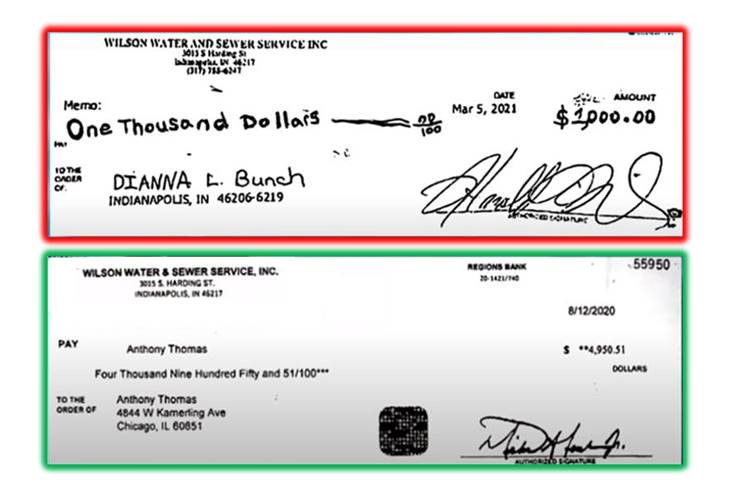

What is not difficult to estimate is the postive impact that many banks are seeing with the deployment of image-analysis leveraging forensic AI technology for mRDC. The technology interrogates the image of a check deposited through mRDC, utilizing multiple analyzers such as check stock validation (CSV-AI), automated signature verification, and alteration detection using check style comparison and amount discrepancy to identify counterfeit, forged, and altered checks.

When reviewing an example from the video, the system would identify major red flags, preventing the items from being deposited. These include, but are not limited too:

- Date field location

- Serial field location

- Payer field location and number of lines

- Pay to the order of field location

Signature verification issue:

- Forged signature

The banks that are not deploying image-analysis with forensic AI technology are not only absorbing losses, but also damaging their reputation with clients. While some examples are blatant when examined by the human eye, the technology utilizes 200+ analyzers to review images of checks that are able to identify check fraud on more than 95% of targeted use cases. It's easy to see the value banks derive from investing in this technology.