Healthcare M&A Generates $19B in Q2 2022

Mergers and acquisitions (M&A) are common occurrences in the healthcare market. Whether it's consolidation of healthcare providers/hospitals/systems or synergistic healthcare technology companies advancing their capabilities to improve healthcare, M&A within the industry is seen as a major positive.

Over the past decade, we've seen what have been dubbed "mega-deals," including:

- Microsoft acquiring Nuance for $19B

- Oracle acquiring Cerner for $28.3B

- Optum acquiring Change Healthcare for $13B

- Hellman & Friedman and Bain Capital acquiring athenahealth for $17B

- R1 RCM acquiring Cloudmed for $4.1B

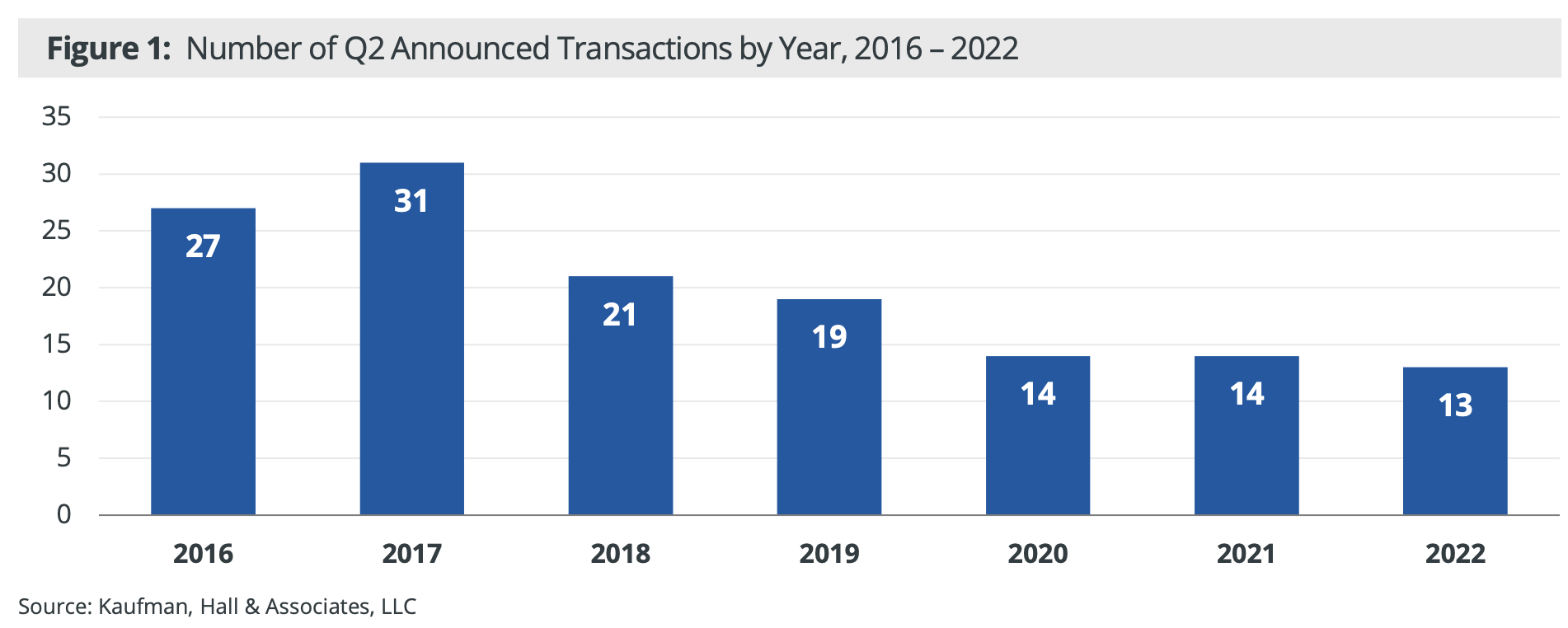

The second quarter of 2022 was no different, with a record high 13 transactions generating $19.2 billion, according to the latest edition of Kaufman Hall’s M&A Quarterly Activity Report. RevCycleIntelligence reports that the figure represents fewer transactions than in the years leading up to the COVID-19 pandemic; however, it was consistent with the 14 transactions that occurred in Q2 2021. Additionally, there were 12 transactions announced in Q1 2022.

Whereas Q1 2022 didn’t see any mega transactions, two of the 13 deals in Q2 2022 were considered mega transactions—transactions in which the seller or smaller party has an annual revenue of more than $1 billion.

These deals included the merger between Advocate Aurora Health and Atrium Health, where the smaller party had a revenue of $12.9 billion, and the acquisition of MercyOne by Trinity Health, where the smaller party had a revenue of $3.0 billion.

What to Expect for H2 2022

As you probably already know, it's extremely difficult to predict M&A activity. However, in Q3 of 2022, we have seen some major announcements, including:

- CVS Health acquiring Signify Health for $8 billion -- outbidding Amazon and UnitedHealth Group

- Walgreens finalizing majority stake acquisition of CareCentrix

- Trinity Health completing acquisition of MercyOne Health System

- Optum UK acquiring healthcare software group EMIS for $1.5 billion

And, of course, we cannot ignore the recent announcement that OrboGraph has been acquired by Revenue Management Solutions (RMS) & Thompson Street Capital Partners.

As we wind down Q3 and move into Q4 of 2022, we can expect that healthcare M&A will continue to flourish, even during these uncertain economics times.