AI Tech for Community Banks and Credit Unions: Fintech Vendors Must Step Up

Many people in today's financial services industry applaud the emergence of AI technology as an excellent equalizer for financial institutions, allowing community banks and credit unions a level of parity with their larger competitors. After all, it's just a matter of recognizing and embracing the emerging AI technology, right?

It turns out things are not that simple for smaller players in an aggressively competitive market. In fact, as reported by The Financial Brand, vendors of AI tech may actually be focusing on mega-banks at the expense of smaller financial institutions. The thought is, of course, that big contracts with giant mega-banks are the way to success -- and, one has to admit, landing the "big fish" is a satisfying goal to attain.

However, as The Financial Brand notes:

But AI vendors should sell to the little guys too. It’s not just an investment in the common good — it’s worth bearing in mind that multiple small fish can outweigh a big one.

AI: Soon Required for ANY Financial Institution to Succeed

Though the tendency is for vendors to sell the largest targets, The Financial Brand identifies four main reasons that fintech vendors should not neglect "non-mega" community banks and credit unions.

- Financial Institutions of All Sizes Need AI

- The Fate of Community Institutions Depends on Tech Parity

- Fintech Vendors Could Self-Destruct

- The Technology Should Be the Same

It's also made clear that fintech vendors should not limit smaller financial institutions to a "separate menu" of technology options. In order for community banks and credit unions to compete with the big boys, they must also have the ability to utilize the same technologies.

However, with all that in mind, do community banks and credit unions have the same motivators as the big banks?

Avoid "Legacy Thinking"

As noted here previously, large financial institutions often have sufficient internal resources to quickly acquire and develop technologies, complete with a management structure adequate to institute major changes and acquire the right personnel.

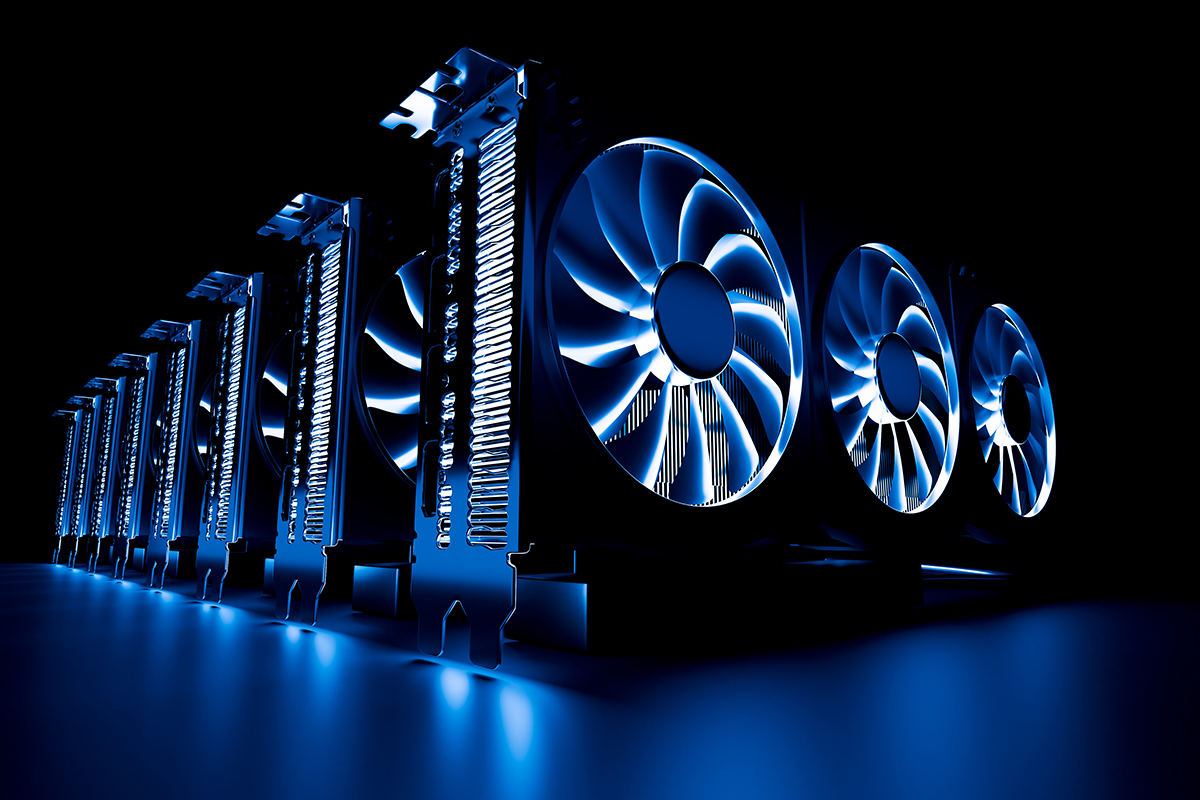

For community banks and credit unions, this is often not the case. Furthermore, they may be less willing to invest in the internal infrastructure needed to support artificial intelligence and machine learning -- from hardware like GPUs to the support staff to maintain the technology. And, it's all too easy to slip into a state of "what brought us here" satisfaction.

That's why many fintech vendors are partnering with core processing and service bureaus vendors like FIS, Jack Henry, Fiserv, and Alogent to make these types of technologies readily available to community banks and credit unions, integrated right into their platforms -- including check processing and check fraud detection. This enables smaller banks and credit unions to acquire the technologies to compete with the bigger banks, while also eliminating most of the overhead and maintenance involved in directly purchasing the tech on their own.