Millennials Become Targets…for Check Fraud

There are many reasons for the resilience of checks (including the small- and mid-sized businesses that rely on the paper check’s “float” for accounting purposes), but one important factor has been fear of fraud and security risks in newer digital transactions. Digital transactions are indeed growing at a rapid rate — particularly among millennials, many of whom never even open a checking account, or use it rarely.

Unfortunately, this means that millennials are also much less experienced at spotting check fraud and have become primary targets of scammers, according to news reports.

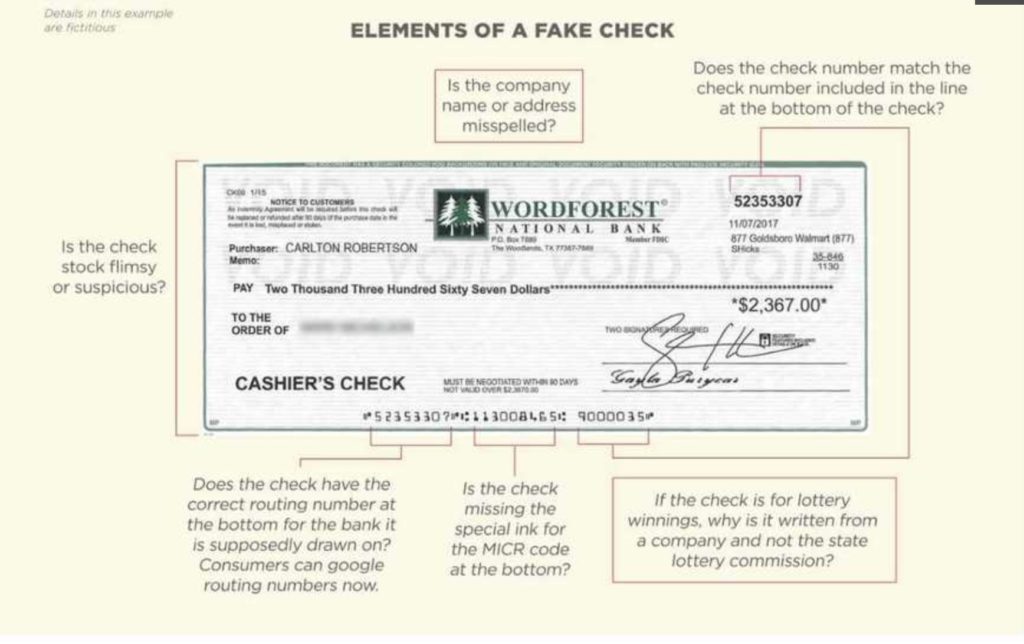

So, while your average Baby Boomer and Gen X’er knows the basic ins and outs of what to look for on the consumer end to set off fraud alarms, there is a new generation that can benefit from knowing what to look for to spot a fake check.

Better Business Bureau of SW Missouri

The Better Business Bureau has released an in-depth study that shows how to avoid being a victim.

Among the BBB’s tips:

Scammers are often successful because consumers don’t realize:

Crediting a bank account does not mean the cashed check is valid.

Federal banking rules require that when someone deposits a check into an account, the bank must make the funds available right away – within a day or two. Even when a check is credited to an account, it does not mean the check is good. A week or so later, if the check bounces, the bank will want the money back. Consumers, not the fraudsters, will be on the hook for the funds.Cashier’s checks and postal money orders can be forged.

A cashier’s check is a check guaranteed by a bank, drawn on the bank’s own funds and signed by a cashier. If a person deposits a cashier’s check, the person’s bank must credit the account by the next day. The same holds true for postal money orders. Scammers use cashier’s checks and postal money orders because many people don’t realize they can be forged.

So, while image analysis and transaction analysis technology provides heightened fraud detection for financial institutions, it’s also important to remind “check novices” of basic consumer-side precautions!