Beware of Inter-Related Use Cases of Payments and Check Fraud

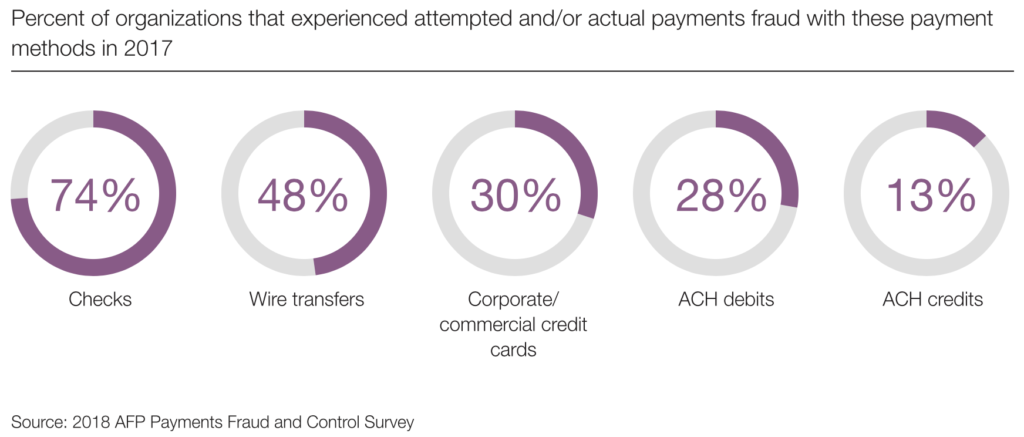

The Association for Financial Professionals (AFP) reports in its annual study of payments fraud risks and realities that nearly 8 in 10 U.S. organizations were targets of payments fraud in 2017.

What’s the best way to protect your organization? US Bank has some solid tips:

- Provide comprehensive training: All employees should receive training to help them identify and respond to potential attacks.

- Institute physical, digital and procedural controls: Require the use of dual approval for all payments. Establish a dedicated workstation through which all payments must be executed and limit employee access to personal email, all of which will limit your organization’s exposure to potential threats.

- Share personal information sparingly: Executives should avoid sharing biographical and direct contact information online, where cybercriminals can harvest it for use in BEC attacks.

The article notes that checks remain a primary target, but it’s important to realize that payment fraud consists of inter-related channels. For instance, in the second half of 2017, Business Email Compromise attacks continued to accelerate with 96% of organizations experiencing breaches. That’s not to mention that when Real Time Payments (RTP) are fully enabled, a push payment can occur on check and other deposits immediately as funds become available. The risk for deposit fraud may increase significantly without the right deposit fraud controls!

The best approach? Recognize and address both the on-us fraud and deposit fraud use cases of payment fraud with image analysis and transaction analytics.

This article contains forward looking statements – for more information, click here.