Automated Endorsement Analysis

In case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

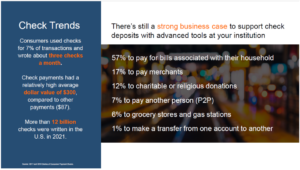

Read MorePYMNTS and Ingo Money have collaborated on The Money Mobility Playbook — an exploration on how Fintechs and FIs can provide clients and customers with optimal money mobility regardless of the type of payment or disbursement they choose to make. One of the many discoveries revealed within is that a considerable amount of payments made…

Read MoreIn a press release by Gartner, Inc., the company boldly predicts that banks and financial firms will boost their technology products and services investments in 2022 to the tune of $623 billion. Gartner Inc. goes on to identify what they consider the top three tech trends emerging in banking and investment services. Generative artificial intelligence…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreThe latest PaymentsJournal podcast, with guest speaker Chuck Doherty, Fiserv’s Director of Client Relations for Deposit Solutions, and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group, discusses mobile check deposits, best practices to drive greater accountholder adoption, and the challenges financial institutions face as they continue to search for…

Read MoreThe OCC’s senior deputy comptroller for midsize and community bank supervision, Sydney Menefee, recently spoke to American Banker about some of the changes she’s observed in the decade since the Office of the Comptroller of the Currency last overhauled its supervision of small and midsize banks. “The industry has evolved, and we have to evolve,…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreA recent Forbes article takes the reader on a nostalgic trip to another era: If you’re of a certain age, you might remember going to a drive-thru bank, where you’d put your deposit into a container outside the bank building. Your money was then sucked up via pneumatic tube and plopped onto the desk of…

Read MoreEPAM Continuum released a report entitled Regional Banks Reimagined. This project presents the results of their annual survey covering attitudes and behaviors of banking customers around the globe. In their inaugural effort, they surveyed 4,500 consumers across four countries to understand their beliefs; for 2021, EPAM surveyed more than 21,000 consumers across seven countries. The…

Read More