OrboNation Newsletter: Check Processing Edition – June 2022

Check Deposits: Turns Out the Amount Matters

The latest episode of Truth in Data, a video series by PaymentsJournal, takes a look at the ways in which banking customers prefer to deposit checks.

While there is a clear need for mobile deposits, it turns out that drive-thru and walk-up have not been made extinct by digital solutions. The size of the deposit very often plays a role in deposit choices...

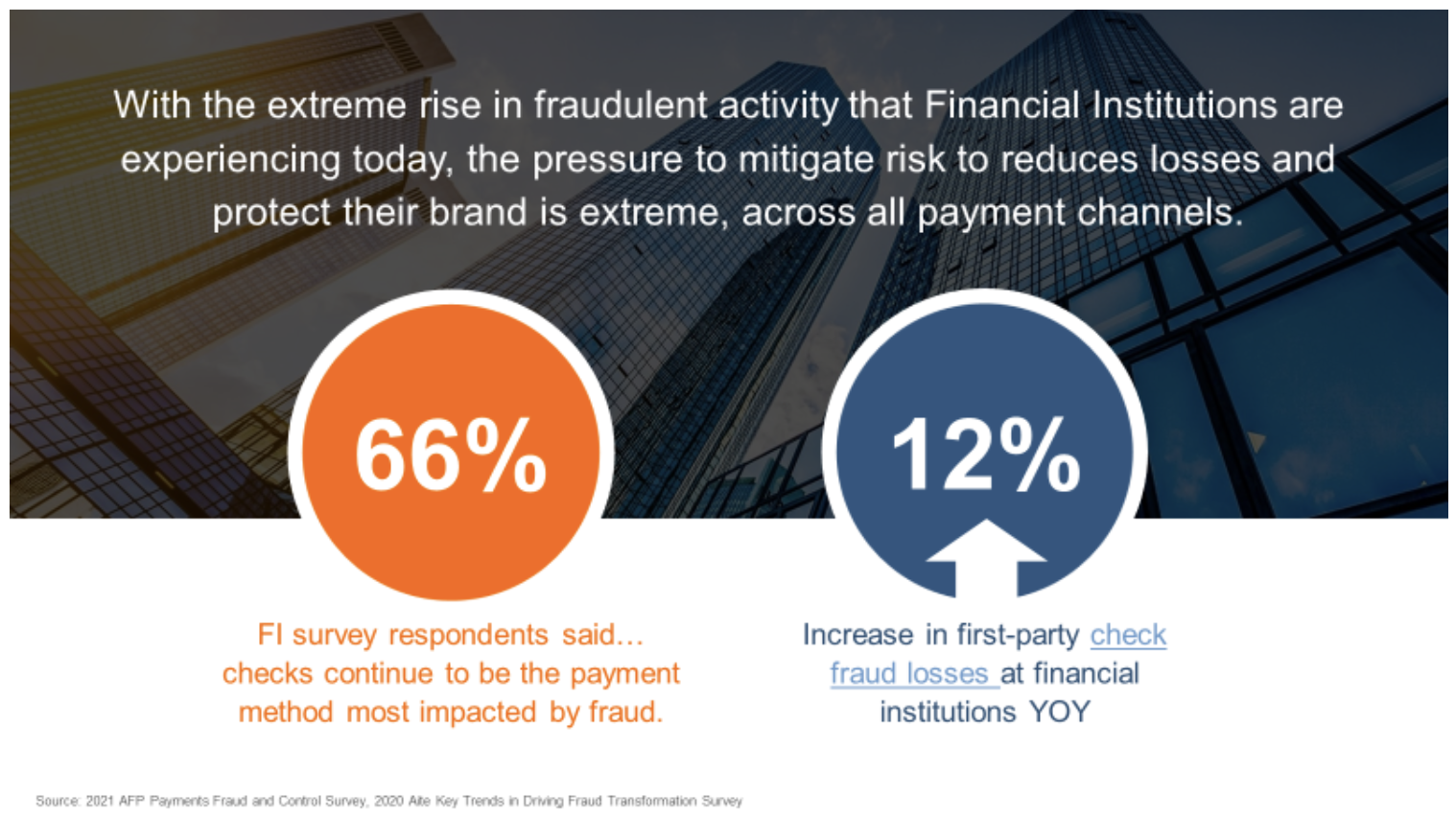

Check Fraud Roundtable

In collaboration with dozens of financial institutions of all sizes, OrboGraph is facilitating the first session (6/28/2022) of the Check Fraud Roundtable -- a series of organized meetings to share experiences, trends, and prevalent fraud use cases, while identifying key technological barriers within on-us and deposit check fraud.

If you would like to participate in this session or future roundtable sessions, please email marketing@orbograph.com.

Fiserv & Mercator Advisory Group Address Check Deposit Risk Mitigation on PaymentsJournal Podcast

The PaymentsJournal Podcast invited guests Bev Nichols, Product Director of Deposit Solutions at Fiserv, and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group, to discuss the state of check fraud and its prevention, particularly as check deposit behavior shifts from in-branch to remote channels...

Examining the “Customer Journey” to Prevent ACH and Check Fraud

In their latest “Digital Fraud Tracker” feature, PYMNTS talked with Seth Ruden, senior director of fraud operations for First Tech Federal Credit Union. In his analysis of fraud prevention, he spoke about a holistic approach balancing ironclad security with seamless payments and banking interactions.

“As we move forward with our digital banking shift, we want to ensure that people recognize that digital banking has created a significant uptick in the amount of fraud risk,” noted Ruden. “Deploying these technologies like multifactor authentication, as well as getting greater visibility to all channels and cross-channel activity, is where we’re going to be able to deliver on the promise of significantly elevated and enhanced protection.”

Small Banks Reinventing Checking Accounts: Eliminating Overdraft Fees to Keep Up?

It's no secret that bank consumers are not fans of overdraft fees. A number of big banks eliminated overdraft and/or non-sufficient funds (NSF) fees in 2021-22, responding to governmental pressure and competition from neobanks.

While this might be welcome news to the consumer, The Financial Brand reports that smaller community banks and credit unions face a significant challenge in matching these policies and staying competitive with the "big guys."

PaymentsJournal: Checks are the Top Vehicle for Commercial Payments Fraud

The new episode of Truth In Data from PaymentsJournal features information on the types of commercial payments fraud that are afflicting organizations -- and they find that, while declining, checks are the leading tool used for fraud.

According to Data provided by Mercator Advisory Group’s Report entitled The Cost of Fraud: B2B Payments Experience 10% Increase During the Pandemic, of the organizations surveyed...

Digital Lockbox Networks: Addressing Paper Checks’ Challenges?

Chris Clausen, executive director of digital payment solutions for Deluxe Corporation, points out via an article at bai.org that, though almost all B2B checks begin and end as data, there remains a “messy middle” consisting of conversions from electronic to paper and back to electronic. That creates both time and monetary costs: on average, check mailing and delivery takes seven to ten days, and processing fees can be up to $1.50 per check....

2021 AML Fines = $1.6B…Combining Multiple Technologies to Mitigate Compliance Risks

In a recent article from Compliance Week, Editor in Chief Kyle Brasseur reviews the AML fines levied to banks in 2021. According to the Kroll’s Global Enforcement Review 2022, regulators issued a total of 55 money laundering fines in 2021, totaling approximately $1.6 billion in value -- the highest number of fines observed by Kroll since 2016, which is as far back as its data tracks.