OrboNation Newsletter: Check Processing Edition – April 2022

Fiserv Survey: 64% Would Increase Check Usage if Funds Were Immediately Available

Victoria Dougherty, Fiserv's Director of Product Management, Financial and Risk Management Solutions, notes that "reports of the paper check's death have been greatly exaggerated."

Most people still write and cash checks, even if they do it less frequently. Plus, with fewer checks in circulation, the checks people write and receive – and the funds tied to them – may be more relevant to how people live and work.

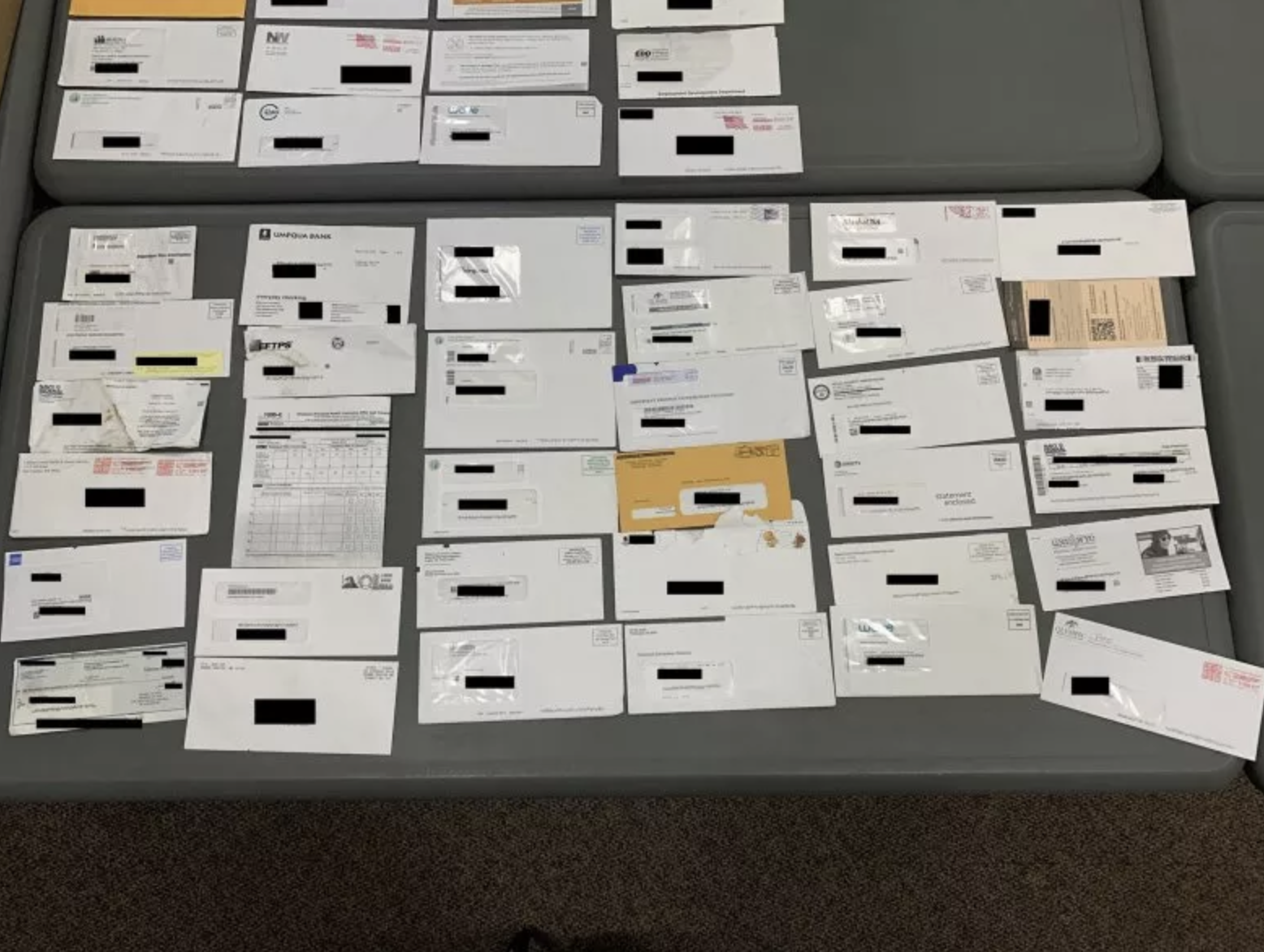

Fraud Chain: Mail Theft → Black Market Sales → Check Fraud

We've all read the stories about mail theft of checks, and even cases where postal workers commit the theft. Crime researchers say check fraud is spreading rapidly. Thieves are becoming more brazen in their attacks on mailboxes and postal workers.

Bad actors can’t keep cashing thousands of stolen checks without arousing suspicion, so the thieves will often sell checks to other fraudsters -- they do it online, with personal checks typically selling for around $175, and business checks going for $250. If you buy in bulk, they're cheaper...

Zelle: Instant Payments = Instant Fraud

Digital payments are becoming more and more popular. You can pay for that haircut or pizza almost instantly with the touch of a button on your iPhone. Certain retailers encourage it as well; this week Starbucks is offering a free reusable cup if you order or reload your account via PayPal.

Zelle, in particular, is growing in popularity. It's speedy and easy...

Automated Banking: Next Big Thing or Already Here?

A recent Forbes article takes the reader on a nostalgic trip to another era:

If you’re of a certain age, you might remember going to a drive-thru bank, where you’d put your deposit into a container outside the bank building. Your money was then sucked up via pneumatic tube and plopped onto the desk of a human bank teller, who you could talk to via an intercom system...

EPAM Continuum Identifies Key Trends from Global Consumer Banking Report

EPAM Continuum released a report entitled Regional Banks Reimagined. This project presents the results of their annual survey covering attitudes and behaviors of banking customers around the globe. In their inaugural effort, they surveyed 4,500 consumers across four countries to understand their beliefs; for 2021, EPAM surveyed more than 21,000 consumers across seven countries.

The Trends

Consumers are responding positively to the “unbundling” of financial services

While most customers might remain tethered to their primary bank, many are increasingly looking to specialized services delivered by standalone providers to meet more specific needs...

Stolen Checks and Social Media Money Mules: 3 Charged in Racketeering Case

Check fraud, unfortunately, can be the work of more than one bad actor. There are more and more cases of highly organized, coordinated "recruiters" creating groups that take aim at businesses.

Here's a fairly simple example, as reported at LehighValleyLive.com: Recruit people (money mules) via social media -- with the promise of money up front -- to open new accounts into which they deposit...

AP Takes Blended Approach for Checks and Electronic Payments

PYMNTS.com reports that many businesses are looking for ways to optimize their accounts receivable (AR) and accounts payable (AP) processes in line with their emerging digital needs. One might imagine that check payments are becoming scarce.

Wrong.

In fact, some experts estimate that 40% of all B2B payments in the U.S. are still made via check, meaning they play a critical role for a large share of businesses, as reported in “The Treasurer’s Guide To AR Payment Optimization,” a PYMNTS and CheckAlt collaboration.