Automated Endorsement Analysis

Getting the money is always a challenge with fund raising, as is reconciliation and record keeping. Additionally, it’s beneficial to communicate to the individuals who donate, because they are interested in your program and a great “target market” for the next fundraising effort. Very often, contributions are solicited via social media, allowing contributors to go…

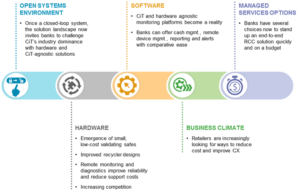

Read MoreWhile steadily declining in overall usage, cash remains “as relevant in retail as it has ever been,” according to an article by Bob Meara, Senior Analyst with Celent, in an article previewing his presentation at November’s AFP 2018, “Fewer Cash Receipts Still Mean Big Retail Challenges.” RCC (Remote Cash Capture) is noteworthy for the collaborative service delivery required to…

Read MoreAlfredo Alvarez, a principal at Liberty Advisor Group, writes in his article how modernizing legacy technology wins the digital customer: Nimble new entrants and rapidly increasing customer expectations for digital products and services continue to disrupt financial services firms. In response, financial services organizations have made significant investments in agile development and DevOps (development and…

Read MoreLast week, USA TODAY published a consumer-focused article explaining new deposit requirements from a number of banks: Depositors must now include the phrase “For Mobile Deposit Only” underneath their signature on all checks deposited using mobile apps. Some banks are also suggesting you add “For Mobile Deposit Only at (Bank Name)” or “For (BANK NAME) Mobile Deposit…

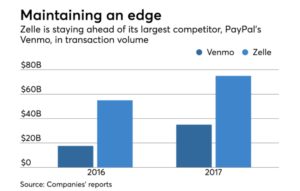

Read MorePayments 3.0 columnist George Warfel signs off of his last column for the site by noting what he considers deep trends to watch in banking and payments. One particular point he makes is something we’ve seen borne out again and again as cleverly-named payments technology brands appear and then either disappear or team with more established…

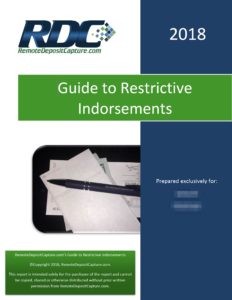

Read MoreIf you already know the difference between “indorsement” and “endorsement,” you’re the kind of professional who will benefit from the newly-released RemoteDepositCapture.com’s Guide to Restrictive Indorsements, available to purchase at their website. The report is authored by John Leekley, founder and CEO of RemoteDepositCapture.com, who is widely regarded as the leading authority on all things…

Read MoreAdmit it – you thought everyone knows the basics of check writing, and figured that the younger generation is not using checks. So who cares? Well, you might think this is the case, but there are fresh ideas in this article at the street.com including safeguards against check fraud, which, according to the ABA Deposit Fraud Study, saw…

Read MoreAccording to Thomas Skala, chief executive officer and president of telecommunications and payments company Genie Gateway, a mitigated risk of chargebacks makes checks the best path for high-risk sellers. High-risk sellers can include, for example, product repair companies if a customer is unhappy with a repair result; or the travel industry, in which buyers can chargeback travel…

Read MoreSmall banks are at a crossroads: adopt new technologies or face the possibility of shutting the doors. According to Americanbanker.com: For community banks in highly competitive markets, service with a personal touch can be a differentiator to win and keep customers. But when legacy technology hampers the customer experience, all the cups of coffee in…

Read MoreThere is a trend in the wind, according to AmericanBanker.com: Over the past few days, midsize banks — such as Comerica, Commerce Bancshares and M&T Bank — have reported notable declines in total deposits, with M&T, in particular, reporting a 6% drop from a year earlier. Executives have offered a number of reasons why, saying…

Read More