Here Are 5 Reasons to Re-Think Remote Cash Capture

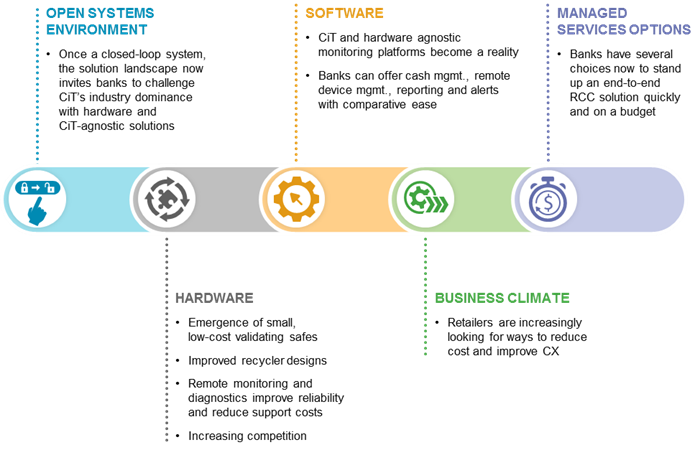

RCC (Remote Cash Capture) is noteworthy for the collaborative service delivery required to bring it about. Historically working in isolation, banks, safe manufacturers, and cash logistics providers are now collaborating to add considerable efficiency to what until recently had been an antiquated and error-prone cash cycle in many businesses. But RCC adoption has not set records. Both economic and systemic barriers have limited its adoption — but all that is changing. With US retail merchant utilization of just 10%, now is a perfect opportunity for banks to revisit their involvement in RCC.

RCC adoption has been slow thus far, with economic and systemic barriers limiting its adoption — however, we know that best practices advise thinking long term when investing in financial industry tech. Meara offers five reasons that he sees a great current opportunity for banks to revisit their involvement and investment in RCC — check them out here.

Sounds eerily familiar to many of the challenges remaining check processing, doesn’t it? The economics of declining volumes drives a need for improved efficiencies…and there are many ways to achieve this, through technology as well as outsourcing. Additionally, there are other challenges which are typical in a mature payment, i.e. errors and fraud.

OrboAnywhere will handle the future of the check — now it’s your turn to look at cash options.