Automated Endorsement Analysis

If you’re a sports fan, you are undoubtedly familiar with the four major sports leagues in the US: Major League Baseball (MLB) The National Football League (NFL) The National Basketball Association (NBA) The National Hockey League (NHL) You may be asking yourself, “What do sports have to do with banking?” Well, it turns out there’s…

Read MoreWe’ve spent quite a bit of time on the emergence of artificial intelligence (AI) and machine learning (ML) as vital technologies for the banking space — and for good reason. In today’s competitive environment, every possible tool must be leveraged. Steve Morgan, Banking Industry Market Lead at Pegasystems, contributed an informative commentary to Finextra regarding the…

Read MoreForrester reports that, according to their Future Fit Survey, 2022, a whopping 77% of bank business and technology professionals are looking to increase their spending on emerging technologies over the next twelve months. Emerging technologies could mean the difference between gaining, retaining, or losing competitive differentiation. Yet failure remains commonplace. Only a quarter of business and…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreOther developed countries have had it for years, but the United States is a Johnny-Come-Lately to RTP, or Real Time Payments. The Federal Reserve recently confirmed that FedNow, the government’s version of real-time payments (RTP), will launch this summer. In a piece for Forbes Magazine, Ron Shevlin, Chief Research Officer at Cornerstone Advisors, points out…

Read MoreApple is well known for staying one step ahead of technology trends. Since the launch of its iTunes® Music Store in April of 2003, we’ve seen the tech giant continue to penetrate the payments arena. Apple made its biggest contribution to tech when it launched the first iPhone in January of 2007. While it was…

Read MoreMcKinsey Digital weighs in with suggestions for how banks can modernize legacy systems to help them reduce IT costs and complexity while improving productivity in a competitive environment. Even before the onset of the COVID-19 pandemic, persistently low interest rates had increased pressure on banks to reduce their IT costs. The pandemic exacerbated this issue,…

Read MoreDigital is undoubtedly going to play a major role in the future of banking. As we noted previously, digital banking market valuation is predicted to exceed USD 13.5 trillion by 2032. The real question is: How each bank is approaching digital banking? From our friends at BAI, author Emily Steele, president and COO at Savana,…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

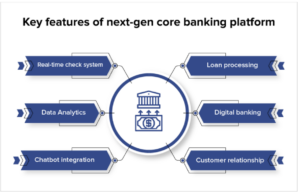

Read MoreAs reported at Mobil App Daily, competition in the banking industry is fierce and at a consistently high level — a good situation for consumers, and an ongoing challenge for the banks themselves. They want to dramatically improve the experience their consumers receive from their optimized digital banking services by utilizing the next-generation banking platform.…

Read More