OrboNation Newsletter: Check Processing and Fraud – April 2023

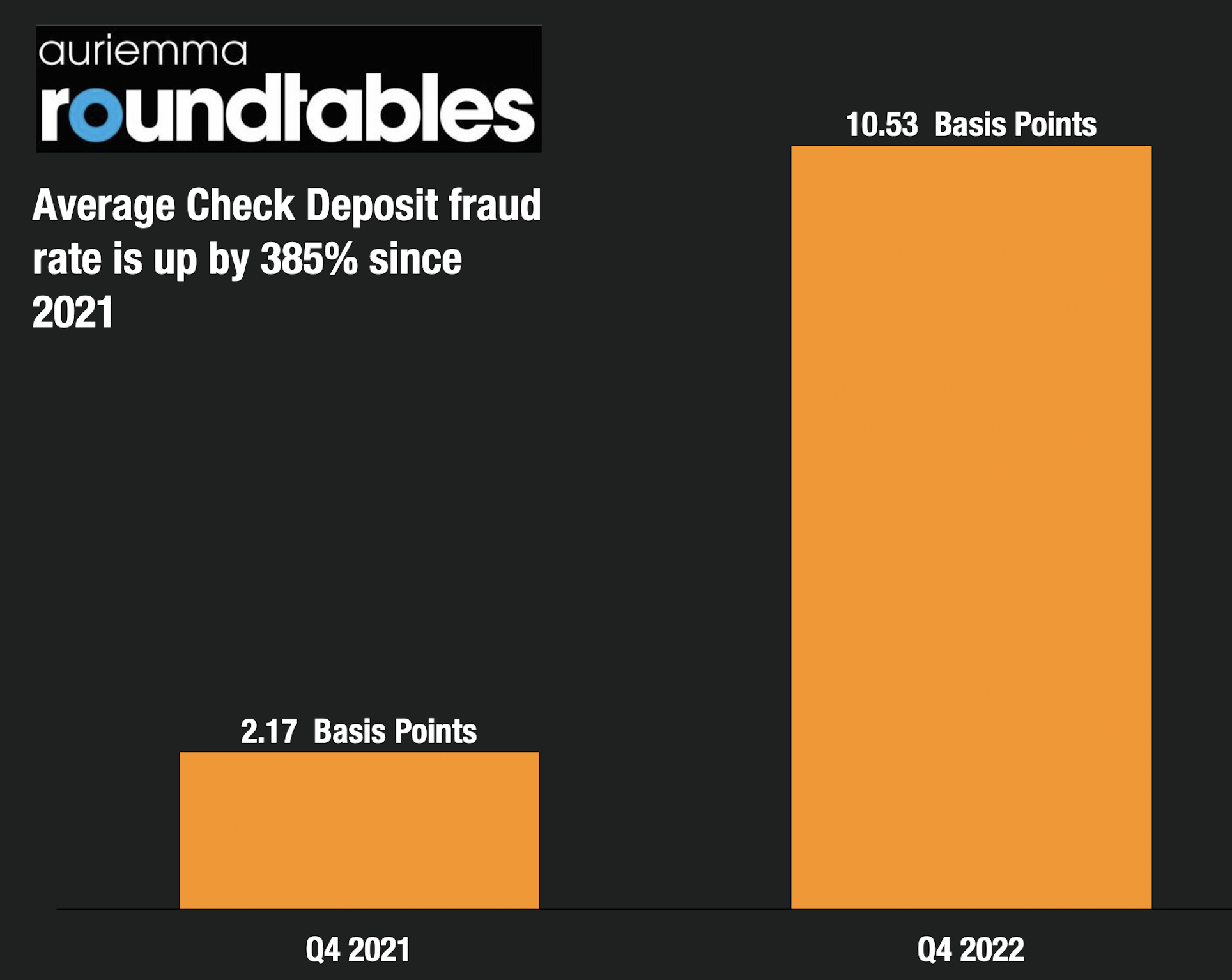

Check Deposit Fraud Increased 385% in 2022 – According to Auriemma Bank Fraud Control

"It’s clear now," says Frank on Fraud in his latest blog post. "Check fraud is the #1 problem for banks in 2023."

The basis for his conclusion is benchmarking data collected by Auriemma Roundtables, which concludes that check deposit fraud is up 385% in 2022. The collected data exceeds the common held belief of industry experts and financial institutions that check fraud has 3X from pre-pandemic levels.

The company collected benchmarking data from 2021 and 2022 and calculated each year’s total check deposit fraud rate. The check deposit fraud rate is measured as total check deposit losses divided by total check deposit transaction dollars.

Podcast: Interview with Ex-Check Fraudster Turned #FraudFighter

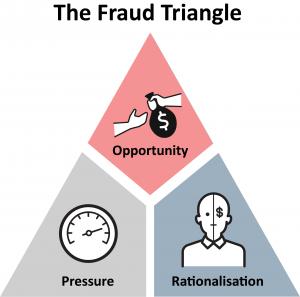

Recently, we covered insider check fraud and the reasons individuals perpetrate it -- even when they may not need the money. But what about the other side of the coin? The professional fraudster who is perpetrating check fraud as a business?

Apple Upping Its Banking Game with New Savings Account Offering

Apple is well known for staying one step ahead of technology trends. Since the launch of its iTunes® Music Store in April of 2003, we've seen the tech giant continue to penetrate the payments arena.

Now, Apple has announced that they are also offering a savings accounts, complete with a 4.15% interest rate. Could a checking account be next?

The MUSE Scam: A New Fake Check Scam Variant…Stopped by Reddit?

Recently, a young artist shared via Reddit an offer he'd received from a "potential client/middle man" who offered a "collaborative" gig with some interesting strings attached specific to payment.

Wisely, he shared his initial interactions with the Reddit "Scams" group, along with a screenshot of the exchange...

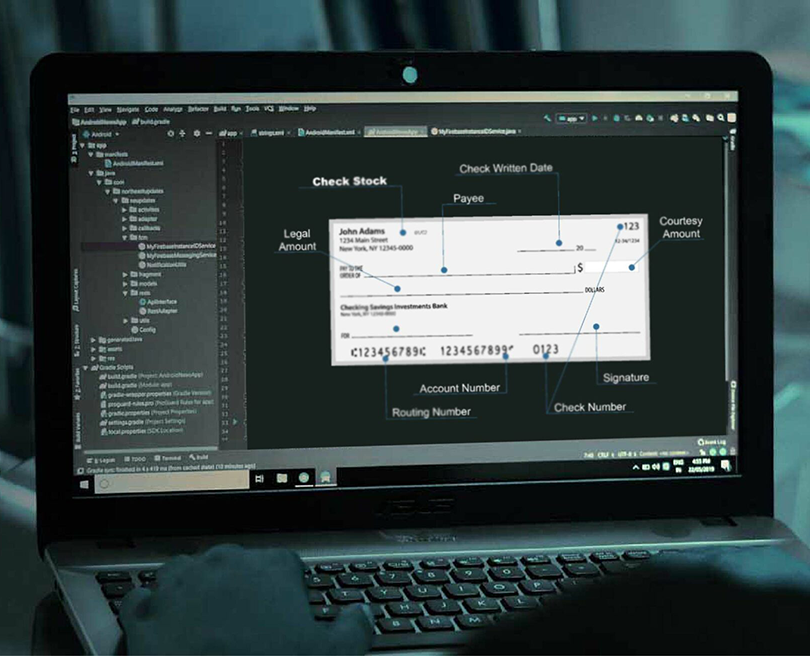

Old School Check Fraud Supercharged by New Technology

Abrigo's new and informative downloadable PDF, Check Fraud: New Tech Driving Old School Scam by Kate Stoneburner, is a succinct look at the ways in which modern scammers are deploying cutting edge technology to instigate account theft. The numbers are daunting:

In an age of online banking, data storage, and cryptocurrency, cybercrime is a hot topic among financial institutions, regulators, and law enforcement. Meanwhile, an older and less high tech form of fraud is surging—check fraud.

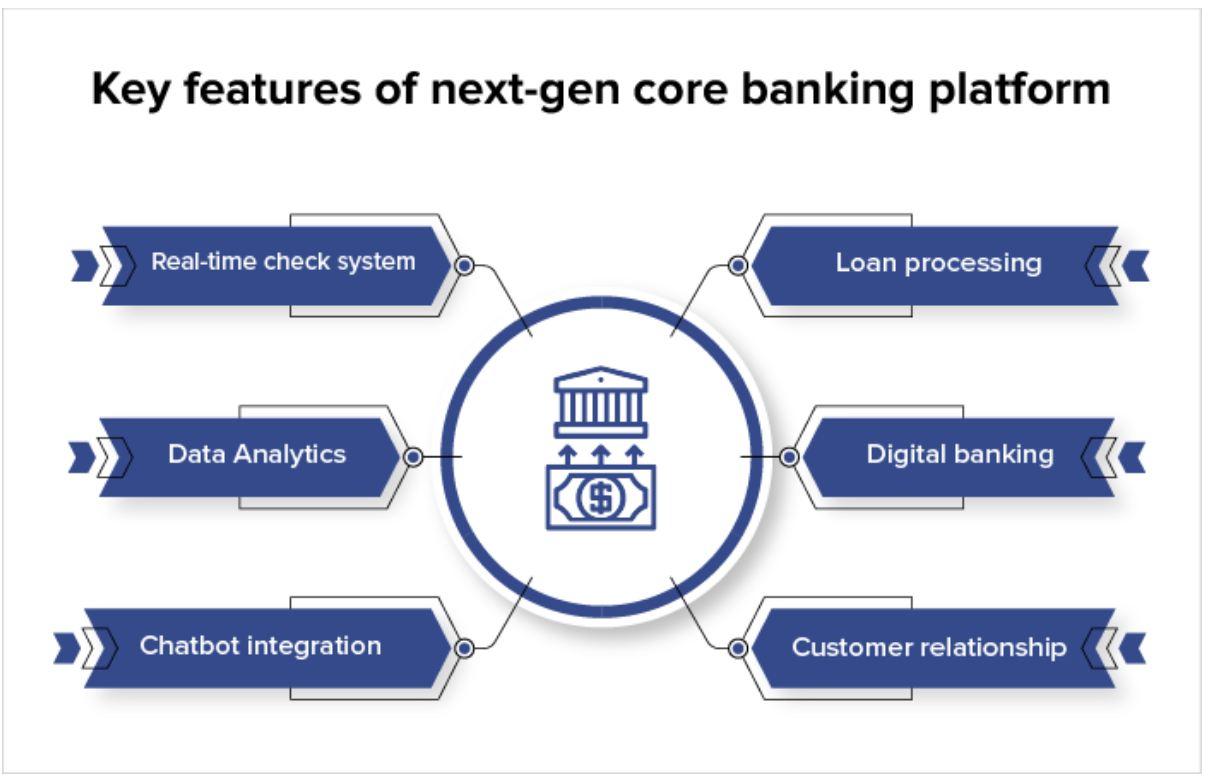

Checks Play Major Role in Next-Gen Core Banking Platforms

As reported at Mobil App Daily, competition in the banking industry is fierce and at a consistently high level -- a good situation for consumers, and an ongoing challenge for the banks themselves.

They want to dramatically improve the experience their consumers receive from their optimized digital banking services by utilizing the next-generation banking platform. Current traditional banks, which are built on the outdated core banking infrastructure, frequently struggle to stay up. However, they manage to function because of their substantial financial resources...

B2B Payments Fraud: 56% of Businesses Flagged Checks as Biggest Target

When it comes to business-to-business (B2B) payment fraud, checks lead the field.

This is according to an article from Digital Transactions reporting on a survey sponsored by Trustpair, a Paris-based anti-fraud technology provider for more than 200 large companies worldwide, and Allen, Texas-based Giact Systems, which provides identity and authentication services.

The new survey findings reveal more than half the U.S. companies polled in a recent survey—56%—said they were the target of at least one business-to-business check payment-fraud attempt in 2022.

Check Fraud: Tactical Approach Is Not Enough

Fraudsters are continuing to cultivate new and ever more outlandish scams to swindle Americans out of their earnings. Check fraud still appears in traditional forms, including basic counterfeit checks, forging checks, paperhanging (writing a check from a closed account) and check kiting. Some of the more innovative check fraud schemes include check mail fraud, check washing, use of the Dark Web and identity check theft. However, the most traditional, low-tech method – over-the-counter fraud – continues to be the channel with the greatest loss, at 49 percent. According to fraud experts, attempted check fraud is up more than 100% compared to 2021, even though check volume is only up 8%...

Achieving Next-Gen Legacy Modernization: Focus on Productivity

McKinsey Digital weighs in with suggestions for how banks can modernize legacy systems to help them reduce IT costs and complexity while improving productivity in a competitive environment.

Even before the onset of the COVID-19 pandemic, persistently low interest rates had increased pressure on banks to reduce their IT costs. The pandemic exacerbated this issue, as banks scrambled to deliver new digital IT solutions faster and at lower cost.

Insider Check Fraud — The How, The Why, and Prevention

Over the past year, most of the media coverage has spotlighted post office insider check fraud -- where a postal employee is responsible or part of scheme to steal checks in the mail. However, insider check fraud is not limited to the post office; EVERY company needs to be vigilant.

CPA and Certified Fraud Examiner Charles Hall has, for the last thirty years, primarily audited governments, nonprofits, and small businesses, and is the author of The Little Book of Local Government Fraud Prevention and Preparation of Financial Statements & Compilation Engagements. At the CPA Halltalk website, heoffers a look at "inside job" check fraud using city government and a wayward city clerk as an example.

Credit Unions: Ease of New Account Openings, Ease of Check Fraud?

CU Management takes a look at how the increase in check fraud has specifically impacted credit unions. In an article by Al Pascual, SVP/Enterprise Solutions at TransUnion, we get a bit of background applicable to banks of all kinds:

It's not just how checks are deposited that is driving a resurgence in check fraud, but the ability of criminals to source a massive volume of real checks—many of which are tied to accounts with significant balances. Criminals are using various methods to steal real checks in transit through the Postal Service and re-sell them on the dark web. Sometimes, account statements accompany the check to show the amount of funds available, which increases the black-market value. Small businesses in particular have become valuable targets because their accounts are twice as valuable when compared to the average consumer’s.

Core-to-Customer Technology Approach: Eliminate Siloes, Enabling Unification

Digital is undoubtedly going to play a major role in the future of banking. As we noted previously, digital banking market valuation is predicted to exceed USD 13.5 trillion by 2032. The real question is: How each bank is approaching digital banking?

From our friends at BAI, author Emily Steele, president and COO at Savana, examines the challenges of digital banking that banks are facing...

The Dark Web: An Online Market for Stolen Checks

Modern day success owes much to technology. The advent of the computer, the internet, and mobile phones are just a few technologies that have played a major role in everyday life. However, as with many leaps forward, there is the good and there is the bad. A perfect example is the dark web -- the part of the internet not indexed by popular search engines like Google.

In their new report entitled Check Fraud and the Dark Web: Detection and Prevention, Mary Ellen Biery of Abrigo and Robert Villanueva of Q6 Cyber -- and formerly with the Secret Service, where he specialized in transnational cybercrimes, access device fraud, network intrusions, and identity theft data breaches affecting the private sector -- explore and explain the ways fraudsters are leveraging the "dark web" to better enrich themselves through the sale and purchase of stolen checks.