Billers

Yahoo Finance reports that, this past Tuesday, Nvidia (NVDA) — founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem — recorded a landmark achievement in becoming the first chipmaker ever to reach a market valuation of $1 trillion. The Santa Clara, Calif.-based chipmaker became the ninth public company to ever hit the $1…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreMany people in today’s financial services industry applaud the emergence of AI technology as an excellent equalizer for financial institutions, allowing community banks and credit unions a level of parity with their larger competitors. After all, it’s just a matter of recognizing and embracing the emerging AI technology, right? It turns out things are not…

Read MoreIf you’re a sports fan, you are undoubtedly familiar with the four major sports leagues in the US: Major League Baseball (MLB) The National Football League (NFL) The National Basketball Association (NBA) The National Hockey League (NHL) You may be asking yourself, “What do sports have to do with banking?” Well, it turns out there’s…

Read MoreWe’ve spent quite a bit of time on the emergence of artificial intelligence (AI) and machine learning (ML) as vital technologies for the banking space — and for good reason. In today’s competitive environment, every possible tool must be leveraged. Steve Morgan, Banking Industry Market Lead at Pegasystems, contributed an informative commentary to Finextra regarding the…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

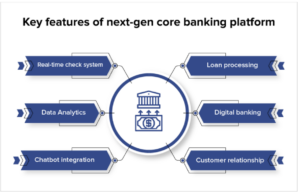

Read MoreAs reported at Mobil App Daily, competition in the banking industry is fierce and at a consistently high level — a good situation for consumers, and an ongoing challenge for the banks themselves. They want to dramatically improve the experience their consumers receive from their optimized digital banking services by utilizing the next-generation banking platform.…

Read MorePYMNTS talked to Manish Jaiswal, chief product and technology officer at Corcentric, about the ways AI technology can and will improve business payments by making them faster and — most importantly — safer. Source: PYMNTS.com “Real-time payments processing is becoming a reality in B2B,” Mr. Jaiswal noted. Still, there are challenges to address. Most companies, no matter the…

Read MoreChatGPT, the artificial-intelligence chatbot, has been making news on a regular basis for its growing list of applications in business and entertainment. We recently highlighted the possible impact ChatGPT may have on the banking industry. So, it was only a matter of time before it emerged in the payments field. Via Digital Transactions, we learn…

Read More