OrboNation Newsletter: Check Processing and Fraud – May 2023

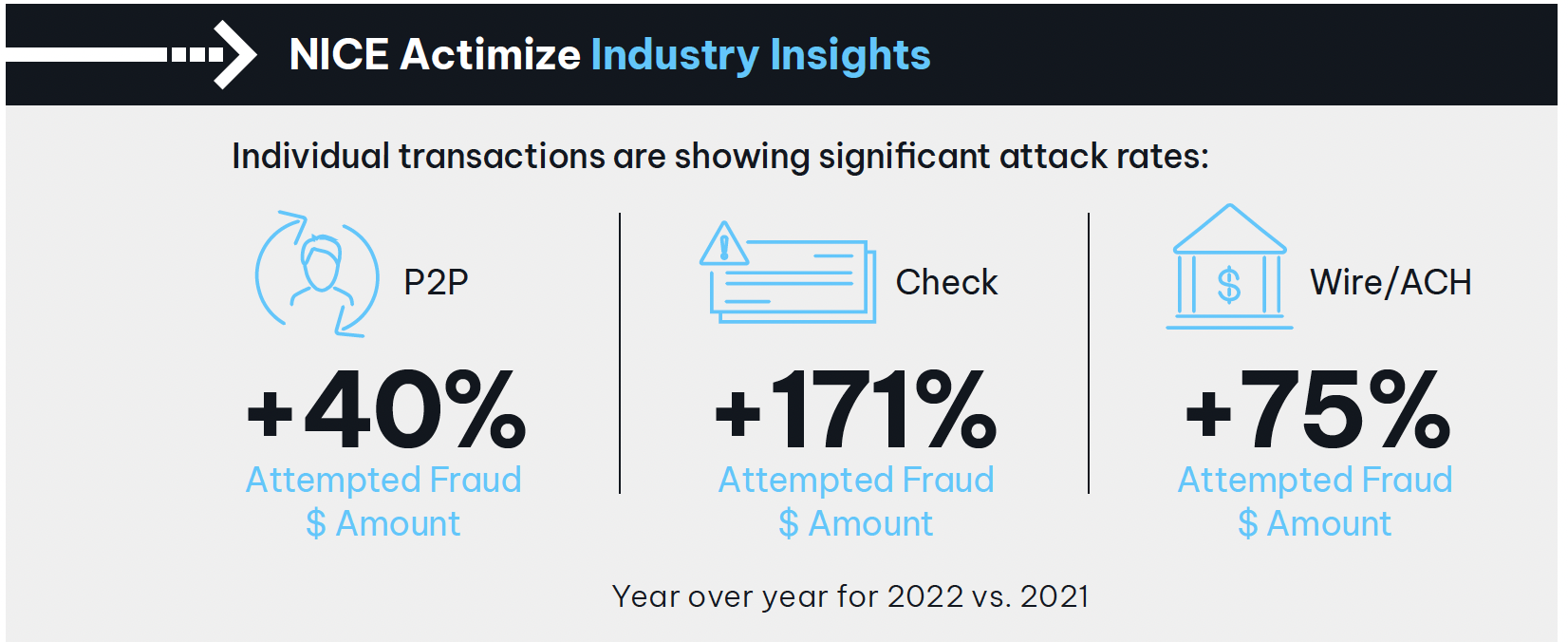

NICE Actimize: Attempted Check Fraud Up +171% in 2022

The latest NICE Actimize article is available for download, and it's called Check Fraud Running Rampant in 2023. The report is full of valuable information and data, including a rather startling look at where checks stand in the hierarchy of payments fraud increases from 2021 to 2022.

As summarized by in the report's introduction:

The 2023 NICE Actimize Fraud Insights Report shows a significant spike in check fraud that correlates to first-party deposit fraud. In this scenario, bad actors are opening bogus bank accounts for the sole purpose to defraud the bank. This is done by depositing forged or counterfeit check items into accounts, then depleting the accounts before the funds are reversed....

OrboGraph Writer Verification Technology Wins Business Intelligence Group’s 2023 AI Excellence Award for Detecting Altered and Fictitious Checks

Company wins award back-to-back years for Hybrid Intelligent Systems category

Burlington, MA, April 4, 2023 - OrboGraph, a premier supplier of check processing automation and fraud detection software and services, announced today that the company was selected as winner of the prestigious 2023 AI Excellence Award in the Hybrid Intelligent Systems category for its latest AI innovation in detecting altered and counterfeit checks with its new Writer Verification™ technology.

Legacy Thinking: How Banks Can Learn From Major League Baseball

Recently, we covered insider check fraud and the reasons individuals perpetrate it -- even when they may not need the money. But what about the other side of the coin? The professional fraudster who is perpetrating check fraud as a business?

Check Fraud: Understanding the Elements and Bad Actors

Infamous Ghost Money, a masked YouTuber whose channel about "fraud awareness and prevention" has been featured in our blog previously, recently discussed the "updated climate of check fraud" the way only Infamous Ghost Money can do it -- with a mask on.

AI & Machine Learning: Driving Automation & Resiliency for Banks & Customers

We've spent quite a bit of time on the emergence of artificial intelligence (AI) and machine learning (ML) as vital technologies for the banking space -- and for good reason. In today's competitive environment, every possible tool must be leveraged.

Steve Morgan, Banking Industry Market Lead at Pegasystems, contributed an informative commentary to Finextra regarding the strengths AI and ML bring to banks and their customers.

USPS Announces Joint Project Safe Delivery Initiative to Curb Stolen Mail/Checks

A few weeks ago we talked about how mail theft is on the rise -- as check fraudsters seek to acquire more "raw material" from which they can wash, alter, and create fake checks to defraud countless accounts -- and the subsequent responses of federal and state governments.

While this is certainly a step in the right direction, it does NOT address actual, shocking physical assaults on carriers, which are also on the rise.

Forrester Research: 77% of Banks Execs Will Invest in Emerging Technologies in 2023

Forrester reports that, according to their Future Fit Survey, 2022, a whopping 77% of bank business and technology professionals are looking to increase their spending on emerging technologies over the next twelve months.

Emerging technologies could mean the difference between gaining, retaining, or losing competitive differentiation. Yet failure remains commonplace. Only a quarter of business and technology professionals whose organization has one or more central emerging-technology functions reported that 76% or more of the projects their organization undertook were successful.

Generative AI Scams — Are Counterfeit Checks Next?

By now most people have read, heard, or seen the fruits of Generative AI, a technology that is gaining broad attention due to its ability to quickly and inexpensively create shockingly realistic images, audio, and text. We've previously explored various advantages Generative AI brings to the banking world.

However, there have been varying degrees of concern raised about its potential negative implications, including the creation of effectively deceptive "deepfakes" and the violation of individuals' privacy rights.

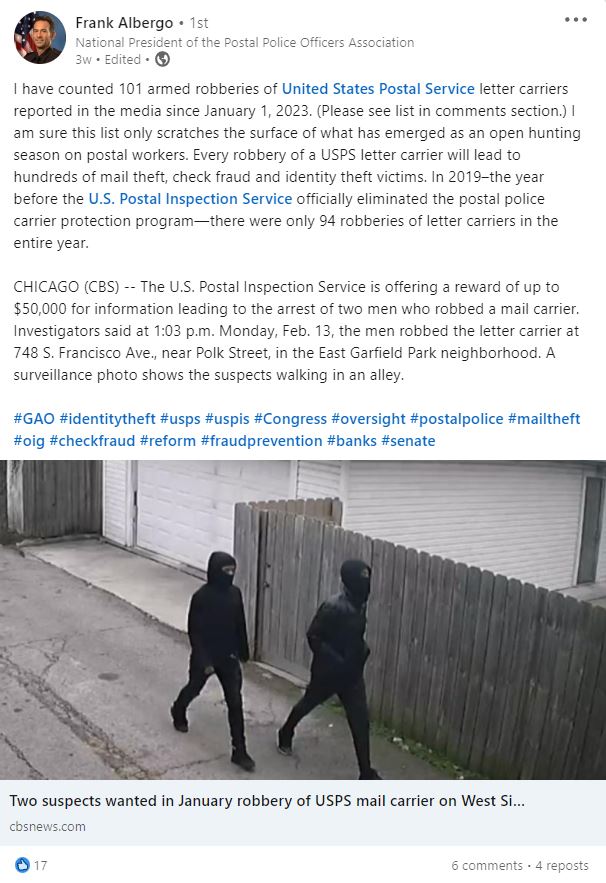

2023 Update on Mail Theft & Check Fraud: Government Increasing Pressure

Over the past year, we've covered the sharp increase in mailcarrier and mailbox robberies in the USA. With news & media across the country reporting the trend, it would be reasonable to believe that the exposure would slow the pace. However, that does not appear to be the case.

On his LinkedIn page, Frank Albergo, National President of the Postal Police Officers Association, pointed out the ongoing threat to US Post Office mail carriers:

I have counted 101 armed robberies of United States Postal Service letter carriers reported in the media since January 1, 2023. I am sure this list only scratches the surface of what has emerged as an open hunting season on postal workers. Every robbery of a USPS letter carrier will lead to hundreds of mail theft, check fraud and identity theft victims...

AI Will Be the Next Tool for Fraudsters

Not long ago we talked about the way Generative AI is gaining popularity, embraced for its ability to quickly create images, audio, and text-- quickly and inexpensively, which is the key factor. With very little expenditure of either time or learning effort, anyone can become proficient at using Generative AI.

Microsoft’s chief economist, Michael Schwarz, has a warning for all of us. While serving on a World Economic Forum panel in Geneva on Wednesday (May 3), Mr. Schwartz said, as reported by Bloomberg News via PYMNTS.com: “I am confident AI will be used by bad actors, and yes, it will cause real damage.”

National Law Review: Regs and Policies for Check Fraud

The National Law Review notes that, even in the face of so many fast and easy ways to accomplish lightning-quick bank functions -- complete with nearly instantaneous reporting of transactions -- through online and mobile banking, one of the more common account frauds today is "good old-fashioned check fraud." They note as well the use of the US mail as a means of committing such check fraud, the subject of a recent Financial Crimes Enforcement Network alert.

AI Tech for Community Banks and Credit Unions: Fintech Vendors Must Step Up

Many people in today's financial services industry applaud the emergence of AI technology as an excellent equalizer for financial institutions, allowing community banks and credit unions a level of parity with their larger competitors. After all, it's just a matter of recognizing and embracing the emerging AI technology, right?

It turns out things are not that simple for smaller players in an aggressively competitive market. In fact, as reported by The Financial Brand, vendors of AI tech may actually be focusing on mega-banks at the expense of smaller financial institutions.

Gel Ink Pens — Important Tool, But Not Enough to Stop Check Fraud

A WSAW-7 consumer alert offers a simple way to make "washing more difficult or even impossible" -- gel pens.

If anyone in the community is writing out a personal check, consider using gel ink pens as they are much harder to remove and deter fraud when it comes to personal checks. Also consider bringing mail with personal checks directly into the post office and avoid using the USPS blue boxes.

But, is writing with gel ink pens enough to prevent check fraud? Unfortunately, the answer is NO.