Check Fraud Prevention

Microsoft Corp. will stop supporting its Windows 7 operating system next January, which is a bellwether to both independent operators of ATM machines and large financial institutions — time to update! Digital Transactions reports that independent ATM operators seem to have the upper hand in the conversion race: Independent ATM owners’ decision to eschew Windows…

Read MoreIn the banking industry, AML/KYC (Anti Money Laundering and Know Your Customer) was previously a very slow, methodic process — the government would put out their lists of sanctioned bad guys (hostile governments, drug kingpins, organized crime organizations and affiliates, etc.) and compliance teams would then carefully (and manually) check onboarding customers to make sure…

Read MoreIn the third annual edition of its “The Best Bank for You” report, Kiplinger identifies top picks among national, regional, and internet banks, as well as credit unions, that offer the best combination of high rates, low fees, and a customer-friendly focus. Many of these institutions are customers of OrboGraph, so it’s is great to…

Read MoreAn article from Digital Transactions finally quantifies the relationship between payments fraud and terrorism! Startling facts in this report show that, outside of pure fraud losses, there is a crucial national security component to fraud prevention. Information-security firm Terbium Labs, in its “The Next Generation of Criminal Financing: How Payment Fraud Funds Transnational Crime” report,…

Read MoreFor all the upbeat and optimistic talk about Artificial Intelligence and its emerging role in the banking industry (not to mention healthcare), it’s certainly well worth taking the time to examine the issues of ethics and privacy as they relate to deployment of these new tools. David Lott, a payments risk expert in the Retail…

Read MorePYMNTS.COM takes a look at the implementation of Artificial Intelligence solutions in Financial Institution fraud departments — or, rather, the stunning lack thereof: AI systems are unique, can process large volumes of data in real time and can “learn” to quickly identify suspicious financial activity. Yet, few FIs leverage this technology in their anti-fraud efforts…

Read MoreWe’ve noted here before that there is a Millennial and sub-Millennial generation for whom checks are a bit of a novelty. Still, they will need to use checks more than they may expect or desire, so it’s important that they learn how to use them properly. Fraud is becoming easier and easier to overcome in…

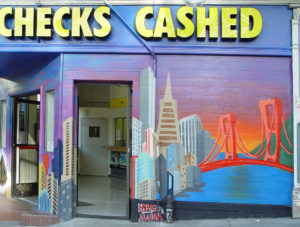

Read MoreOne reason Financial Institutions don’t jump in the MSB banking ring is the perception that MSB’s don’t have what it takes from a compliance perspective. Au contraire! As an MSB (Money Service Business), these entities have strict guidelines for compliance. Just like financial institutions, the MSB must have a written policy and procedure, on-going training,…

Read MoreA Special Guest Host Blog Post by Bob Frimet, CAMS Millions of Americans depend on banking services each and every day, for everything from writing checks and paying bills to wiring money. But when was the last time you thought about the millions of “under-banked”? Where does that customer go? There are many reasons why…

Read MoreBank fees have been in the news lately, particularly with the ramp up of 2020 presidential candidates. Not only is the aggregate number, $15B, in question, but so also is the issue of whether or not fees are unfairly targeting persons with lower incomes. From WashingtonExaminer.com: One of the Democrats vying to run against President…

Read More