Check Fraud Prevention

Let’s get crazy! OK, maybe a podcast from BAI Banking Strategies isn’t crazy, crazy, but if you are into payments, this could be the best 10-15 minutes of the year! Managing editor Lou Carlozo speaks with Tommy Marshal, FinTech Lead for North America at Accenture about their new payments report entitled Driving the Future of Payments: 10 Mega…

Read MoreThe “death” of the check is still way behind schedule, according to many organizations that predicted the end of paper checks many years ago. We keep reporting that checks are still popular when they were supposed to have been dwindling years ago. (That’s the boring part of the post) The latest installment in PYMNTS’ Kill…

Read MoreTHE TECHNOLOGY HEADLINES features an article examining OrboGraph’s utilization of AI technologies and the effect it’s had the check and healthcare lines of the business. With OrboGraph’s main focus on automating payments, the company looks at AI as a means to improve efficiencies into the entire payment mix and to facilitate electronification of payments, which ultimately…

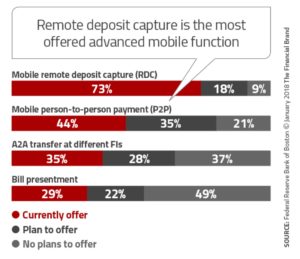

Read MoreThe Financial Brand website summary of mobile banking report shows a disappointing rate of mobile payment and payment adoption among consumers. Consumer enrollment in mobile banking services is growing as more individuals rely on their mobile phones for access to financial services. While growing, the total enrollment and usage percentages for most organizations still falls short…

Read MoreThe Expedited Funds Availability Act (EFAA) and the Check Clearing for the 21st Century Act (Check 21 Act), announced in 2014, will have amendments effective July 1, 2018. We learn this via the Federal Reserve Board (FRB) publishing in the Federal Register final amendments to Regulation CC (Availability of Funds and Collection of Checks). These amendments contain…

Read MoreA new year means new opportunities, and Aite Group’s Top 10 Trends Report tells us to be ready for changes in 2018! It looks to be an amazing year of challenges for retail banking payments as well as wholesale banking. Note: Both sites also feature a link to their Top 10 Trends in Financial Services, 2018 summary…

Read MoreAn interesting new white paper from Digital Check explores the expected demise of paper checks – – and how, as if by magic, the “expected” suddenly did not occur. We all know the drill: 50 billion checks written in the 90s; 20 billion checks written in 2013 – – – do the math, and at…

Read MoreIt was only a few weeks ago that we reported that Bitcoin is trading on Wall Street in the futures market, and all of the persons who’d jumped on that train early were being hailed as forward-thinking geniuses. In a bit of an anti-holiday spirit message (well – they mention Santa at one point), Huffington Post…

Read MoreOne reason check volume has stabilized is due to the marriage of the “tech evolution in check capture” and old-school paper…made possible by remote capture apps that are offered by nearly every major bank. The 2016 Mobile Deposit Benchmark Report, released Sept. 14 and put together by Futurion, a fintech and digital commerce research firm, makes a strong…

Read MoreThey are called the Faster Payments Task Force. They’ve chronicled 252 meetings and teleconferences, 19 surveys and votes, and 120,000 estimated hours of work, the chronological equivalent of 13.7 years. The output is two impressive strategic reports totaling 126 pages, part one released a year ago this month, part two in July. And in retrospect, that…

Read More