Cryptocurrency

In case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreIf you’re a sports fan, you are undoubtedly familiar with the four major sports leagues in the US: Major League Baseball (MLB) The National Football League (NFL) The National Basketball Association (NBA) The National Hockey League (NHL) You may be asking yourself, “What do sports have to do with banking?” Well, it turns out there’s…

Read MoreForrester reports that, according to their Future Fit Survey, 2022, a whopping 77% of bank business and technology professionals are looking to increase their spending on emerging technologies over the next twelve months. Emerging technologies could mean the difference between gaining, retaining, or losing competitive differentiation. Yet failure remains commonplace. Only a quarter of business and…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreDigital is undoubtedly going to play a major role in the future of banking. As we noted previously, digital banking market valuation is predicted to exceed USD 13.5 trillion by 2032. The real question is: How each bank is approaching digital banking? From our friends at BAI, author Emily Steele, president and COO at Savana,…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

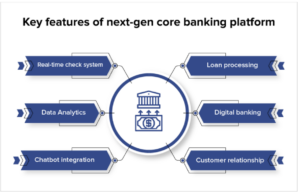

Read MoreAs reported at Mobil App Daily, competition in the banking industry is fierce and at a consistently high level — a good situation for consumers, and an ongoing challenge for the banks themselves. They want to dramatically improve the experience their consumers receive from their optimized digital banking services by utilizing the next-generation banking platform.…

Read MorePYMNTS talked to Manish Jaiswal, chief product and technology officer at Corcentric, about the ways AI technology can and will improve business payments by making them faster and — most importantly — safer. Source: PYMNTS.com “Real-time payments processing is becoming a reality in B2B,” Mr. Jaiswal noted. Still, there are challenges to address. Most companies, no matter the…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreBanks and credit unions recognize that they need to modernize Key to modernization is collaboration Product and data silos, outdated infrastructure, and a risk-averse culture are obstacles The Financial Brand cites a recent report from the Federal Reserve that delineates three types of digital banking experience partnerships being sought by banks and credit unions seeking to…

Read More