Collaborating with Core Processing Providers & Fintech Critical for Banking Digital Transformation

- Banks and credit unions recognize that they need to modernize

- Key to modernization is collaboration

- Product and data silos, outdated infrastructure, and a risk-averse culture are obstacles

The Financial Brand cites a recent report from the Federal Reserve that delineates three types of digital banking experience partnerships being sought by banks and credit unions seeking to modernize digital banking experiences.

From their report, these are the primary third-party partnerships taking place today:

- Operational technology partnerships. Banking organizations deploy third-party technology to existing processes or infrastructures to improve efficiency and effectiveness. These arrangements can involve several third-party partners to transform processes such as new account opening or loan origination. The adoption of operational technology partnerships may also require new types of expertise.

- Customer-oriented partnerships. Financial institutions collaborate with third-party firms to enhance various customer-facing aspects of their business, with the banks or credit unions continuing to interact directly with their customers. Examples include online account opening tools, goal-based savings applications, applications to simplify person-to-person (P2P) money movement and enhancements to existing mobile banking platforms. Customer-oriented partnerships can also improve agility in serving customers.

- Front-end banking partnerships. A bank’s infrastructure is combined with technology developed by a fintech or other third-party provider, with the partner organization interacting directly with the end customer in the delivery of banking products and services. This form of partnership is far less common, but occurring more frequently as organizations increasingly test banking-as-a-service (BaaS) options in the marketplace. These partnerships offer the opportunity to reach new or broader customer segments than the bank may be able to reach through established channels.

They cite new research via 2023 Retail Banking Trends and Priorities, sponsored by Q2, which found that 60% of financial institutions are already using collaboration with fintech firms and other third-party solution providers to successfully meet the digital banking needs of customers.

These collaborations are increasing the speed and scale of innovation, resetting business models and making traditional financial services organizations more future-ready. The progress made over the past two years varies widely based on the asset size of institutions, with the largest and smallest organizations showing the greatest willingness to collaborate with outside firms.

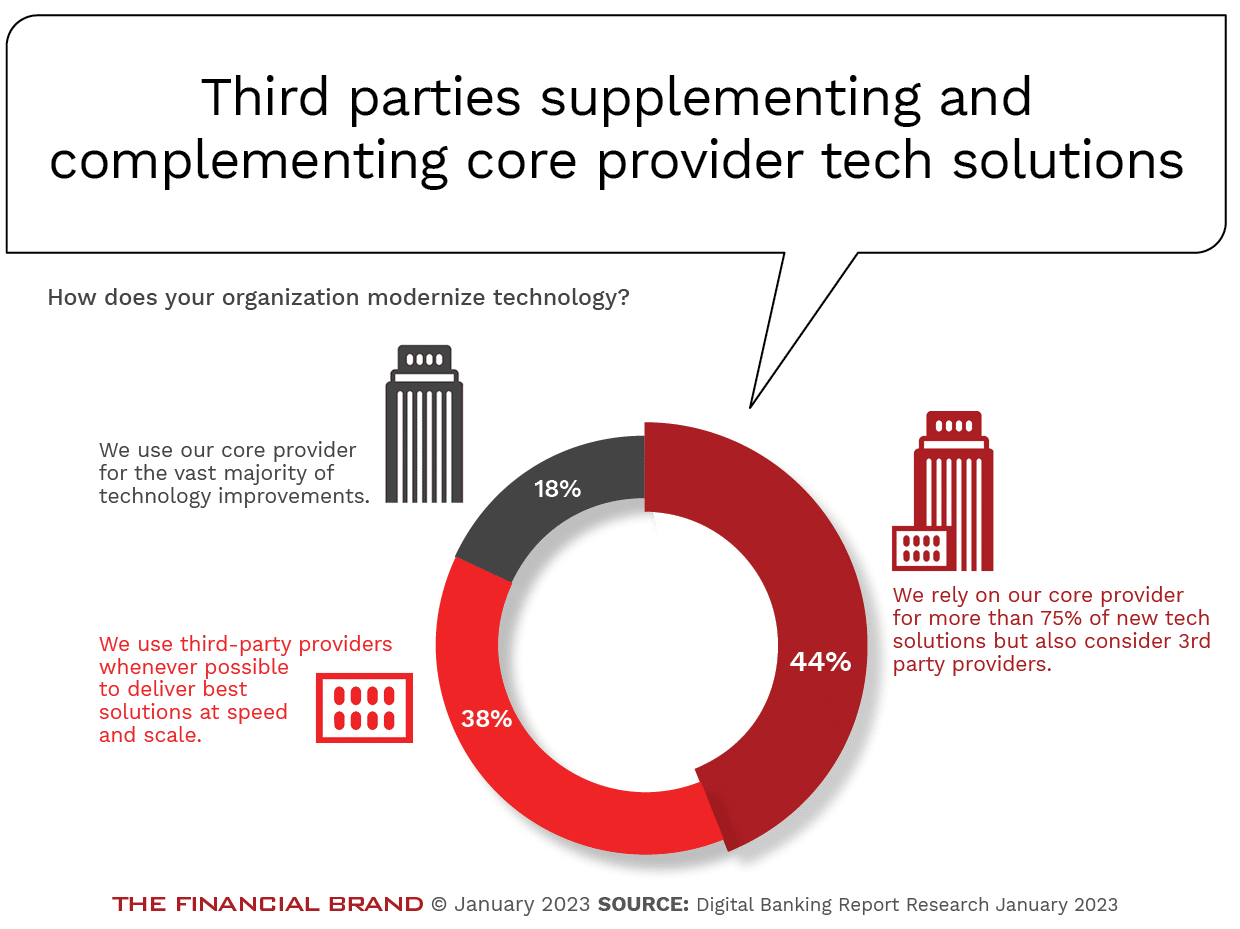

Core Provider Tech Solutions

Banks continue to rely on core provider tech solutions such as Jack Henry & Associates, FIS, Fiserv, Alogent, etc. These providers are key for innovation in the banking industry, particularly with medium-to-small banks, who do not have the necessary internal resources to develop innovative solutions on their own.

Despite the perception that core providers should be able to deliver all the needed modern digital solutions desired by traditional banking organizations, it is very tough to support so many specialized digital solutions that change so rapidly. The shift to platform-based business models and an ecosystem set-up provides banks with various opportunities, if they decide to enter into these collaborations.

That is why these providers partner with 3rd parties technology companies like OrboGraph, to integrate new technologies like AI and machine learning for automating payments like checks.

Successful, But Still Not Universally Adopted

Even so, The Financial Brand points out that this is not yet a universally held objective:

Many banks and credit unions have found it difficult to deliver a consumer experience that replicates those offered by fintech and big tech firms due to the presence of product and data silos, outdated infrastructure, and a risk-averse culture. This has created an opportunity for partnering with startups and other third-party solution providers that can leverage data, modern technology and an agile mindset to assist legacy financial institutions in delivering enhanced experiences.

Still, the majority of financial services leaders responding to the Q2 research believe that, in order to succeed in the near future, some manner of partnership and/or collaboration will be required. Banks will not be able to do it alone -- fortunately, companies like OrboGraph will continue to support the industry.