Financial Industry

Accelerated funds availability allows depositors to instantly access the money they deposit via check. That way, there’s no waiting period for the check to clear and no penalty if the check writer’s account has insufficient funds. An article at BAI Banking Strategies by Victoria Dougherty, director of Payment Management Solutions, Fiserv, opens by wondering why…

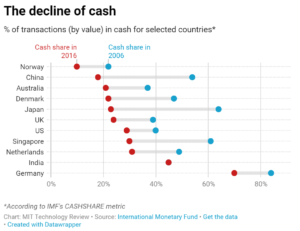

Read MoreIs cash becoming an endangered species? And, if so, is that good? Mike Orcutt, an associate editor at MIT Technology Review, has written what he calls an elegy for cash at the MIT Technology Review site, and includes some points to ponder regarding whether the demise of cash could actually be a negative development, as…

Read MorePaymentsJournal.com took a look at the world of corporate payments and listed nine things corporate treasurers can expect in 2020. This includes: a categorical rise of real-time banking (No. 1) explosive new records for the volume of payments managed by corporate treasurers (No. 3) a warning that fear of fraud and security breaches will increase…

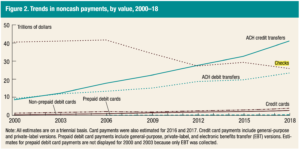

Read MoreThe Federal Reserve released the 2019 Federal Reserve Payments Study Executive Report on December 19, 2019. Based on 2018 compared to 2015, aggregate payment growth in “core noncash payments,” including debit card, credit card, ACH, and checks, were up as a whole by 6.7% representing an incremental 30.6 billion transactions valued at $97B! Comparing actual…

Read MoreIn today’s world, abbreviations are utilized on a daily basis. Simple contractions such as “don’t”, “couldn’t”, and “we’ll” are all commonly used in the English language. In the banking world, abbreviations are most common in the date field, as many in society choose to abbreviate the year from 01/08/2020 to 1/8/20. Seems harmless, right? Maybe…

Read MoreWe love this time of year! It’s a week when everyone the payments industry can take a deep breath, celebrate successes, reflect, and then blog about the future. And now that 2020 is upon us, what better time to “look ahead” toward 2030! PYMNTS.com is one of the first publications to make a prediction related…

Read MoreAnd another year comes to a close! It’s been our pleasure to share observations, insights, and solutions from across the industry via the OrboNation Blog. As 2019 comes to end, we have much to be thankful for. Most importantly, however, we’re thankful for the clients and customers that are crucial to OrboGraph’s success. Looking back,…

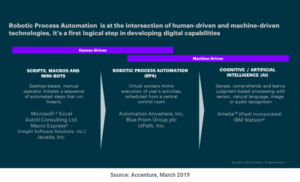

Read MoreAs part of a recent series of blog posts about Intelligent Automation, Adam Swinglehurst of Accenture offered the chart below to illustrate the necessary “overlap” as AI solutions develop and improve. The role of intelligent automation is important to Chief Financial Officers (CFOs) across the globe. CFOs seek to drive efficiencies, create team capacity, meet…

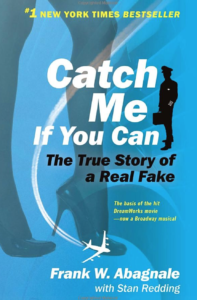

Read MoreIf you’ve seen the Leonardo DiCaprio movie Catch Me If You Can, then you know who Frank Abagnale is, and why he’s a good guy to listen to when it comes to protecting yourself from fraudsters – – he is (or was) the best, after all. Abagnale is using his powers for good these days,…

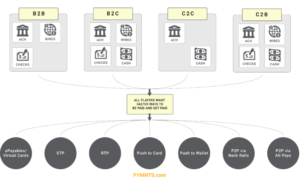

Read MoreThe FedNow Service, the Federal Reserve’s planned faster payments service, promises to have a positive impact on the speed with payments are processed. As the FED navigates their way toward a solution, The Clearing House continues to promote RTP (real-time payments). But the path to a world of real-time, integrated payments is not an easy…

Read More