Intelligent Automation & Cloud-Specific Services for FI’s

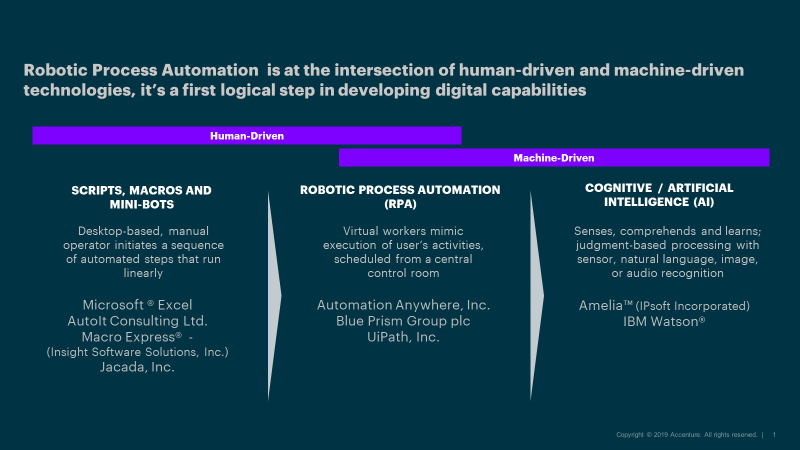

As part of a recent series of blog posts about Intelligent Automation, Adam Swinglehurst of Accenture offered the chart below to illustrate the necessary “overlap” as AI solutions develop and improve.

The role of intelligent automation is important to Chief Financial Officers (CFOs) across the globe. CFOs seek to drive efficiencies, create team capacity, meet new regulatory requirements, accelerate the month end close and reduce their finance footprint while still delivering a service focused on operational excellence.

While many CFOs are turning to intelligent automation to help them meet these goals, we find that they are at different points on the automation journey. CFOs may have started the processes of identifying and implementing automation opportunities, but only a few are tackling larger programs.

Mr. Swinglehurst goes on to list several main factors that determine effective adoption:

Create and Communicate Vision. Implementing an effective intelligent automation program requires sustained commitment from the business and IT throughout the development and deployment lifecycle. C-suite sponsors should enthusiastically and clearly communicate their vision for a virtual workforce to all levels of the organization. Realizing such a vision requires buy-in from key stakeholders across the business.

Seek the Full Spectrum of Benefits. For greater impact, firms should not only identify processes suitable for automation but should also map current resource use and forecast future resource requirements. Intelligent automation can help to meet not only current process demand but also future demand (in relation, for example, to upcoming regulatory requirements). Only when considering current and future demand can a firm be confident that any planned process automation can generate the most benefits. Firms should seek – on an ongoing basis – to apply intelligent automation to existing processes. Accenture has developed a prioritization tool that assesses both the viability of process automation and the potential benefits associated with it.

These two factors are clearly on the minds of IBM and Bank of America as they team up to adopt financial services-specific cloud technology.

Bank of America has focused on its internal cloud computing capabilities. Over the past several years the second largest U.S. bank has gotten down to about 70,000 servers from over 200,000 and trimmed its data centers to 23 from 67.

Streamlining those operations has saved $2 billion annually, Chief Executive Brian Moynihan said on an earnings call last month. However, the bank still relies on cloud services from external vendors since third parties can usually offer the service 23%-30% cheaper, he said.

“We don’t need to own the hardware,” he said. “We just need to find out who can provide it the right way.”

We couldn’t agree more with the key takeaway: Investing in cloud computing is key for banks as more transactions become digital, and it’s critical that the platform can transfer information quickly, keep data private, and prevent service outages. At the same time, there are substantial economic advantages in leveraging outside vendors. OrboGraph continues to be cloud-ready for all applications involving check recognition, payment validation, and check fraud detection.

This blog contains forward-looking statements. For more information, click here.