2020-2030: Payments In The Next Decade

We love this time of year! It's a week when everyone the payments industry can take a deep breath, celebrate successes, reflect, and then blog about the future. And now that 2020 is upon us, what better time to "look ahead" toward 2030!

PYMNTS.com is one of the first publications to make a prediction related to payment trends for the next decade. Of the seven trend lines, we think these are most critical to our business partners and clients:

- #5: The Massive Monetization Of Payments Choice

- #1: Rapid Acceleration Of Cash To Digital Payments

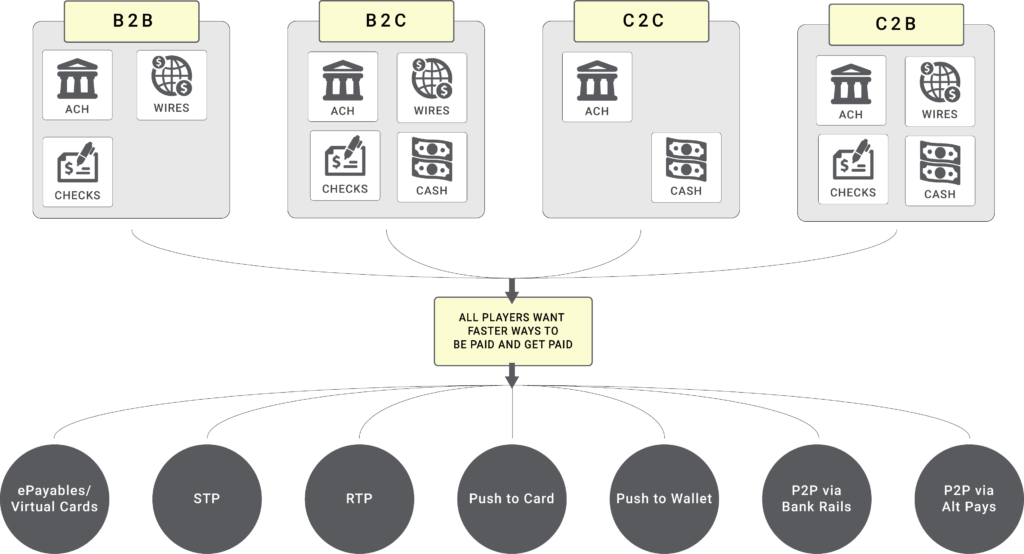

#5: Over the last decade, on the retail side of payments, merchants waited to expand checkout choice until they felt that sales were at risk if they didn’t. On the B2B side of payments, acceptance by suppliers of anything other than a check or ACH payment often came through brute force. The larger the enterprise, the more demanding the supplier onboarding process becomes, and many simply defaulted to the paper check, particularly for one-off or infrequent ad-hoc payments, including disbursements. Today, the paper check still drives well more than half of all payments made between businesses – a percentage that’s even higher when small businesses pay each other.

#1: In developing and emerging economies, thin-feature, phone-friendly apps will give way to more robust apps and ecosystems that power shopping and buying online, paying bills, banking...

When nearly every phone is capable of conducting a transaction and nearly every adult human on the planet is capable of engaging in digital commerce, there will naturally be a spike in demand to digitize cash and take advantage of a connected digital ecosystem that was once totally out of reach.

This is happening even faster than we anticipated.

Market Driven Choice:

The prevalent theme in this article is the battle for market share and profits. A cycle of offering innovation choices, monetizing the value proposition, and converting to market share is the ultimate construct for our capitalistic society.

Choices implies change -- but it also means consumers and business may not change unless there is a compelling argument to do so.

What can we expect for the next decade (2020 - 2030)?

- There will be more choices for consumers and businesses

- Cash will become the target of mobile payment apps and drive greater acceleration to digital for consumer

- New innovations will drive B2B activities...but those darn checks will continue to persevere due to two very important points: choice plus process innovation.

Innovation comes in the form of new payments, but it also is delivered as process reinvention to legacy payments. Stand by -- OrboGraph will soon announce a new revolution in Intelligent Payment Automation, enriching the safety, cost effectiveness, and reliability of digital image (paper-originated) transactions through the use of AI, machine learning, and deep learning technologies.