Mobile Banking

A new article about AI on the Which 50 website cites a recent report from McKinsey Global Institute that makes two vital points about Artificial Intelligence as a tool: The AI revolution is no longer in its infancy The main economic impact of artificial intelligence hasn’t yet arrived That’s what many industry pundits like to call…

Read MoreIs it important for financial institutions to deploy the best possible tools to fight fraud? Consider this: According to LexisNexis Risk Solutions in its 2018 True Cost of Fraud study for the financial-services sector, for every dollar of fraud a financial institution absorbs, it drains an additional $2.92 in associated costs — that’s up 9% from…

Read MoreGetting the money is always a challenge with fund raising, as is reconciliation and record keeping. Additionally, it’s beneficial to communicate to the individuals who donate, because they are interested in your program and a great “target market” for the next fundraising effort. Very often, contributions are solicited via social media, allowing contributors to go…

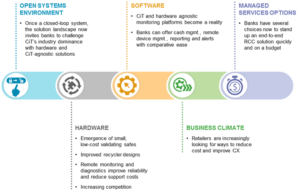

Read MoreWhile steadily declining in overall usage, cash remains “as relevant in retail as it has ever been,” according to an article by Bob Meara, Senior Analyst with Celent, in an article previewing his presentation at November’s AFP 2018, “Fewer Cash Receipts Still Mean Big Retail Challenges.” RCC (Remote Cash Capture) is noteworthy for the collaborative service delivery required to…

Read MoreThere are many reasons for the resilience of checks (including the small- and mid-sized businesses that rely on the paper check’s “float” for accounting purposes), but one important factor has been fear of fraud and security risks in newer digital transactions. Digital transactions are indeed growing at a rapid rate — particularly among millennials, many…

Read MoreLast week, USA TODAY published a consumer-focused article explaining new deposit requirements from a number of banks: Depositors must now include the phrase “For Mobile Deposit Only” underneath their signature on all checks deposited using mobile apps. Some banks are also suggesting you add “For Mobile Deposit Only at (Bank Name)” or “For (BANK NAME) Mobile Deposit…

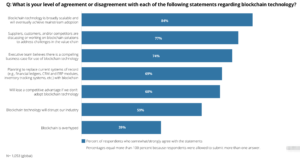

Read MoreVarious applications of blockchain technologies have been hyped and praised, and nearly everywhere you look, there is a company or start-up touting the benefits of the tech. Auditing and tax-services firm Deloitte conducted a survey called Breaking Blockchain Open wherein several aspects of blockchain were covered. In their analysis, Ambcrypto.com points out that, while 84% of…

Read MorePayments 3.0 columnist George Warfel signs off of his last column for the site by noting what he considers deep trends to watch in banking and payments. One particular point he makes is something we’ve seen borne out again and again as cleverly-named payments technology brands appear and then either disappear or team with more established…

Read MoreHats off to Wells Fargo for taking a position which protects themselves and their clients against fraud losses…even if there are bumps along the way. Sometimes risk mitigation has a price in terms of review processes, funds availability or customer service for a select few. In an effort to protect itself and clients in light of…

Read MoreIf you already know the difference between “indorsement” and “endorsement,” you’re the kind of professional who will benefit from the newly-released RemoteDepositCapture.com’s Guide to Restrictive Indorsements, available to purchase at their website. The report is authored by John Leekley, founder and CEO of RemoteDepositCapture.com, who is widely regarded as the leading authority on all things…

Read More