Modernizing Omnichannel Check Fraud Detection

Scammers are opportunists COVID relief checks provided a “porthole” to scams Consumers need reminders to stay vigilant even in challenging times It is no surprise to note that scammers are, first and foremost, opportunists. When the United States government began issuing several rounds of stimulus checks, they were right there with complicated — and not-so-complicated…

Read MorePaymentsJournal offers a podcast wherein Patricia Rojas, Senior Manager Data Scientist at ACI Worldwide, and Tim Sloane, VP of Payments Innovation at Mercator Advisory Group discuss the ways Machine Learning (ML) has become a vital component in the fight against fraud — particularly during the pandemic, when fraud rates have escalated.

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreCheck scammers are well organized A group of online fraud-fighters is helping to ID the bad guys FI’s need to maintain cutting edge fraud detection to protect customers What if you could see a multi-victim, megabucks scam unfold right in front of your eyes? An online fraud fighter known as “Brianna Ware” (“B. Ware” for…

Read MoreThere is no doubt that the pandemic has created opportunities for fraudsters. Atlas VPN reports that cybercrime cost the world more than $1 trillion in 2020, which works out to around 1% of global GDP. Access via online “pirating” to information like email addresses and social security numbers creates opportunities for phishing and other attacks.

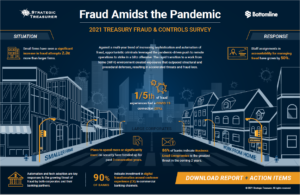

Read MoreOnce again, we see evidence that the COVID pandemic boosted the frequency and sophistication of fraud activity. As tallied in the 2021 Treasury Fraud & Controls Survey by Strategic Treasurer and related by Omri Kletter, global VP for fraud and financial crime at Bottomline, a good deal of fraud is due to the contortions businesses had to make — in a hurry — to accommodate remote work.

Read MoreBanks in New Jersey were taken for many thousands of dollars The scam was a fairly elaborate, multi-step affair $250,000 had been stolen before the scammers were caught We all know about scams involving passing fake or altered checks, but what about elaborate multi-step operations? Here’s an interesting “What if?” exercise — could your bank…

Read MoreStimulus and unemployment check proliferation requires higher-than-ever vigilance Scammers are using the phone to go after checks Which states are the biggest targets? As noted in this space previously, an unfortunate side-effect of the distribution of stimulus checks has been heightened activity by scammers attempting to take advantage of the situation via various fraud tactics.…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreAFP 2021 is coming November 7-11 both virtually and in-person Frank D’Amadeo, director of treasury at Con Edison, sees new sophistication in fraudsters “We’re no longer fighting the so-called ‘amateur fraudsters’” The Association for Financial Professionals — known by industry professionals by its acronym AFP — will be hosting its AFP 2021 Annual Conference both…

Read More