Modernizing Omnichannel Check Fraud Detection

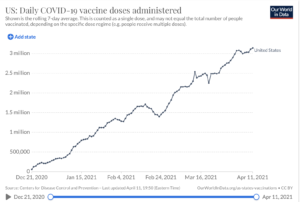

The good news is this: COVID vaccinations are becoming easier and easier to get for more and more people in the United States. Many states are opening up vaccinations to the general public after early limited availablity, making it possible for anyone to get vaccinated against the COVID-19 virus and (so far) its variants. As more and more people get immunized, we head toward “herd immunity” and — dare we hope? — normal life again. As of mid April, half of all US adults will have been vaccinated.

Read MoreWhile it would be nice to hear that the goal pandemic has slowed down scammers much like it has impacted above-board businesses of all kinds, the opposite is unfortunately true. The FBI has seen more complaints over the last year than years prior. As reported at KimKomando.com, The FBI’s Internet Crime Report annual release has revealed a shocking scope of online scams in the 2020 version. The FBI logged 791,790 complaints in 2020 — that’s 300,000+ more than in 2019.

Read MoreThe Financial Crimes Enforcement Network (FinCEN) recently issued an advisory to banks that outlined fourteen red flag indicators to be on the lookout for (and report) related to pandemic related economic relief payments. “Advisory on Financial Crimes Targeting COVID-19 Economic Impact Payments” is based on FinCEN’s “analysis of COVID-19-related information obtained from Bank Secrecy Act (BSA) data, public reporting, and law enforcement partners.”

Read MoreIn the pandemic era, with relief checks being mailed regularly, there is growing concern over the fact that these documents are being transported via fairly low-security boxes on street corners.

The Philadelphia Inquirer reports that fraudsters have begun to look upon mailboxes as buffet lines for scams: “The thieves have been stealing checks, forging signatures, and amassing personal information from the mail to commit identity theft, according to interviews with victims, Philadelphia police, and postal sources. Of the more than a dozen victims The Inquirer has interviewed, the total funds stolen over the last three months amounts to at least $100,000. Multiple individuals had more than $15,000 stolen. The speed and breadth at which the thieves are compromising the mail, and the lack of any physical damage to the structures, suggests they may have keys to the boxes, law enforcement and postal experts say.”

Read MoreAFS Positive Pay is a new product being rolled out by Advanced Fraud Solutions (AFS). The new product looks to advance the capabilities of a traditional positive pay solution by assisting financial institutions (FIs) and enterprise customers examine the changes in payments information to prevent fraud. As reported on PYMNTS: AFS Positive Pay will allow FIs and businesses to monitor payments and receive immediate notices when payment information from vendors, including routing numbers, account information or amounts, doesn’t correctly correspond, the release stated.

Read MoreLexology recently released their Economic Sanctions and Anti-Money Laundering Developments: 2020 Year in Review report, examining economic sanctions and anti-money laundering (“AML”) developments and trends in 2020 as well as a look at the year ahead under the new Administration in Washington.

Read MoreWe are pleased to announce that the Fraud Detection section of #OrboZone is now live! Banks and financial institutions have many tools at their disposal for fighting financial crime. The OrboZone is designed to point fraud specialists to high impact resources with an immersive experience. For example, Artificial Intelligence & Deep Learning can be applied to detect fraudulent attacks and protect customers funds like never before.

Read MoreHere’s a jarring and somewhat novel experience: You go to your mailbox and find IRS Form 1099-G waiting for you — you know, the form you get when you’ve been collecting unemployment. But you haven’t been collecting unemployment… According to NBC News, millions of Americans are receiving 1009-G IRS Tax forms for unemployment benefits for which they never applied — resulting in a conservative estimate of over $36B in losses, with a significant portion from fraud.

Read MoreDigital Transactions took a look at data from credit-reporting agency TransUnion LLC and determined that the shift to digital payment methods brought on by COVID-19 concerns fueled a concurrent rapid rise in fraud and identity theft though those channels. In other words, a pandemic became endemic to fraud.

Read MoreThis comes as no surprise to anyone involved with financial institutions — a new round of stimulus checks has spurred a new round of fraud. The Better Business Bureau has already received reports of con artists asking individuals to provide personal information in order to receive their stimulus funds. WWMT in Michigan points out, for instance, that scammers were contacting people through text messages, e-mail, and robocalls about the new COVID-19 stimulus checks and direct deposits.

Read More