Retail Banking

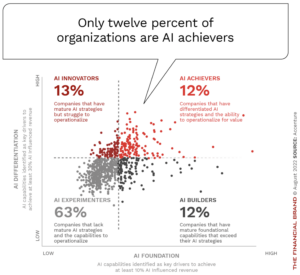

A post at The Financial Brand by Jim Marous, Co-Publisher of The Financial Brand, CEO of the Digital Banking Report, and host of the Banking Transformed podcast, paints a grim picture of AI development and adoption progress in the banking industry. Despite the importance of leveraging data and artificial intelligence for risk management, enhanced operations,…

Read MoreThe newest episode of This Week on PYMNTS.COM covered, among other topics, the impending entry of Walmart into the banking space. PYMNTS’ Karen Webster spoke to Ingo Money CEO Drew Edwards, who is sometimes referred to as “the OG [Original Gangster] in FinTech.” Source: PYMNTS.com (jump to 12:55 for Walmart segment) Walmart is beginning neobank services for its…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreThe San Diego Business Journal asked a group of banking leaders for their impressions of the digital revolution in banking, and received valuable insights regarding human interactions, response to pandemic-era restrictions, and fraud prevention. Even before the COVID-19 pandemic impacted the world economy in early 2020, the financial sector was developing and deploying digital tools…

Read MoreWhile many industry experts have predicted the demise of checks and subsequent move towards fully digital payments, the reality is that checks are NOT going away anytime soon. In fact, a new PYMNTS report, THE TREASURER’S GUIDE TO AR PAYMENT OPTIMIZATION, reveals that 81% of businesses still pay other firms via paper checks, making it…

Read MoreEven as we read more and more about the popularity of digital banking, a study by PYMNTS reveals that many consumers are not yet prepared to cut ties with their traditional financial institutions (FIs) and go fully digital. In their new collaboration with Treasury Prime entitled “How Consumers Use Digital Banks,” 2,124 consumers were surveyed regarding…

Read MoreBAI examines the ongoing transformation of the branch experience: Long before the pandemic hit, many banks were well on their way to rethinking their branches to better accommodate customers’ increased use of digital channels. With the net closure of nearly 3,000 branches in the U.S. last year and a similar pace in the first half of 2022,…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreIt’s an open secret that the types of products and services corporate clients demand from their financial institutions (FIs) are shifting to digital banking solutions. This month PYMNTS Intelligence takes a look at recent changes in corporate clients’ requirements for online versus in-branch banking as well as how banks can use embedded and open banking…

Read MoreCheck Fraud and Recognition Solutions Business Will Continue to Run Independently Billerica, MA, August 16, 2022 – OrboGraph, a premier supplier of check processing automation, fraud detection, and healthcare payment electronification, announced today that Revenue Management Solutions (RMS), a provider of automated healthcare payments reconciliation services has acquired OrboGraph. Thompson Street Capital Partners (TSCP), a private…

Read More