OrboNation Newsletter: Check Processing Edition – September 2022

PYMNTS.com: 81% of Businesses Still Pay Other Firms Via Paper Checks

While many industry experts have predicted the demise of checks and subsequent move towards fully digital payments, the reality is that checks are NOT going away anytime soon. In fact, a new PYMNTS report, THE TREASURER'S GUIDE TO AR PAYMENT OPTIMIZATION, reveals that 81% of businesses still pay other firms via paper checks, making it the most common B2B payment method, even amid companies’ digitization efforts.

Automated clearing house (ACH) payments are used by just fewer than 64% of firms. Thus, about a third of businesses have not yet even adopted this most basic and long-tenured form of digital payment....

Check Fraud Roundtable -- Session 2

Over a dozen banks participated in the second session of the Check Fraud Roundtable (10/13/2022). The focus of the session was the topic of deposit fraud. During the session, OrboGraph announced the launch of the #OrboIntelligence Check Fraud Hub -- the centralized resource for primary and secondary research, industry trends, and 3rd party reports.

To read the agenda, summary notes from the first two sessions, or to participate in future roundtables, visit www.orbograph.com/check-fraud-roundtable.

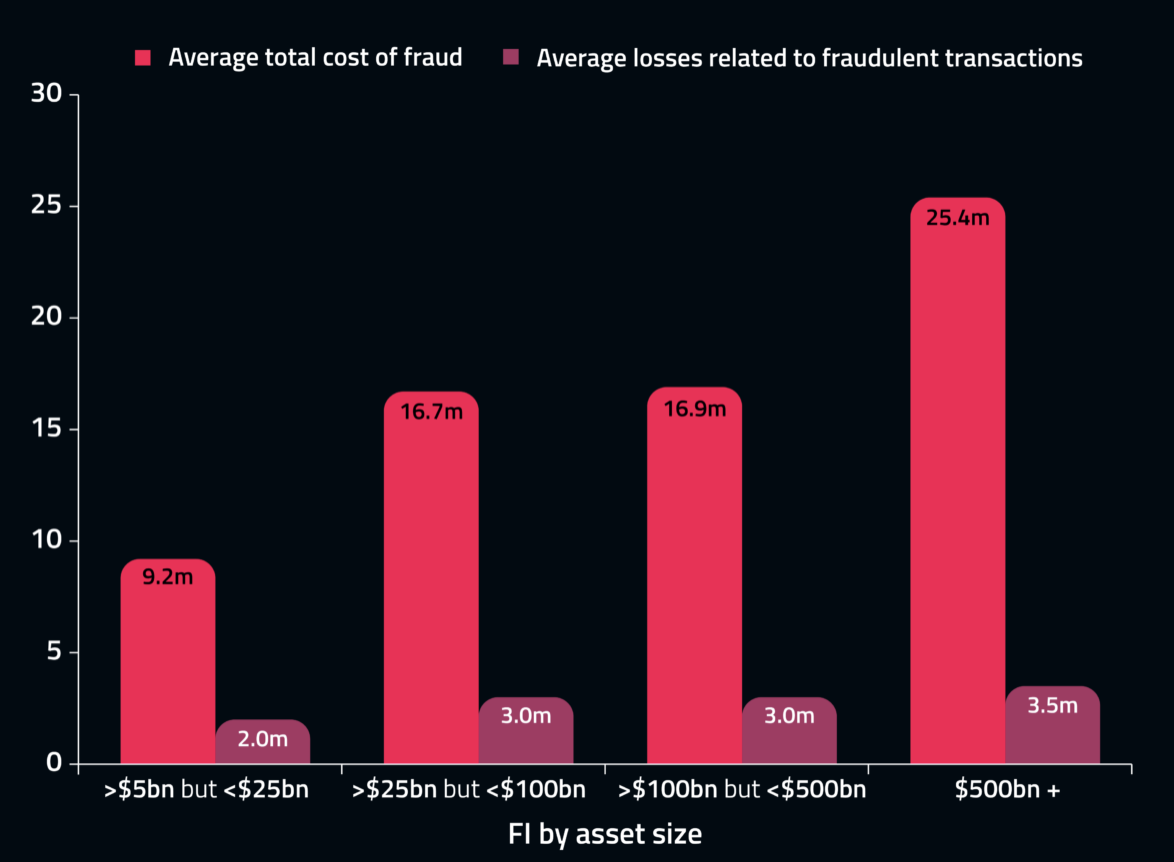

66% of Bank Execs Perceive Complexity in Integrating New Fraud Tech

A new report from Featurespace -- entitled The State of Fraud and Financial Crime in the US -- said that while 62% of global financial institutions reported a year-over-year increase in fraud volumes, they remain hesitant to take action due to perceived regulatory and technological hurdles...

PYMNTS Study Reveals Fewer Than 10% of Consumers Use FinTechs as a Primary Bank

Even as we read more and more about the popularity of digital banking, a study by PYMNTS reveals that many consumers are not yet prepared to cut ties with their traditional financial institutions (FIs) and go fully digital.

In their new collaboration with Treasury Prime entitled “How Consumers Use Digital Banks,” 2,124 consumers were surveyed regarding their experiences with digital banking in order to to learn about their current habits, examine the digital banking services they are looking for, and discover which features would bring more customers to a digital bank...

Stopping Check Fraud: A Collaborative Effort — Law Enforcement, Banks, and Consumers

"Crime doesn't pay" is a familiar statement. The deeper meaning is that the punishment outweighs the benefits. However, if we take the statement at face-value, its appears that-- at least in the case of check fraud -- fraudsters are "getting paid."

Over the past year we've see a rash of criminal activity to acquire stolen checks -- so much so that, through his LinkedIn profile, Frank Albergo, National President of the Postal Police Officers Association...

Digital Banking: Teller Transactions Down -10%, Remote Deposits Up +25%

The San Diego Business Journal asked a group of banking leaders for their impressions of the digital revolution in banking, and received valuable insights regarding human interactions, response to pandemic-era restrictions, and fraud prevention.

Even before the COVID-19 pandemic impacted the world economy in early 2020, the financial sector was developing and deploying digital tools that would make banking faster, safer and more convenient for businesses...

Mail Theft in Philadelphia Leads to Congressional Hearing

Over the past several months, we have covered the wave of mailbox thefts & mail carrier robberies that has plagued the US. In fact, according to data from the Postal Inspection Service, there have been more than 2,000 assaults or robberies against postal carriers since 2020 -- fueled by criminals and fraudsters who steal the mail to obtain paper checks with the intention of either selling them or making alterations to cash.

For the great state of Pennsylvania, these crimes have not gone unnoticed -- by police, FBI, and now Congress. As detailed by NBC10 Philadelphia...

Abrigo Webinar: 77% of Attendees Identify Check Fraud as Major Contributor for Total Bank Account Theft

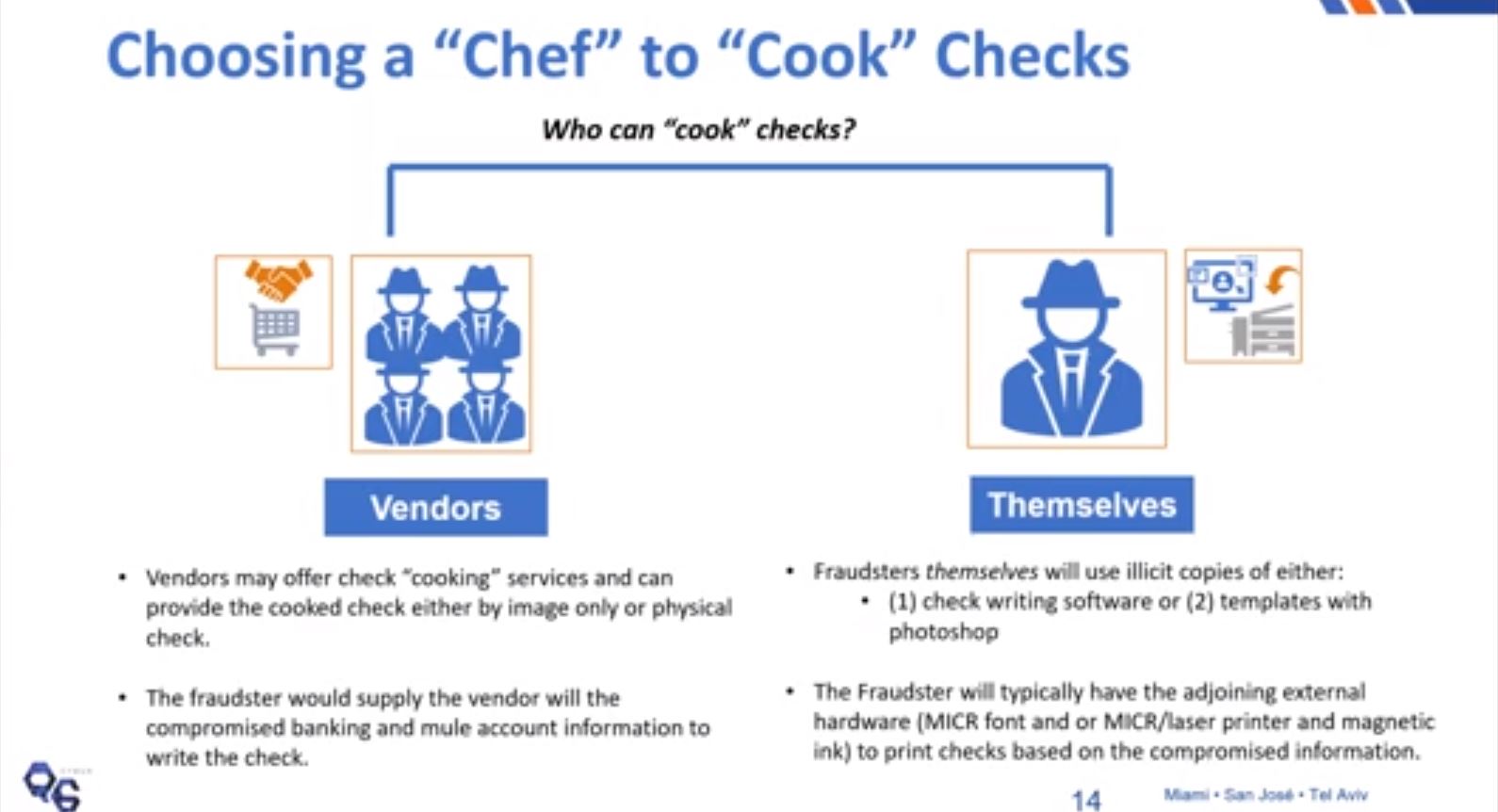

In a new webinar presented by Abrigo, Mara Gibor, VP Of Intelligence Operations; Maria Noriega, Senior Cyber Threat Intelligence Analyst at Q6 Cyber; and Jess Kelley, Senior Cyber Threat Intelligence Analyst at Q6 Cyber, show in great detail:

- How to alleviate rising check fraud

- Key tools and services used by fraudsters

- Resources available to combat fraud

Bank Branches Transformation: “Experience Stores”

According to BAI Banking Outlook research that identifies the top banking trends and challenges for 2022, customers expect that by 2024:

- 61% of their banking business will be digital

- 39% will be human-assisted

The biggest projected increases will likely come from mobile and ATM, according to BAI Banking Outlook...

#CheckFraud & #FraudFightersUnited: Check Out the Latest Posts on LinkedIn

LinkedIn -- the world's largest internet professional network -- is a great way for professionals to connect with colleagues and other industry leaders, strengthening relationships to advance their careers.

Over the past few years we've seen many of these professionals use the LinkedIn platform to take an active role in spreading news and content that is most important to them. For the banking industry -- given the rise in check fraud -- more and more pros are spreading information utilizing the hashtags #checkfraud and #fraudfightersunited.

PYMNTS Intelligence: Digital Tools vs. In-Branch Banking for SMBs

It's an open secret that the types of products and services corporate clients demand from their financial institutions (FIs) are shifting to digital banking solutions.

This month PYMNTS Intelligence takes a look at recent changes in corporate clients’ requirements for online versus in-branch banking as well as how banks can use embedded and open banking to meet these expectations...