Retail Banking

And another year comes to a close! It’s been our pleasure to share observations, insights, and solutions from across the industry via the OrboNation Blog. As 2019 comes to end, we have much to be thankful for. Most importantly, however, we’re thankful for the clients and customers that are crucial to OrboGraph’s success. Looking back,…

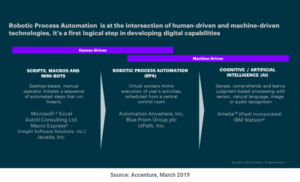

Read MoreAs part of a recent series of blog posts about Intelligent Automation, Adam Swinglehurst of Accenture offered the chart below to illustrate the necessary “overlap” as AI solutions develop and improve. The role of intelligent automation is important to Chief Financial Officers (CFOs) across the globe. CFOs seek to drive efficiencies, create team capacity, meet…

Read MoreIf you’ve seen the Leonardo DiCaprio movie Catch Me If You Can, then you know who Frank Abagnale is, and why he’s a good guy to listen to when it comes to protecting yourself from fraudsters – – he is (or was) the best, after all. Abagnale is using his powers for good these days,…

Read MoreThe FedNow Service, the Federal Reserve’s planned faster payments service, promises to have a positive impact on the speed with payments are processed. As the FED navigates their way toward a solution, The Clearing House continues to promote RTP (real-time payments). But the path to a world of real-time, integrated payments is not an easy…

Read MoreRemember “cash, check, or credit card”? Ah, the simpler days of yore. As reported in PaymentsJournal.com, we are experiencing more payments choices at the consumer level than ever before. Indeed, their article starts out with a parade of options: “Swipe, dip, tap. Credit, charge, debit, prepaid, reloadable. Apple Pay, Google Pay, Samsung Pay, Starbucks, Dunkin’.…

Read MoreJust when you thought you heard it all when it comes to financial crimes, here comes … accidental? A Pennsylvania couple thought they were tokens on a Monopoly board when they had $120,000 mistakenly deposited into their bank account. As far as they were concerned, they’d passed “GO” and picked a pretty good Community Chest…

Read MoreJack Henry & Associates Inc, a provider of technology and payment processing services for the banking industry based in Missouri, recently announced the retirement of their executive vice president and chief technology officer, Mark Forbis. Mark began his career in 1982 with Systemics. He was named vice president and CTO at Jack Henry in 2006…

Read MoreAs technological innovation continues to evolve society, so does the way it affects society’s interaction with businesses, including their banks!

Read MoreThe US real-time payments network currently reaches about 50% of the population, and was on track, via private sector channels, to provide complete coverage by the end of next year, as noted in an article at Forbes.com by Ike Brannon, a senior fellow at the Jack Kemp Foundation.

Read MoreWant to go deep on financial fraud and crime, and learn the difference between the two while also learning about the role of modern cybersecurity tools in curtailing both? Get comfortable and spend some time with this comprehensive article from McKinsey & Company covering Financial crime and fraud in the age of cybersecurity. Their analysis…

Read More