Retail Banking

While the consumer “civilian” world has pretty much learned and accepted the “don’t take checks from strangers” rule, the corporate world is both slow to adopt that guideline — and often unable to. This is due to the fact that suppliers like the “float” advantage they enjoy with check payments. (“We paid you on Tuesday…

Read MoreIs it important for financial institutions to deploy the best possible tools to fight fraud? Consider this: According to LexisNexis Risk Solutions in its 2018 True Cost of Fraud study for the financial-services sector, for every dollar of fraud a financial institution absorbs, it drains an additional $2.92 in associated costs — that’s up 9% from…

Read MoreAn article produced by Intel outlines the ways Artificial Intelligence — AI — solutions can be deployed while using an organization’s existing technological infrastructure. The result is maximum gain with minimum expense and downtime. Watch this video for an interesting perspective on AI utilization. Intel’s article outlines three key areas where enterprises are experimenting with AI…

Read MoreGetting the money is always a challenge with fund raising, as is reconciliation and record keeping. Additionally, it’s beneficial to communicate to the individuals who donate, because they are interested in your program and a great “target market” for the next fundraising effort. Very often, contributions are solicited via social media, allowing contributors to go…

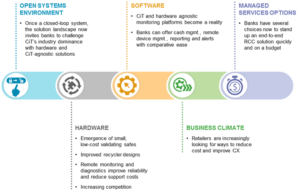

Read MoreWhile steadily declining in overall usage, cash remains “as relevant in retail as it has ever been,” according to an article by Bob Meara, Senior Analyst with Celent, in an article previewing his presentation at November’s AFP 2018, “Fewer Cash Receipts Still Mean Big Retail Challenges.” RCC (Remote Cash Capture) is noteworthy for the collaborative service delivery required to…

Read MoreThere are many reasons for the resilience of checks (including the small- and mid-sized businesses that rely on the paper check’s “float” for accounting purposes), but one important factor has been fear of fraud and security risks in newer digital transactions. Digital transactions are indeed growing at a rapid rate — particularly among millennials, many…

Read MoreAlfredo Alvarez, a principal at Liberty Advisor Group, writes in his article how modernizing legacy technology wins the digital customer: Nimble new entrants and rapidly increasing customer expectations for digital products and services continue to disrupt financial services firms. In response, financial services organizations have made significant investments in agile development and DevOps (development and…

Read MoreLast week, USA TODAY published a consumer-focused article explaining new deposit requirements from a number of banks: Depositors must now include the phrase “For Mobile Deposit Only” underneath their signature on all checks deposited using mobile apps. Some banks are also suggesting you add “For Mobile Deposit Only at (Bank Name)” or “For (BANK NAME) Mobile Deposit…

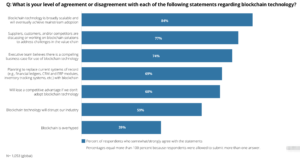

Read MoreVarious applications of blockchain technologies have been hyped and praised, and nearly everywhere you look, there is a company or start-up touting the benefits of the tech. Auditing and tax-services firm Deloitte conducted a survey called Breaking Blockchain Open wherein several aspects of blockchain were covered. In their analysis, Ambcrypto.com points out that, while 84% of…

Read MoreWe’ve talked recently about how banks are, to a greater and greater extent, making significant investments in technology to make transactions both more convenient and more secure for their customers/members. But another path to maintaining and, indeed, growing a loyal customer base in the age of remote deposit capture via mobile device — and an…

Read More