Technology

RemoteDepositCapture.com creates one featured poll question per month on RDC-related topics. If you’re at all interested in check processing [who wouldn’t be, right?], then we invite you to visit their site and register your input. While you’re there, it’s well worth signing up for their newsletter so you can get poll results regularly. This month’s featured…

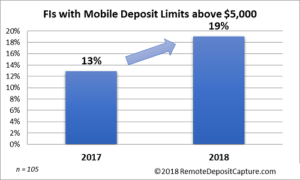

Read MoreA RemoteDepositCapture.com poll reveals that the limits banks and credit unions place on the size of consumer checks eligible for depositing via mobile RDC are rising steadily. In fact, the past year has seen the number of financial institutions with standard per-item deposit limits above $5,000 for consumer mobile deposit customers growing by nearly 50%, according to the…

Read MoreOn July 1st, 2018, Amendments to Federal Reserve Regulation CC take effect. Many financial institutions are taking a passive approach to these very important changes. Others are serious about making changes to their deposit agreements and are changing workflows to modernize their risk and fraud practices. What’s your position on these changes? The amendment creates…

Read MoreIs your financial institution ready for payment innovation? The Innovation Readiness Playbook from PYMNTS.COM surveyed US financial institutions and created a gem for strategic and tactical considerations. Like many surveys, you can take a positive or negative spin on the data and critique the questions. For example: Is this a wake-up call to mid-sized financial institutions that…

Read MoreThe “death” of the check is still way behind schedule, according to many organizations that predicted the end of paper checks many years ago. We keep reporting that checks are still popular when they were supposed to have been dwindling years ago. (That’s the boring part of the post) The latest installment in PYMNTS’ Kill…

Read MoreTHE TECHNOLOGY HEADLINES features an article examining OrboGraph’s utilization of AI technologies and the effect it’s had the check and healthcare lines of the business. With OrboGraph’s main focus on automating payments, the company looks at AI as a means to improve efficiencies into the entire payment mix and to facilitate electronification of payments, which ultimately…

Read MoreFrost & Sullivan’s Growth Innovation Leadership (GIL) briefing titled, “Global Healthcare Market Key Predictions for 2018,” was held on December 13, 2017, and their experts predicted another year of big disruptions, transformations, and innovations as the healthcare industry — really, in health care??? As reported at HospiMedica.com: Human-machine collaboration will bridge the gap between artificial intelligence…

Read MoreThey are called the Faster Payments Task Force. They’ve chronicled 252 meetings and teleconferences, 19 surveys and votes, and 120,000 estimated hours of work, the chronological equivalent of 13.7 years. The output is two impressive strategic reports totaling 126 pages, part one released a year ago this month, part two in July. And in retrospect, that…

Read MoreThe Land Down Under is introducing New Payments Platform (NPP), the modestly-named and soon-to-be-launched system that will enable almost instantaneous transactions between banks and bank accounts, any day of the week. With convenience comes a level of jeopardy. Finder.com.au insights manager Graham Cooke told The New Daily that the new platform could expose consumers to fraud risks. “While…

Read MoreFintechs and banks have been at odds with one another over customer information since the first moment that someone somewhere decided “fintech” was an actual word. American Banker reports that the icy relationship may be thawing. Fintechs have been arguing that they need to access bank customer account data to provide a variety of services,…

Read More