Technology

The Money20/20 conference this year in Las Vegas gathered an astounding array of speakers for what is called “The World’s Largest Payments & Financial Services Innovation Event.” Artificial intelligence, online commerce, robotics, even materials handling – – the spectrum of topics covered was enormous. In case you missed the conference (or if you attended but,…

Read MoreIt’s advertised as “The World’s Largest Payments & Financial Services Innovation Event,” and it’s taking place right now (October 22-25) in Las Vegas – – the 2017 Money20/20 event expects 11,000+ attendees, including more than 1,700 CEOs and Presidents, from 4,500 companies and 85 countries. Their agenda is comprehensive and includes themes like PAYMENTS, BANKING, COMMERCE, SECURITY,…

Read MoreThe adoption of online banking, now incorporating mobile, has become a staple for the industry over the past couple of years. However, the online experience can vary greatly based on what features are offered from each financial institution. One area which has not received its share of improvements are value-added features for check-type payments. The…

Read MoreA new analysis of industry data by the ATM Industry Association (ATMIA) reveals that there are now between 475,000 and 500,000 ATMs operating out there in the U.S. market. This achievement comes after years of what can be characterized as fairly stagnant growth (attributable to a struggling economy, Windows updates, and a complex EMV migration, among…

Read MoreThe story of Eastman Kodak’s fate is often used to illustrate the danger of late adoption of new technology. Even venerable and ostensibly rock-solid entities can find themselves marginalized and, ultimately, pushed out the picture (so to speak) if they don’t keep up with emerging tech. An article in the Harvard Business Review uses the…

Read MoreThe Association for Finance Professionals (AFP) has made available a white paper entitled “Not Going Anywhere: Why Checks Still Matter” (log-in required) that offers valuable insights in an easily digestible package. As pointed out in the report, check use in the United States for business-to-business (B2B) transactions remains at roughly 50% in spite of a multitude…

Read MoreHere’s a terrific podcast interview via BAI Banking Strategies that you should listen to during your commute. In it, Andres Wolberg-Stok, Citi FinTech’s global head of policy, talks about best practices and approaches to incorporating financial tech – FinTech – in financial organizations. An important point Wolberg-Stok makes early in the conversation is the fact that,…

Read MoreAn article at Banking Exchange takes an interesting look at the often uneasy relationship between financial technology organizations vs. the Fintech market covering the hot topic of compliance management. Instruments like the expanded UDAAP standards implemented by the Consumer Financial Protection Bureau need to be at the forefront. Richard Holbrook, chairman and CEO of $9.6 billion-assets…

Read MoreWe’ve heard stories of card skimmers at outdoor ATM machines and even gas pumps ripping off consumers’ card information, but, admit it – – you always trusted card machines that are inside of retail establishments just a bit more, right? Watch this clip and marvel at the fact that this caper is pulled off in…

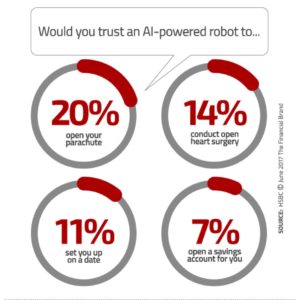

Read MoreArtificial Intelligence, chatbots and robo-advisors are coming. Here’s an interesting example of how perceptions can yield crazy statistical results. A “Trust in Technology” report published by HSBC found that consumers are leery of allowing chatbots and robo-advisors to help them open a savings account or provide mortgage advice – – but they would trust them more for heart surgery! In an article…

Read More