Uncategorized

A post at Forbes describes an environment where regional banks in the US face growing digital disruption and “macro headwinds” — and describes how embracing technological change is crucial for their revival. The author, Forbes Councils Member Rodrigo Silva, goes on to note that this transformation must prioritize fraud prevention to protect both the banks…

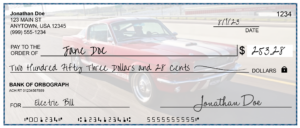

Read MoreTikTok sometimes allows poor advice to be posted The “Infinite Money Glitch” is one such example — encouraging check fraud There are several different methods banks can use to detect this sort of fraud TikTok trends are all the rage now. While YouTube remains the leader for content created by individuals, many are addicted to…

Read MoreNICE Actimize shares tips for fighting check fraud Technology plays key role in check fraud detection Banks are shifting from competitors to collaborators while tackling challenges Brian Keefe, Senior Pre-Sales Consultant at NICE Actimize, shares some advice for combating check fraud in the financial industry. Via “Q&A” format, Keefe highlights the ongoing threat posed by…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreSome major retailers have announced they will no longer take checks “High Dollar Services” remain popular for checks Check usage remains prevalent enough to merit effective security measures PaymentsJournal reports that, in spite of news that Target stores has stopped accepting checks (joining other major merchants such as Whole Foods and Aldi) the “grand old…

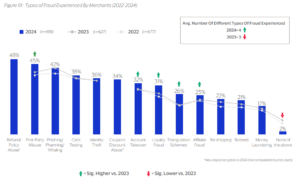

Read MoreFraud attacks of many types are on the rise Merchants are reporting huge fraud impacts A shift from operational costs to improving customer experience and mitigating payment fraud is evident While our blog’s main focus is the checks payment channel, it’s worth taking a look at other payment channels and their fraud trends — particularly…

Read MoreThe internet is buzzing this morning with news that Telegram CEO Pavel Durov was arrested in Paris. According to APNews: Durov was detained in France as part of a judicial inquiry opened last month involving 12 alleged criminal violations, according to the Paris prosecutor’s office. It said the suspected violations include complicity in selling child…

Read MoreWe’re beginning the second half of 2024, a great time to examine the trends of the year. In a recent post, IBM examined what they consider the seven top financial services trends of 2024. They are as follows: Generative AI Hybrid cloud technology Cybersecurity risk management Sustainability Customer experience Open banking Digital currencies Open Banking…

Read MoreCheck writing remains common, with 61% of Americans still using checks. Most persons using checks believe they are deploying all available safeguards In fact, many check-writing habits need to be “upgraded” Recently, Kiplinger Personal Finance Magazine posted a helpful article that explains how to safely write a check in a world where fraud is not…

Read MoreYouTuber Tommy G goes “deep dive” with actual scammers The video discusses the motivations behind scamming, particularly among Gen Z It’s suggested that disillusionment with the financial system, which is see as corrupt and unjust, fuels their involvement in fraud. A recent YouTube video by Tommy G. offers a pretty comprehensive, 30-minute dive into the…

Read More