Check Baking: More Dangerous Than Check Washing?

A new YouTube video by Debra Richardson, who specializes in providing vendor process guidance to avoid fraud, fines, and bad vendor data, identifies a particularly pervasive form of check fraud called check baking.

She explains that whereas "whitewashing" checks entails erasing and replacing information on a check, check baking involves taking a picture of a check signature and then Photoshopping the signature onto an easily-created fake check, which has the routing number and bank account number needed to carry out the transaction.

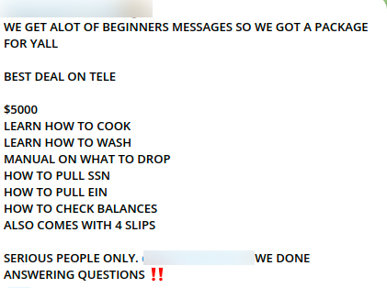

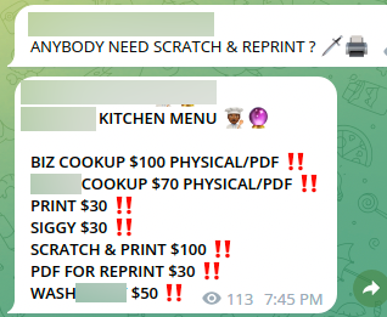

Efficient Check Fraud Tactic

Check baking is a more efficient avenue for fraudsters because washing a single check -- no matter how it is procured -- typically creates one opportunity to commit fraud. Want to pull off more fraudulent transactions? You'll have to procure more checks to wash.

"Baking" checks, on the other hand, makes it possible for a fraudster to easily manufacture dozens of checks and deposit them into numerous drop accounts -- a much more lucrative and efficient methodology. An inexpensive subscription to photo editing software like Photoshop is all that's needed to create very effective counterfeit checks at virtually no cost. And, if you are not an expert in the software, there are dozens of tutorial videos available on YouTube or "trainers" on the dark web who are willing to teach future fraudsters.

Fraudsters also take advantage of the "quantity over quality" strategy. While the counterfeit checks are by no means "unskilled" -- a term used by fraud analysts depicting poor attempts at counterfeiting a check, fraudsters will create a number of checks with small amounts to remain undetected. This is particularly effective on business checking accounts, where smaller check payments can be unnoticed for weeks or even months before being detected. By the time it's noticed, the fraudster could have made away with thousands of dollars.

This does not mean fraudsters won't avail themselves to any opportunity to steal "raw material" checks, however. More checks mean more potential for successful transactions via multiple channels.

Blending Transactional Analysis with Image Forensic AI to Combat Check Baking

Check baking is notorious difficult for banks and customers to identify without keeping a close eye on accounts. However, new enhancements to technologies enable banks to assist their customers in uncovering these types of false transactions.

Transactional analytics leveraging artificial intelligence analyze all account transactions to find those that deviate from normal behavior. This will be particularly important when the fraudsters try to make multiple payments that are not consistent with prior actions.

Additionally, financial institutions utilizing image forensic AI are able to analyze the counterfeit images to identify characteristics of fraud. This includes extracting the check number to determine whether the serial is out-of-range, as well as verifying the check writer by analyzing fonts utilized on the counterfeits compared to prior cleared items.

Fraudsters will continue to use any tools and strategies available to them to extract customer funds. FIs, fintechs, and customers need to stay vigilant to ensure they do not succeed.