Generative AI Scams — Are Counterfeit Checks Next?

- Generative AI is gaining popularity for its ability to quickly create images, audio, and text

- The ability to quickly create realistic images introduces check fraud opportunities

- The FTC is aware of this potential and is taking steps

By now most people have read, heard, or seen the fruits of Generative AI, a technology that is gaining broad attention due to its ability to quickly and inexpensively generate shockingly realistic images, audio, and text. We've previously explored various advantages Generative AI brings to the banking world.

However, there have been varying degrees of concern raised about its potential negative implications, including the creation of effectively deceptive "deepfakes" and the violation of individuals' privacy rights.

As reported on Gizbot, the U.S. Federal Trade Commission (FTC) has taken notice:

Seniors in the U.S. Federal Trade Commission (FTC) testified that the agency would legally pursue companies that abuse Generative AI platforms. Legislators around the world appear increasingly concerned about the misuse of platforms such as ChatGPT, Bard, Midjourney, and many others like them, by questionable entities to violate laws enacted against discrimination.

None of these people are real.

Click to enlarge.

Generative AI and Check Fraud

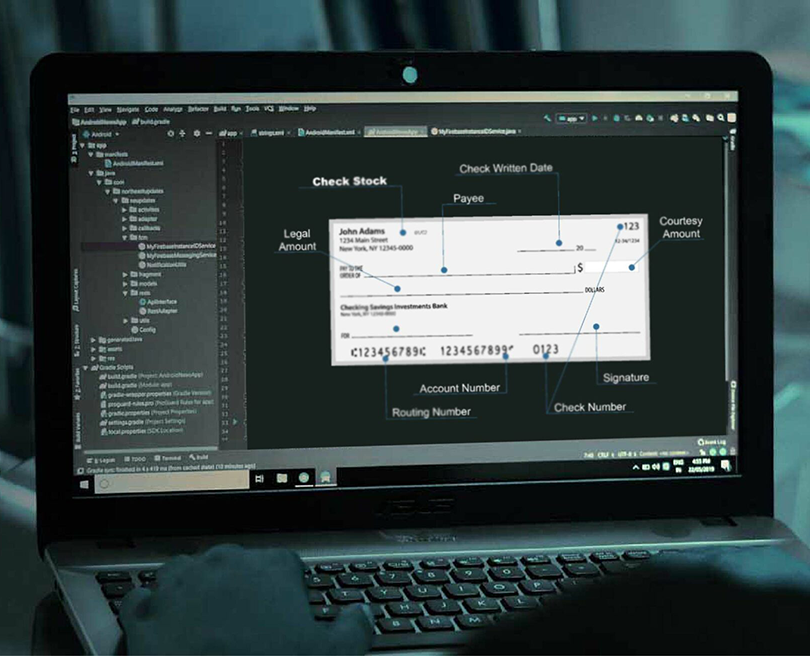

Generative AI platforms, several of which are based on ChatGPT, can be thought of as tools that offer actual answers to queries instead of simply links to web pages. Where these platforms enter the realm of check fraud is via several platforms that draw realistic-looking images and even mimic the voices of people if they are provided enough data.

It doesn't take too much imagination to see how fraudsters could use this readily available technology to quickly and efficiently create incredibly realistic checks. Traditionally, counterfeit checks were labeled in two categories: skilled and unskilled.

For skilled counterfeits, a major reason for success is the utilization of digital editing tools. Could the utilization of generative AI take these counterfeits to a much higher level? For unskilled counterfeiters, would generative AI give them access to a tool that would make it easier to create a skilled counterfeit check?

Additionally, we recently discussed the ease in which fraudsters are able to open new bank accounts to deposit fake checks -- aka drop accounts. As banks look to increase their requirements for opening bank accounts to mitigate the risks of drop accounts, could generative become the tool to quickly create multiple fake identities -- complete with artificial "photo ID," as seen above -- that can be used to open these accounts?

With all these questions and possibilities, it inevitably crossed the FTC's radar:

FTC Chair Lina Khan, and Commissioners Rebecca Slaughter and Alvaro Bedoya, were asked about concerns about using Artificial Intelligence to make more effective scams or otherwise violate laws. As these platforms are already making high-quality deep fakes, they could also be used to commit crimes and fraud. Bedoya has noted that companies using algorithms or AI weren't allowed to violate civil rights laws or break the rules against unfair and deceptive acts. The laws protecting civil rights apply to these companies as well, she noted.

Image Forensic AI to Fight Generative AI

Fraudsters leveraging generative AI for their check fraud scams is almost a certainty. This means that financial institutions must meet technology with technology.

When examining a skilled counterfeit, there are several methods and analyzers that make image forensic AI an enormously effective technology. Check stock validation will enable the comparison of checks from accounts to the generative AI, identifying any variances in the counterfeit checks.

Additionally, new Writer Verification technology -- which analyzes the writing styles of the check writer -- will spot key differences on the check such as date style, font style, etc. Generative AI is able to create new images from data across the internet, but it will not be able to fully mimic a check writing style without a significant amount of data from the specific check writer -- making it difficult to pass counterfeit checks.

As technologies evolve across the globe, financial institutions must stay one step ahead of fraudsters with the latest innovations.