Healthcare Payments Report Outlines Strategies of Payments Leaders

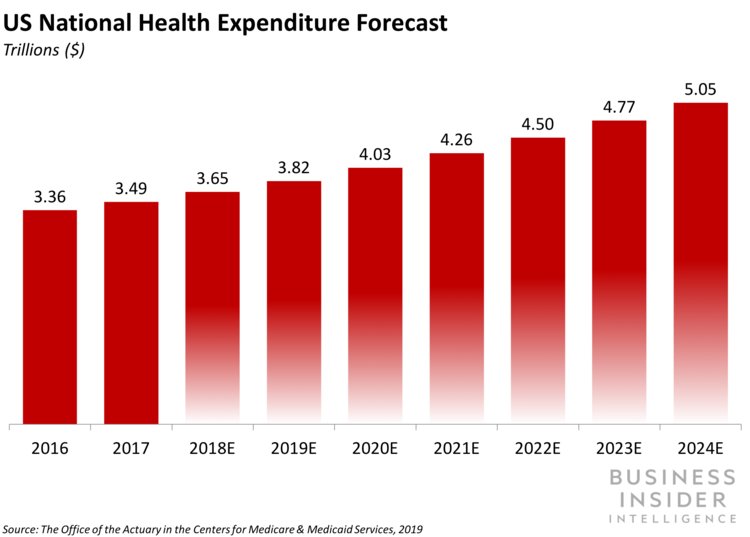

The US healthcare payments market is gigantic, and getting bigger. As seen in the chart above, Healthcare expenditure hit $3.65 trillion in 2018 (per projections from CMS) and this spending is only expected to go up and up (again, as seen in the ski-jump above).

Does that mean cruise control for players in the healthcare payment industry? Don’t get complacent – – Business Insider Intelligence warns that the industry is at a tipping point:

Better-informed and more critical customers, along with a push to combat the complex and opaque medical billing process, are creating demand for innovation in the healthcare payments space.

Despite a titanic market size and room for innovation, digital transformation is occurring incrementally at best. In fact, 90% of healthcare providers still leverage paper and manual processes for collections, according to data from a report commissioned by InstaMed and compiled by Qualtrics.

And even when healthcare providers offer digital solutions like online portals to customers (which 60% do), they seem to be falling short: While the majority of consumers claim they want to make appointments (68%), fill out registration forms (68%), and pay healthcare bills (61%) online, the share of consumers who actually do so hovers around 30% for those use cases. Discrepancies like these make healthcare payments a greenfield for lucrative digital innovation.

The new Business Insider Intelligence Healthcare Payments Report is available at their site, and here are a few takeaways:

- The US healthcare payments market is indeed massive (see above): For reference, consumers spent slightly less on retail purchases — $3.63 trillion — in 2018, per Internet Retailer.

- But healthcare payments innovation has failed to keep up with consumer demands due to providers’ reliance on legacy processes, and this may be hurting providers’ bottom lines.

- Healthcare payments are complicated by the different stakeholders — providers, payers, and patients — that have a role in each transaction. These stakeholders’ needs are shifting as the market changes: Consumers are taking a more active role in paying for their healthcare while states are pivoting toward a model that compensates providers based on the quality of their services rendered rather than the quantity.

- Some payments firms are successfully adapting to the shifting market by creating digital solutions that balance the evolving needs of the entire healthcare payment value chain.

AI and blockchain are already being embraced in the payments industry, but a more sophisticated, price-and-service savvy consumer base will demand that we stay on the cutting edge. The healthcare industry strives for complete electronification of payments, yet paper-based and PDF-originated payments continue to be an issue, requiring manual processing and cash flow delays — both of which slow industry growth and resilience.

While achieving 100% electronification is the goal, many RCM companies, clearinghouses, and healthcare providers are taking a hybrid electronification approach. They utilize technologies like OrboAccess, which leverages AI and deep learning to greatly reduce the amount of manual processing.

This blog contains forward-looking statements. For more information, click here.