The Metaverse: The Next Frontier for Banking?

Brace yourself: It's time for banks to begin planning their move to the Metaverse.

Or Web3. Or Web 3.0. Or whatever they're calling it today. If you're not exactly sure what the Metaverse is, rest assured that you are not alone...but that hasn't stopped banks from eagerly diving in.

The Financial Brand had Mike Abbott, Senior Managing Director and Global Banking Lead at Accenture, explain his approach to the still-forming Metaverse. First, however, he warned against jumping in before becoming aware of how best to deploy this new tool.

“I’ve never seen such FOMO — fear of missing out — before in the industry,” says Abbott, Senior Managing Director and Global Banking Lead at Accenture. “Everyone wants to claim that they were the first in the Metaverse with this, that and the other thing.”

What is the Metaverse

First - what's the Metaverse? Well, check out this quick YouTube clip with Mike Abbott and Jess Murray, Managing Director – Song, Banking & Capital Markets Lead, North America, in the Metaverse.

The Metaverse is basically a virtual reality wherein many parties -- from two to thousands -- can meet, interact, and transact. There are almost limitless possibilities in terms of visual presentation and level of immersion. Environments of any sort can be created.

In a Banking Dive article, Sandeep Vishnu, a partner at consulting firm Capco, describes the Metaverse as a virtual world which users can explore through the use of virtual reality and augmented reality headsets, which is a new interaction and engagement model for society.

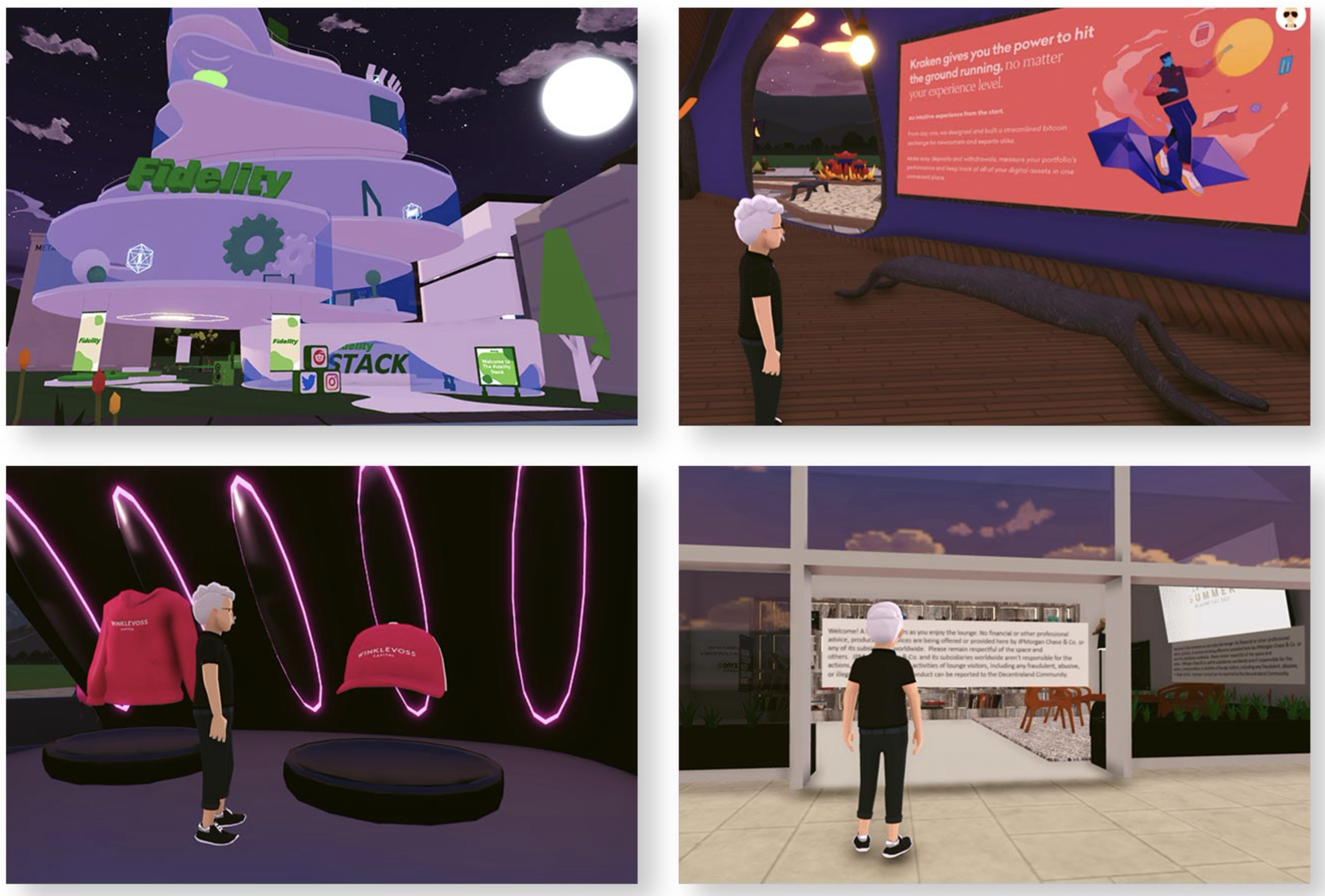

A sampling of financial sites on Decentraland (clockwise):

- Fidelity’s “The Stack,” where the emphasis is on education

- Kraken, the crypto exchange and bank, which includes billboards and a video of one of its founders

- J.P.Morgan Chase, which sponsors the Onyx Lounge, which currently focuses on the bank’s summer employee reading list and which features a disclosure at the entrance

- Winklevoss Capital, owners of multiple crypto and other financial firms

(The Financial Brand graphic)

Banking's Role in the Metaverse

So, it looks great - - but why enter the Metaverse?

Vishnu explains the logic:

“If the Metaverse is a new model for society, for interaction and engagement, then banks have to follow that,” said Vishnu. “Banks have to figure out what role they are going to play in the Metaverse, and getting a move and being part of the ecosystem early on might give them some landing rights that wouldn’t be there if they don’t move early.”

Abbott provides an interesting perspective, noting that the Metaverse is an opportunity for "putting humanity back in banking."

“In solving digital, banks have become functionally correct and emotionally devoid,” he says.

Here’s what he means by that: “The industry pushes people through website pages all day long. But in the process of becoming digital, banks lost humanity, the ability to connect with people. The Metaverse ultimately holds the promise of putting humanity back into banking, to enable bankers and customers to have conversations again.”

The irony is not hard to miss, of course -- a high-tech substitution for reality is the path back to humanity in banking?

Planning for the Metaverse

For most banks, the Metaverse is certainly a goal worth embracing, and becoming acquainted with its possibilities while still in the "Wild West" stage definitely creates an advantage.

That doesn't mean leaping in without a plan, of course.

“Have a purpose and be in control,” advises Abbott. “Don’t let your Metaverse presence become an uncontrolled space, no more than you would let your physical branch become an uncontrolled space.”

The Metaverse presents an opportunity for banks to reinvent banking for the tech-savvy generation. However, David Urbano, Chief Marketing Officer at imagin, notes in an article in FinTech Magazine:

“The success of a financial institution in this new environment will rely on its ability to effectively offer its services and/or products in this new virtual world. We believe that services where we can mediate payments or financing products, could prove to be successful if adapted correctly. If the Metaverse ends up becoming the meeting place for our potential clients, it could even become a new onboarding channel.”

It remains to be seen what the future holds for banking in the Metaverse. Banks will need to find ways to integrate this possible payment channel with current ones like credit cards, debit cards, ACH, and checks.

Who knows, maybe OrboGraph will be hosting digital meetings with current and potential clients in the Metaverse!