Understanding “Hyperautomation” for Banks & Three Keys to Success

Automation has been a popular topic in the world of banking for decades (and discussed here recently as well). However, according to BankingDive.com, there is a new term now picking up steam in the banking world:

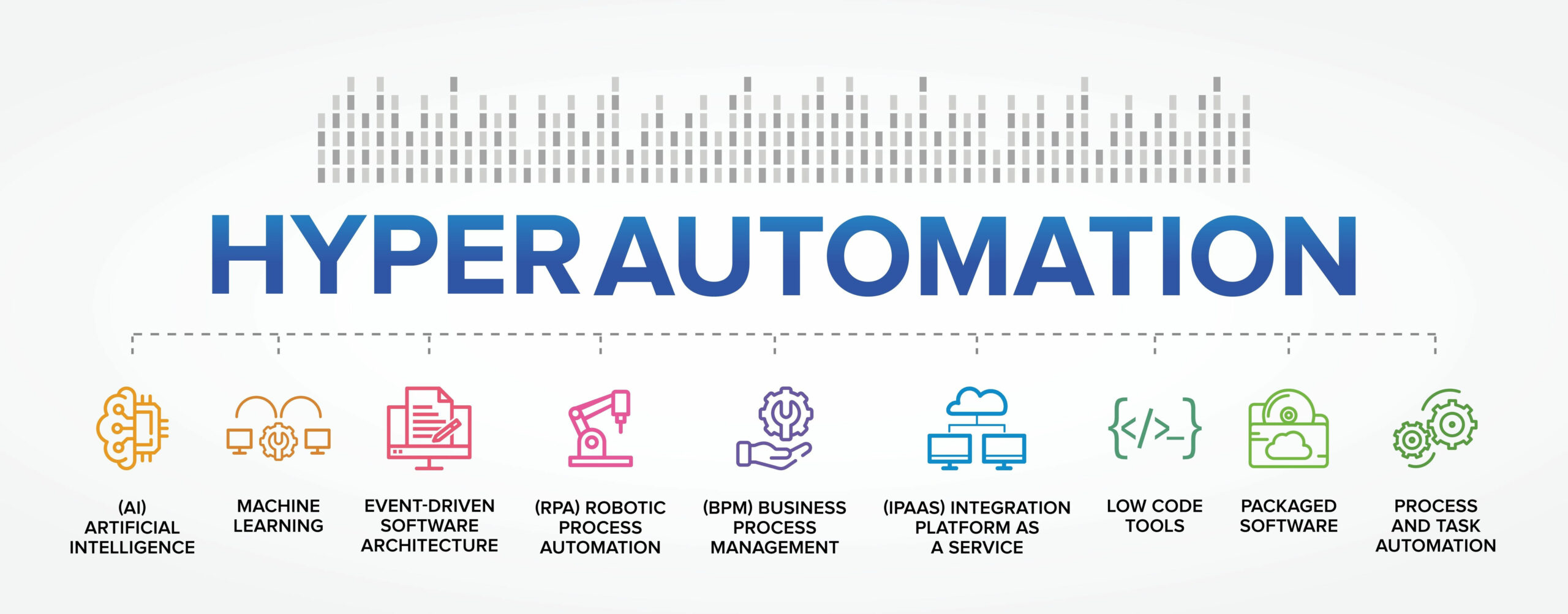

Banks, of course, have been focused on automating processes to improve efficiency and customer service for well over a decade. But hyperautomation that connects disjointed systems and transforms bank processes from end to end with technologies such as machine learning, artificial intelligence, robotic process optimization and low-code application development is still relatively new.

Worries about a recession and the need to drive costs down and accelerate risk has many banks thinking hard about how to seize the benefits of hyperautomation as soon as possible. “If you look at what’s driving the need for hyperautomation at banks, it’s three big things,” said Keith Pearson, a global head of financial services at ServiceNow. “It’s growth, it’s the reduction of costs and it’s the mitigation and reduction of risk. Those are the three things that bank executives get up every day and think about.”

Movement Towards Hyperautomation

BankingDive.com further reports that technological research and consulting firm Gartner found 56% of organizations have an average of four or more hyperautomation initiatives underway.

“Lots of companies jumped on the bandwagon of hyperautomation two years ago,” Pearson said. “But many have now recognized how hard it is to do and have stopped talking about it so much. I don’t think that’s right. Just because something is hard doesn’t mean we shouldn’t continue trying to achieve it.”

It's become obvious to most, however, that escalating automation is an absolute must in the current environment.

Indeed, not pursuing hyperautomation isn’t really an option for banks that have invested so much time and resources into digital transformation designed to vastly improve everything from internal operations and employee productivity to customer satisfaction. Increased competition from digital-first fintech companies and customer expectations that demand ever-more seamless, swift and personalized experiences also underscore the need to pursue hyperautomation.

Three Key Ingredients for Hyperautomation

The puzzle that must be solved by financial institutions, however, is the question of realistic pathways to implement hyperautomation in the most efficient and financially sensible way possible.

BankingDive recommends the following three ingredients as essential to success:

Hyperautomation is not merely a matter of deploying advanced technologies.

Technology is a tool to deliver better experiences and value to customers — be it by onboarding new customers easier and quicker, bringing innovative products to market faster, or processing loan applications in a way that meets customers’ needs.

Hyperautomation needs to be approached through the lens of how technology and data can replace cumbersome and inefficient processes that frustrate both customers and the employees serving them. These are not hard for banks to find and focusing on one is a good starting point for a hyperautomation journey.

Realistic Expectations: Short- and Long-Term Goals

Pearson notes that one of the reasons banks have difficulty securing the benefits of hyperautomation has been the notion that it all happens immediately.

Any moonshot promises that a bank can be fundamentally transformed via hyperautomation should be viewed skeptically. Instead, Pearson said, bank leaders should ask for specific milestones on the road toward hyperautomation. “What does the next six months look like? How do you incrementally build up your expertise to get there?” Pearson said. “You don’t have to throw a bazillion dollars at something. Instead, quickly build increments and demonstrate value. That gives you the confidence to continue.”

Banks need to plan for short-term and long-term goals. When we consider check processing, it's critically important to automate the process utilizing AI and machine learning technologies that achieve field performance of 99% automation and 99.5%+ accuracy. This creates accurate data that can be ingested or connected to other systems, eliminating the "siloed" data approach that banks currently face.