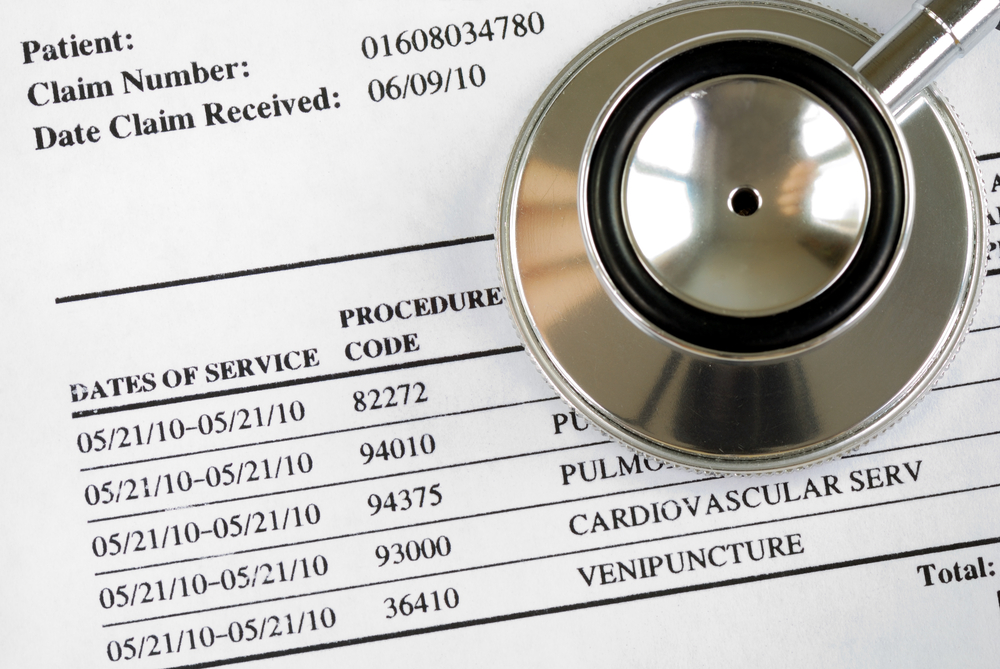

With $140B In Medical Debt, Doctors Saying “I’ll Bill You” Doesn’t Cut It Anymore

The problem, to be specific, is unexpected bills and the ability of patients -- now responsible for so much more out-of-pocket medical expenses -- to pay. Physicians are finding themselves with a pile of unpaid bills that is growing by the month.

To begin attacking this challenge, Mr. Colabella suggests "front-loading" expectations as much as possible.

Instead of subjecting patients to the three most terrifying words in the medical payments experience – “I’ll bill you” – they could just clean up the process and make the payments part of the interaction clearer from the start by telling the patients what they will pay, and then putting the tools in place to make those payments seamless.

“You have to have really spectacular driving tools and modalities for payment so that the patients are engaged and it's easy,” said Colabella. “You get the procedures and can even add some new ones to grow your practice. And you have an opportunity to have a thriving practice in place, instead of a practice that's growing its AR every single day.”

Colabella notes as examples voluntary procedures and treatments; things like cosmetic dentistry, plastic surgery, and dermatological procedures. Consumers understand that these procedures are paid out of pocket, so there is no mystery and no ensuing surprise -- the conversation about price happens before any work begins.

“Nobody is performing a plastic surgery or cosmetic dermatology procedure without being paid upfront,” Colabella noted. “There is a little iPad in the room for consenting to what you owe. You don't go to a massage therapist and not pay. So when you look at all of these, there's a lot to be learned.”

Millennials will push the digital engagement element, Colabella assures us. Still, this is not an easy transition for many practices to make.

The resistance to having the payments conversation earlier in the process happens in places like primary care provisions and practices that have ongoing relationships with consumers. The attitude is that there is no need to bother the consumer with questions about payments, as they will be back – and practices assume they know their patients well enough to know that they will pay … eventually.

But those practitioners don’t realize that the experience is actually counterproductive to their relationships with patients. By pushing payments out and making the process mysterious, they aren’t improving their lives – they are just making it harder for them to pay even though they actually want to. And that makes it more likely that they’ll go looking for a provider who can offer a process that is far more flexible and transparent.

Part of the answer is to capture payment preferences at check-in, establishing immediately who is responsible for payments, and what payment channel will be used. This, Colabella reminds us, requires transparency as to how much the procedure in question costs. Knowing the cost means there is also the ability to set "upper limits" that the patient is comfortable with.

Seamless digital engagement is key to creating a payment plan with which both doctor and patient are comfortable. This is just part of modernization process to automate healthcare payments. To complete the entire scope of the payments landscape, it is important the healthcare industry focus on the payments channels like paper-based remits and EOBs/EOPs that can leverage technologies like electronification through AI to fully automate the process.