Healthcare Data Interoperability: EOBs and Correspondence

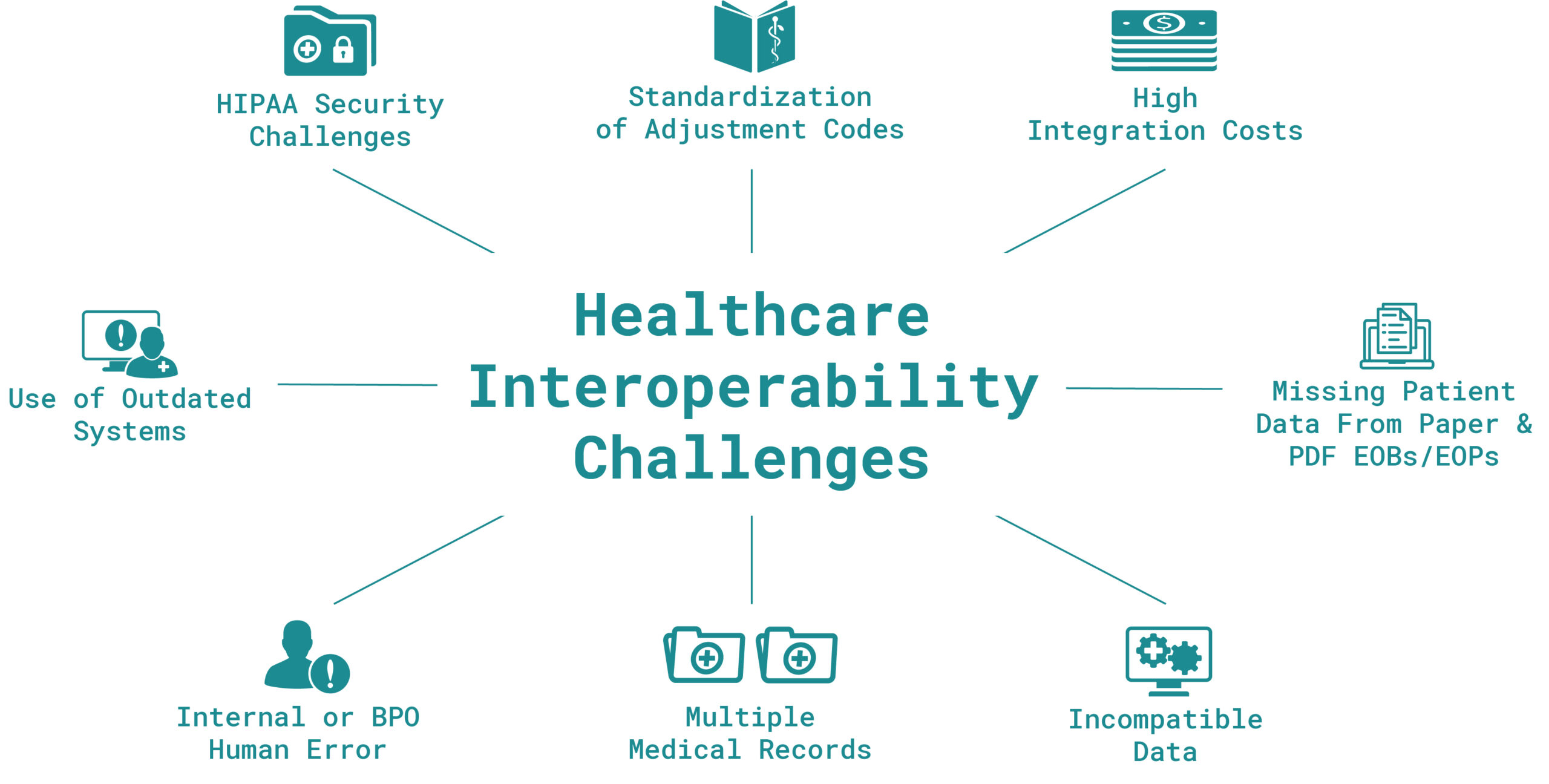

For decades, the healthcare industry has relied on manual posting of healthcare remittances (EOBs) by utilizing off-shore business processing outsourcers (BPOs). BPOs can experience slow turnaround times with high levels of human errors. However, one of the main drawbacks of this approach is the inability to share data across multiple downstream systems.

Additionally, the COVID-19 pandemic has put into question the business resiliency of BPOs, as many were forced to either shut down or relocate business operations across the globe. This crisis caused many organizations to reevaluate processes which were labor dependent.

We now see a major shift in the healthcare industry, as many are adopting innovative Artificial Intelligence and Machine Learning technologies to process payments and effectively automate back-end revenue cycle processes.

Advantages of AI-Based Electronification

Quality

An AI-based electronification system is trained with millions of EOBs/EOPs, thereby delivering superior data accuracy along automated ANSI procedure code verification.

Speed

AI-based electronification enables faster turnaround times including same-day or next-day processing.

Cost

According to the 2021 CAQH Index, the healthcare industry could save $1.8B by converting paper or pdf-originated remittances to EDI 835 output.

AI-Based Electronification of EOBs & EOPs

Access EOB Conversion extracts data from scanned images or PDF documents created from paper-based Explanation of Benefits (EOB) or Explanation of Payments (EOP). The system then delivers EDI 835 Electronic Remittance Advice (ERA) files ready for cash posting. This process is referred to as electronification.

Benefits of this process include:

- Est. cost per claim reduction from $5.44 (manual) to $1.38 (electronic) – a $4.06 per claim savings

- Improved efficiency and improved resource allocation

- Improved data quality for superior postability with reduced patient errors

- Improved interoperability as EOB data is exportable to downstream denied claim and business intelligence systems

Electronification of Correspondence Letters for Denials Management

Correspondence letters, also referred to as denial letters, represent a variety of health plan/payer communications including, but not limited to, insurance payment denial explanations, additional documentation requests, authorization approvals, authorization rejections, patient medical necessity determinations, bill under review, and legal correspondence.

Unfortunately, these letters are typically mailed to healthcare organizations and require manual sorting and manual entry into denial management systems. Function time is consuming, and it can cause delays in payment collection for insurance companies and patients, which drives up receivables.

Access Correspondence Letters utilizes OrbNet AI as part of Opti-Lift to extract the necessary fields from scanned images of correspondence letters. Fields include claim ID, insurance company name, correspondence reason, letter date, and patient account number.

Workflow management is also available to assign claims to internal staff for denied claim resubmissions.

Benefits of this process include:

- Eliminate manual entry of correspondence information

- Expedite denial appeals, improve efficiencies, and reduce costs

- Virtually eliminate posting errors

- Consolidated denial information on HPAC Portal with access to images

- Reduce receivables and improve collection process

- Minimize delays in secondary billing

- Reporting on denial codes and remark code

Medical Lockbox Automation

A lockbox is a treasury management service that simplifies the collection and processing of accounts receivable for the healthcare provider. It’s where the majority of payments and remittances flow, originating from Medicare, Medicaid, and Third-Party Payers into the bank accounts of the health care provider.

Most commonly offered by commercial banks, the lockbox function can also be offered by software companies, RCM companies, and clearinghouses. The Medical Lockbox is an essential part of the AR process as it’s the first touchpoint where paper-originated insurance remittances, payments, and patient payments are received before hitting the bank accounts.

New technologies like AI and deep learning models are evolving these systems into a high-value, innovative platforms that handle not only myriad payments but also paper/pdf remittances facilitating automated, straight-through processing (STP) and payment posting.

The medical lockbox of the future will:

- Process more native EDI files, but also leverage AI technologies to convert remaining remittances into postable data to achieve 100% electronification

- Further leverage cloud computing

- Offer more options and configurations, including fully outsourced, SaaS, in-house via the cloud, or other hybrids

Join OrboNation

Access to critical updates, new industry insights, & thought leaders.